100 STAT. 2852

PUBLIC LAW 99-514—OCT. 22, 1986 .«<..

"(B) such private foundation was not liable for tax under section 4942 with respect to any year in the base period."

SEC. 1833. AMENDMENT RELATED TO SECTION 305 OF THE ACT.

Section 6214(c) is amended by striking out "section 4962(b)" and inserting in lieu thereof "section 4963(b)". SEC. 1834. AMENDMENT RELATED TO SECTION 311 OF THE ACT.

Subparagraph (A) of section 311(a)(3) of the Tax Reform Act of 1984 is amended by striking out "a State law" and inserting in lieu thereof "a State law (originally enacted on April 22, 1977)". CHAPTER 4—AMENDMENTS RELATED TO TITLE IV OF THE ACT SEC. 1841. AMENDMENT RELATED TO SECTION 411 OF THE ACT.

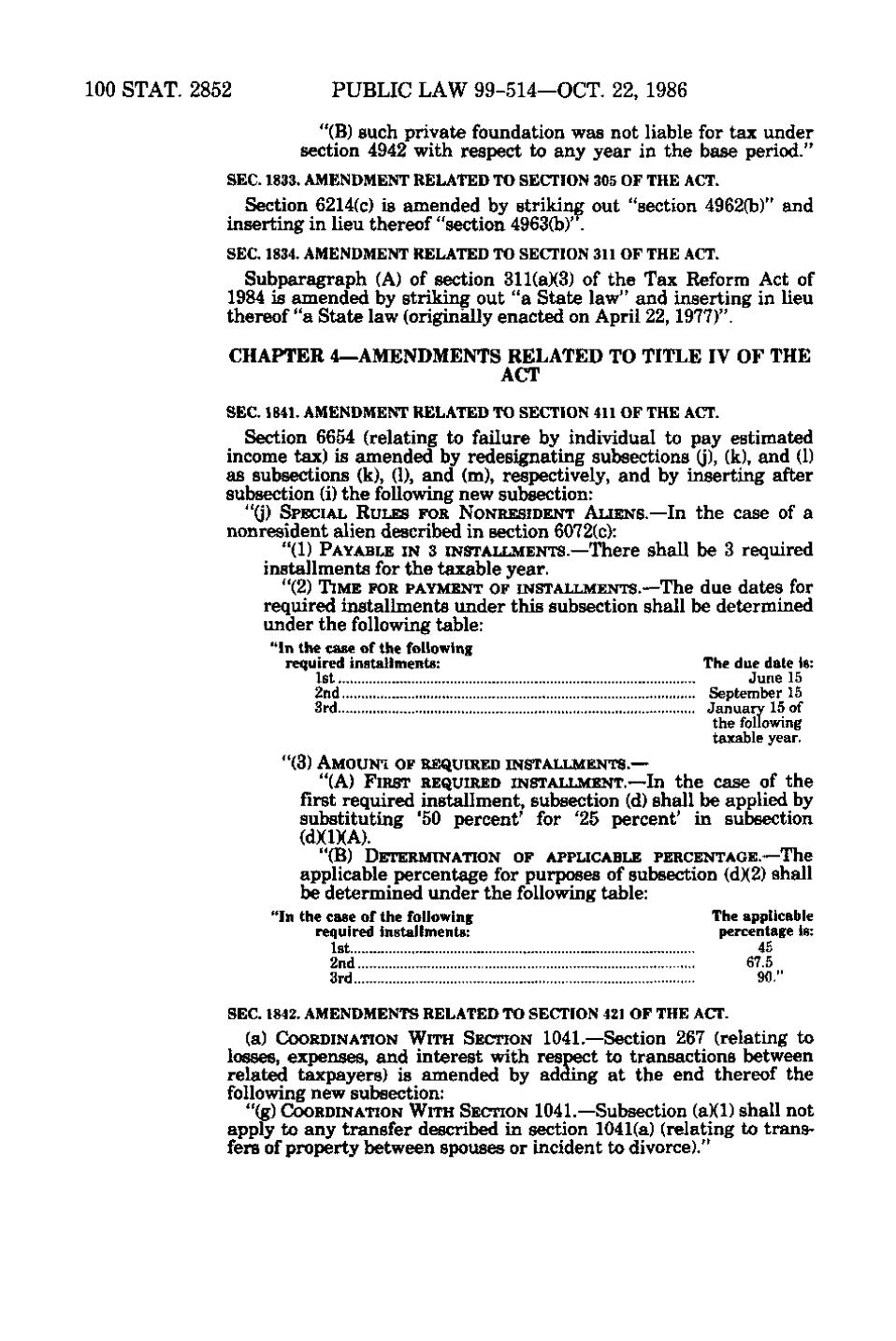

Section 6654 (relating to failure by individual to pay estimated income tax) is amended by redesignating subsections (j)> (k), and (1) as subsections (k), (1), and (m), respectively, and by inserting after subsection (i) the following new subsection: "(j) SPECIAL RULES FOR NONRESIDENT ALIENS.—In the case of a nonresident alien described in section 6072(c): "(1) PAYABLE IN 3 INSTALLMENTS.—There shall be 3 required installments for the taxable year. "(2) TIME FOR PAYMENT OF INSTALLMENTS.—The due dates for required installments under this subsection shall be determined under the following table: "In the case of the following required installments: 1st 2nd 3rd '

The due date is: June 15 September 15 January 15 of the following taxable year.

"(3) AMOUNT OF REQUIRED INSTALLMENTS.— "(A) FIRST REQUIRED INSTALLMENT.—In

the case of the first required installment, subsection (d) shall be applied by substituting '50 percent' for '25 percent' in subsection (d)(1)(A). "(B) DETERMINATION OF APPLICABLE PERCENTAGE.—The

applicable percentage for purposes of subsection (d)(2) shall be determined under the following table: "In the case of the following required installments: 1st »5.t.' 2nd 3rd

The applicable percentage is: 45 67.5 90."

SEC. 1842. AMENDMENTS RELATED TO SECTION 421 OF THE ACT.

(a) COORDINATION WiTH SECTION 1041.—Section 267 (relating to losses, expenses, and interest with respect to transactions between related taxpayers) is amended by adding at the end thereof the following new subsection: "(g) COORDINATION WITH SECTION 1041.—Subsection (a)(1) shall not apply to any transfer described in section 1041(a) (relating to transfers of property between spouses or incident to divorce)."

�