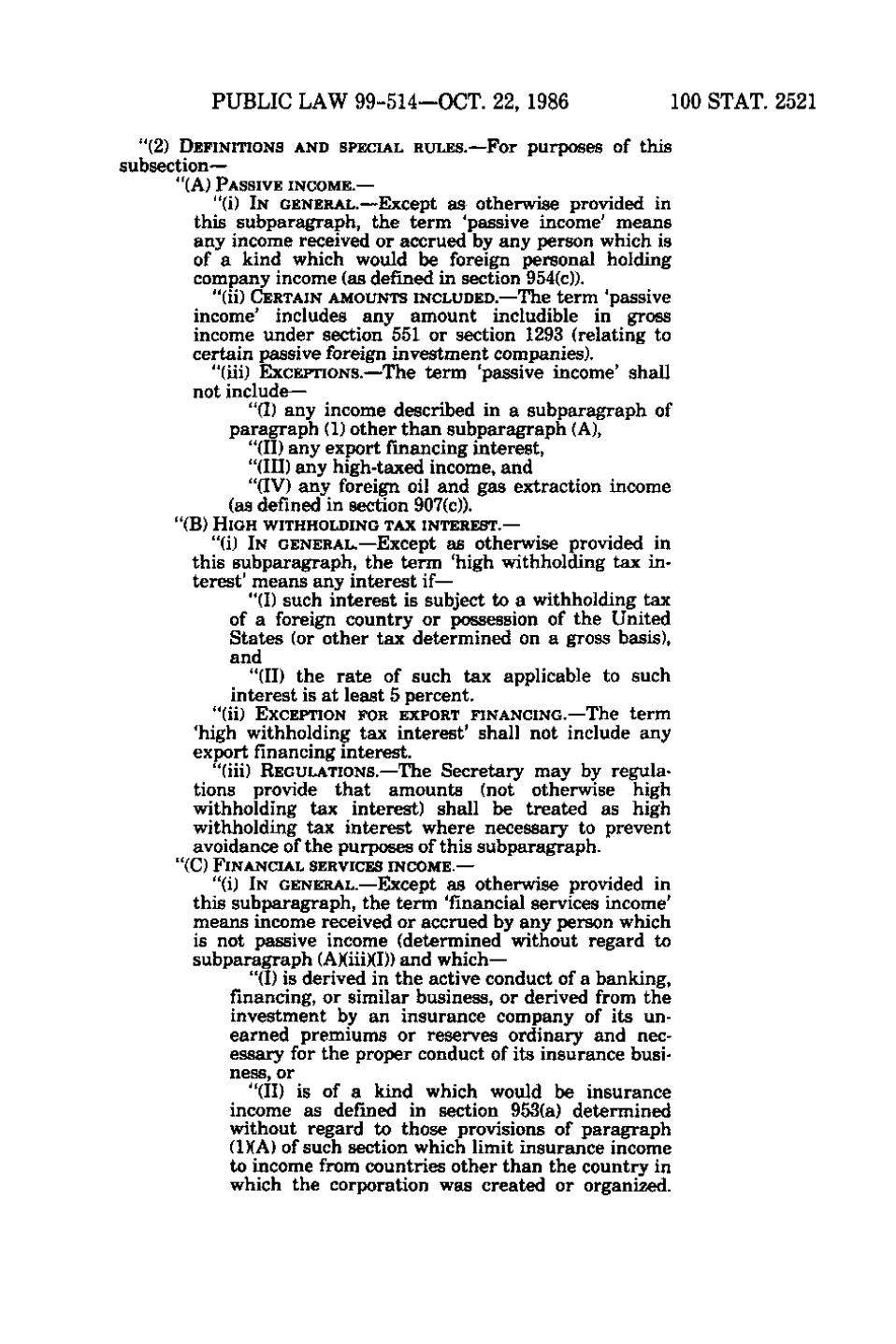

PUBLIC LAW 99-514-OCT. 22, 1986

100 STAT. 2521

"(2) DEFINITIONS A N D SPECIAL RULES.—For purposes of t h i s

subsection— "(A) PASSIVE I N C O M E. —

"(i) IN GENERAL.—Except as otherwise provided in this subparagraph, the term 'passive income' means any income received or accrued by any person which is of a kind which would be foreign personal holding company income (as defined in section 954(c)). "(ii) CERTAIN AMOUNTS INCLUDED.—The term 'passive

- .

>?

income' includes any a m o u n t includible in gross income under section 551 or section 1293 (relating to certain passive foreign investment companies). "(iii) EXCEPTIONS.—The term 'passive income' shall not include— "(I) any income described in a subparagraph of paragraph (1) other than subparagraph (A), "(II) any export financing interest, "(III) any high-taxed income, and "(IV) any foreign oil and g a s extraction income (as defined in section 907(c)). "(B) H I G H WITHHOLDING TAX INTEREST.—

"(i) IN GENERAL.—Except a s otherwise provided in this subparagraph, the term 'high withholding tax interest' means any interest if— "(I) such interest is subject to a withholding tax of a foreign country or possession of the United States (or other tax determined on a gross basis), and "(II) the r a t e of such tax applicable to such interest is a t least 5 percent. "(ii) EXCEPTION FOR EXPORT F I N A N C I N G. — The

term

'high withholding tax interest' shall not include any export financing interest. "(iii) REGULATIONS.—The Secretary may by regulations provide that a m o u n t s (not otherwise high withholding tax interest) shall be treated a s high withholding tax interest w h e r e necessary to prevent avoidance of the purposes of this subparagraph. "(C) F I N A N C I A L SERVICES I N C O M E. —

"(i) IN GENERAL.—Except a s otherwise provided in this subparagraph, the term 'financial services income' means income received or accrued by any person which is not passive income (determined without regard to subparagraph (A)(iii)(I)) and which— "(I) is derived in the active conduct of a banking, financing, or similar business, or derived from the investment by a n insurance company of its une a r n e d p r e m i u m s or reserves ordinary and necessary for the proper conduct of its insurance business, or "(II) is of a kind which would be insurance income as defined in section 953(a) determined without regard to those provisions of paragraph (1)(A) of such section which limit insurance income to income from countries other than the country in which the corporation w a s created or organized.

�