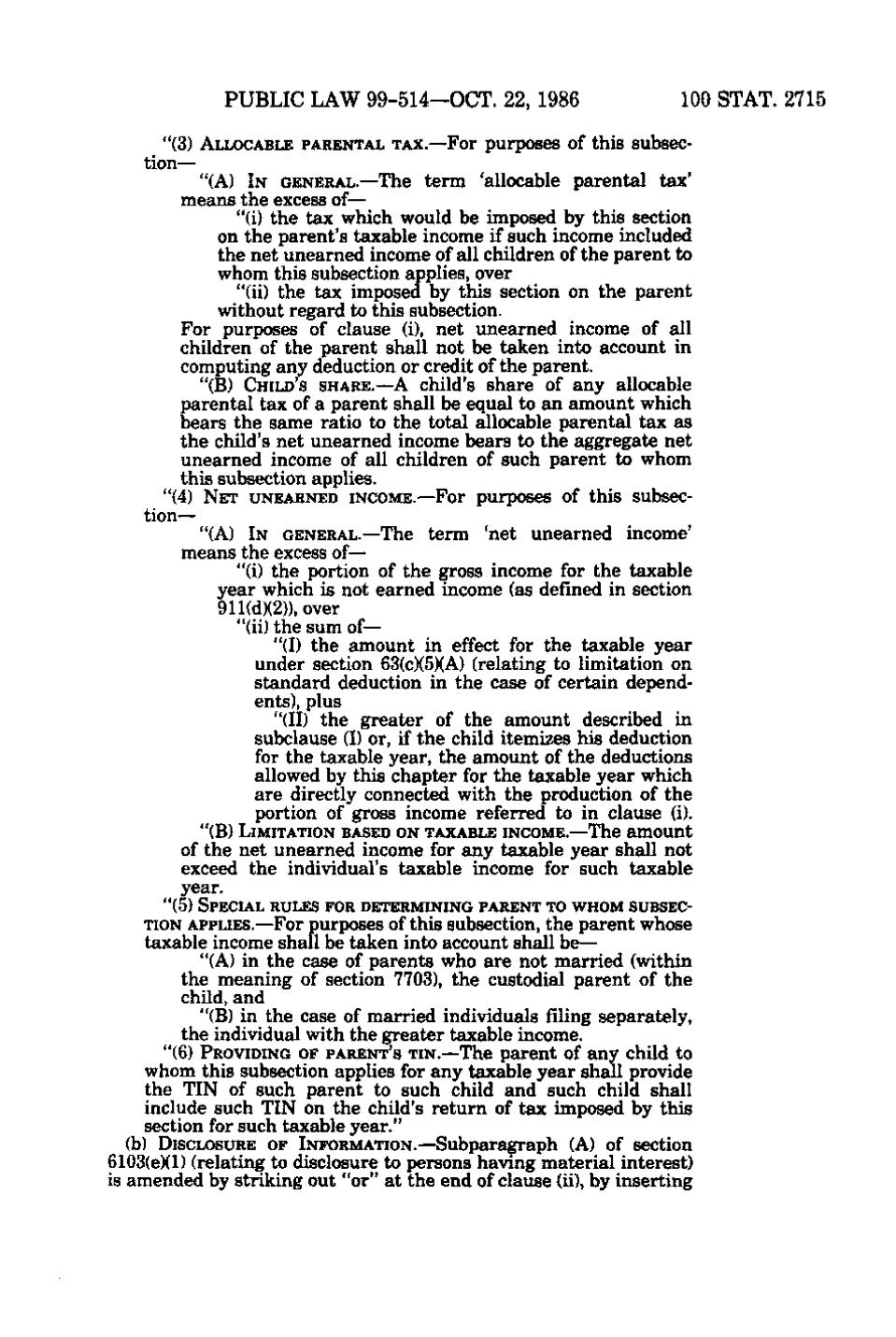

PUBLIC LAW 99-514—OCT. 22, 1986

100 STAT. 2715

"(3) ALLOCABLE PARENTAL TAX.—For purposes of this subsection— "(A) IN GENERAL.—The term 'allocable parental tax' means the excess of— "(i) the tax which would be imposed by this section on the parent's taxable income if such income included the net unearned income of all children of the parent to whom this subsection applies, over "(ii) the tax imposed by this section on the parent without regard to this subsection. For purposes of clause (i), net unearned income of all children of the parent shall not be taken into account in computing any deduction or credit of the parent. "(B) CHILD'S SHARE.—A child's share of any allocable parental tax of a parent shall be equal to an amount which bears the same ratio to the total allocable parental tax as the child's net unearned income bears to the aggregate net unearned income of all children of such parent to whom this subsection applies. "(4) NET UNEARNED INCOME.—For purposes of this subsection— "(A) IN GENERAL.—The term 'net unearned income' means the excess of— "(i) the portion of the gross income for the taxable year which is not earned income (as defined in section 911(d)(2)), over "(ii) the sum of— "(I) the amount in effect for the taxable year under section 63(c)(5)(A) (relating to limitation on standard deduction in the case of certain dependents), plus "(II) the greater of the amount described in subclause (I) or, if the child itemizes his deduction for the taxable year, the amount of the deductions allowed by this chapter for the taxable year which are directly connected with the production of the portion of gross income referred to in clause (i). "(B) LIMITATION BASED ON TAXABLE INCOME.—The amount of the net unearned income for any taxable year shall not exceed the individual's taxable income for such taxable year. "(5) SPECIAL RULES FOR DETERMINING PARENT TO WHOM SUBSECTION APPLIES.—For purposes of this subsection, the parent whose

taxable income shall be taken into account shall be— "(A) in the case of parents who are not married (within the meaning of section 7703), the custodial parent of the child, and ^ "(B) in the case of married individuals filing separately, the individual with the greater taxable income. "(6) PROVIDING OF PARENT'S TIN.—The parent of any child to whom this subsection applies for any taxable year shall provide the TIN of such parent to such child and such child shall include such TIN on the child's return of tax imposed by this section for such taxable year." (b) DISCLOSURE OF INFORMATION.—Subparagraph (A) of section

6103(e)(1) (relating to disclosure to persons having material interest) is amended by striking out "or" at the end of clause (ii), by inserting

�