probable exigency will demand, so as to be absolutely safe. At fixed periods the amount collected, in excess of actual cost, is distributed among the contributing members. It is erroneously called "profits" or "dividends," when, in reality, it is only a return of unexpended assessments. When the system was new and untried, it was not thought prudent to make such restitution oftener than every five years. Gradually experience led to greater confidence, and competition introduced the practice of annual "dividends." These are principally derived from the higher rate of interest realized than the legal standard assumes, from a lower mortality than the table estimates, and from the excess of loading over actual expenses. Various ways of distributing this surplus have been in use, but the so-called "contribution plan," now universally adopted in the United States, is unquestionably the most equitable ever devised, as it returns to every member precisely his proportion of the over-payments. It may be best explained by an illustration.

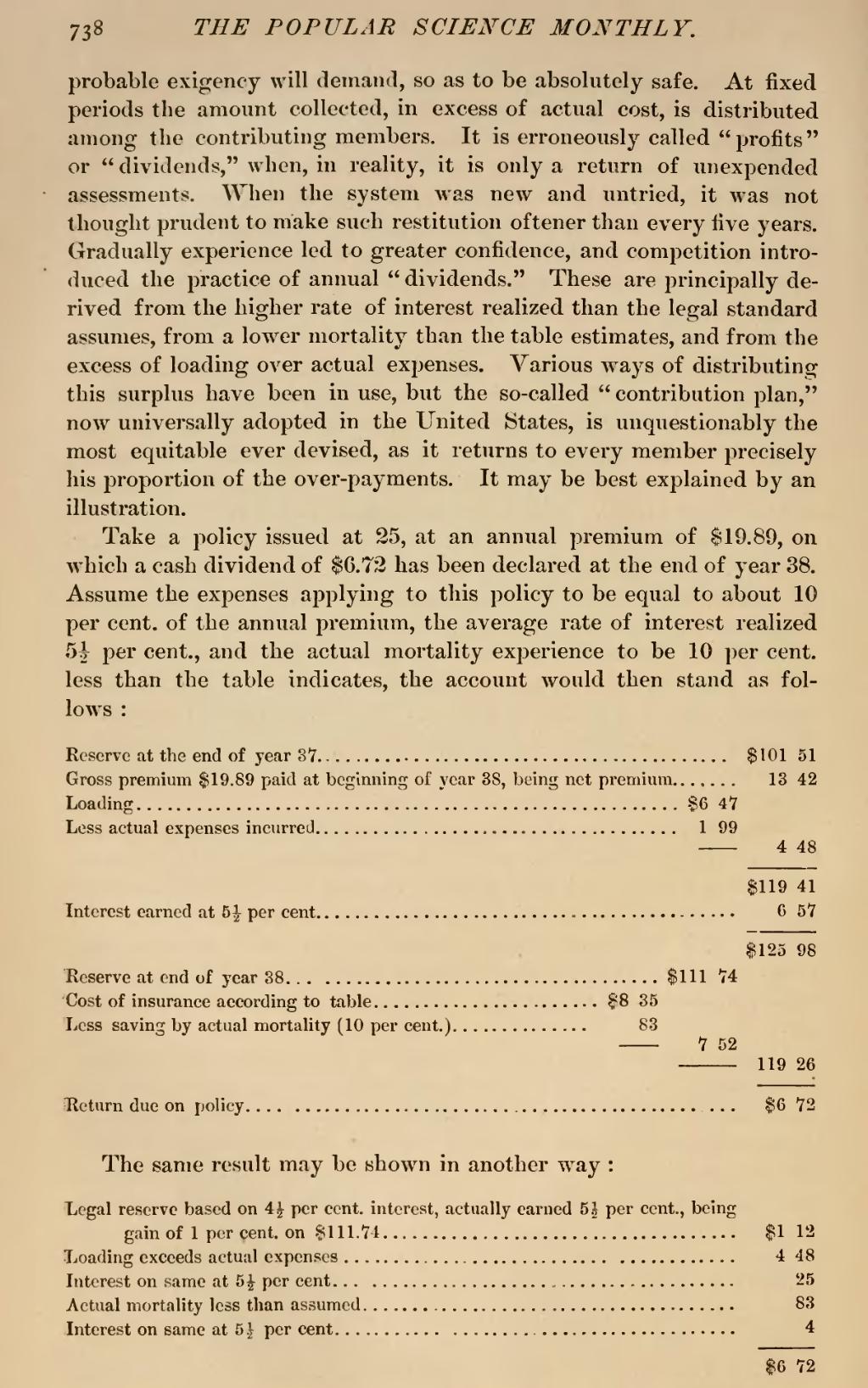

Take a policy issued at 25, at an annual premium of $19.89, on which a cash dividend of $6.72 has been declared at the end of year 38. Assume the expenses applying to this policy to be equal to about 10 per cent, of the annual premium, the average rate of interest realized 512 per cent., and the actual mortality experience to be 10 per cent, less than the table indicates, the account would then stand as follows:

| Reserve at the end of year 37 | $101 51 | ||

| Gross premium $19.89 paid at beginning of year 38, being net premium | 13 42 | ||

| Loading | $6 47 | ||

| Less actual expenses incurred | 1 99 | ||

| ——— | 4 48 | ||

| ——— | |||

| $119 41 | |||

| Interest earned at 512 per cent | 6 57 | ||

| ——— | |||

| $128 98 | |||

| Reserve at end of year 38 | $111 74 | ||

| Cost of insurance according to table | $8 35 | ||

| Less saving by actual mortality (10 per cent.) | 83 | ||

| ——— | 7 52 | ||

| ——— | 119 28 | ||

| ——— | |||

| Return due on policy | $6 72 | ||

The same result may be shown in another way:

| Legal reserve based on 412 per cent, interest, actually earned 512 per cent., being gain of 1 percent, on $111.74 | $1 12 |

| Loading exceeds actual expenses | 4 48 |

| Interest on same at 512 per cent | 25 |

| Actual mortality less than assumed | 83 |

| Interest on same at 512 per cent | 4 |

| ——— | |

| $6 72 |