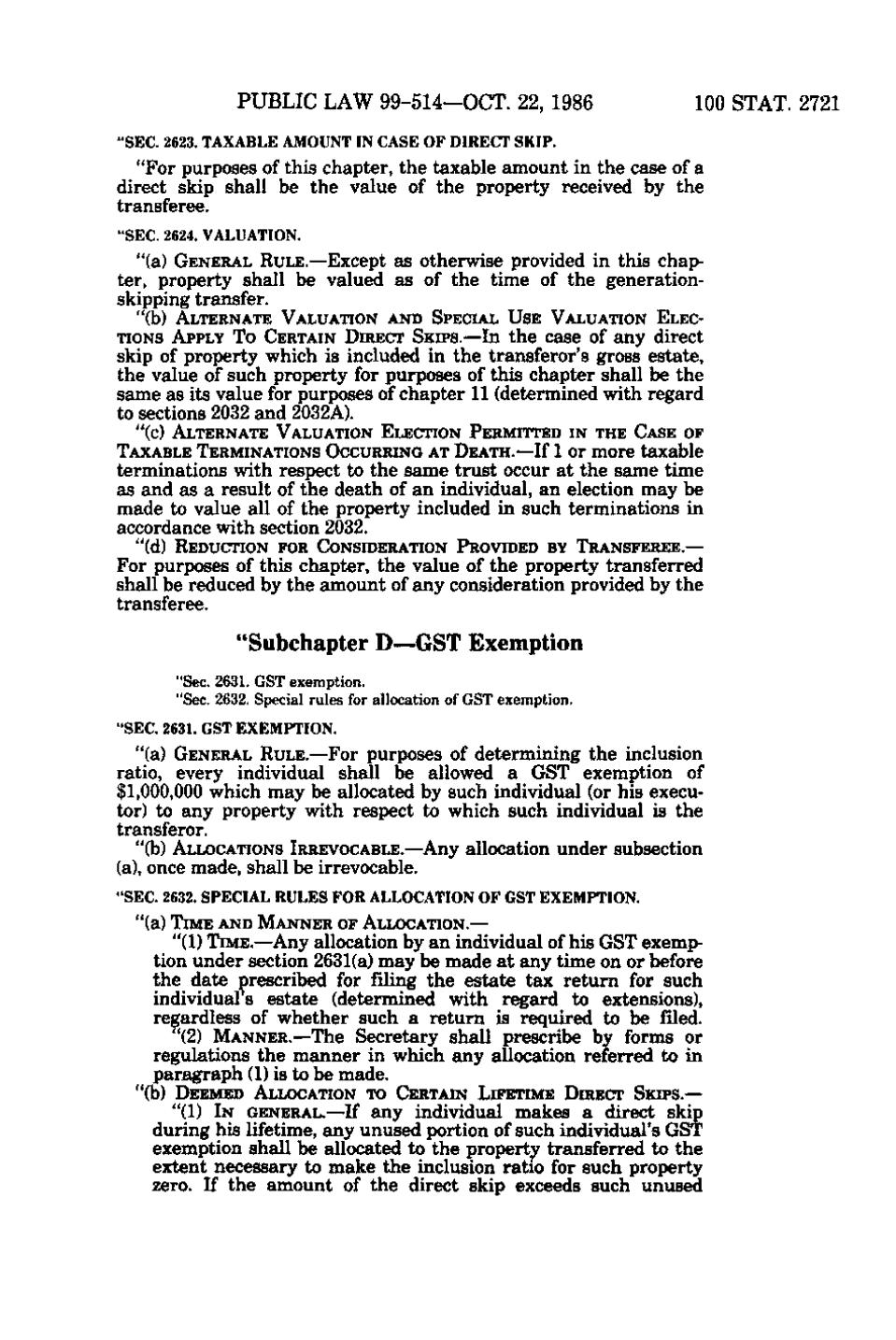

PUBLIC LAW 99-514—OCT. 22, 1986

100 STAT. 2721

"SEC. 2623. TAXABLE AMOUNT IN CASE OF DIRECT SKIP.

"For purposes of this chapter, the taxable amount in the case of a direct skip shall be the value of the property received by the transferee. "SEC. 2624. VALUATION.

"(a) GENERAL RULE.—Except as otherwise provided in this chapter, property shall be valued as of the time of the generationskipping transfer. "(b) ALTERNATE VALUATION AND SPECIAL USE VALUATION ELECTIONS APPLY TO CERTAIN DIRECT SKIPS.—In the case of any direct

skip of property which is included in the transferor's gross estate, the value of such property for purposes of this chapter shall be the same as its value for purposes of chapter 11 (determined with regard to sections 2032 and 2032A). "(c) ALTERNATE VALUATION ELECTION PERMITTED IN THE CASE OF TAXABLE TERMINATIONS OCCURRING AT DEATH.—If 1 or more taxable

terminations with respect to the same trust occur at the same time as and as a result of the death of an individual, an election may be made to value all of the property included in such terminations in accordance with section 2032. "(d) REDUCTION FOR CONSIDERATION PROVIDED BY TRANSFEREE.—

For purposes of this chapter, the value of the property transferred shall be reduced by the amount of any consideration provided by the transferee.

"Subchapter D—GST Exemption "Sec. 2631. GST exemption. "Sec. 2632. Special rules for allocation of GST exemption. "SEC. 2631. GST EXEMPTION.

"(a) GENERAL RULE.—For purposes of determining the inclusion ratio, every individual shall be allowed a GST exemption of $1,000,000 which may be allocated by such individual (or his executor) to any property with respect to which such individual is the transferor. "(b) ALLOCATIONS IRREVOCABLE.—Any allocation under subsection (a), once made, shall be irrevocable. "SEC. 2632. SPECIAL RULES FOR ALLOCATION OF GST EXEMPTION. "(a) TIME AND MANNER OF ALLOCATION.—

"(1) TIME.—Any allocation by an individual of his GST exemption under section 2631(a) may be made at any time on or before the date prescribed for filing the estate tax return for such individual's estate (determined with regard to extensions), regardless of whether such a return is required to be filed. "(2) MANNER.—The Secretary shall prescribe by forms or regulations the manner in which any allocation referred to in paragraph (1) is to be made. "Ob) DEEMED ALLOCATION TO CERTAIN LIFETIME DIRECT SKIPS.—

"(1) IN GENERAL.—If any individual makes a direct skip during his lifetime, any unused portion of such individual's GST exemption shall be allocated to the property transferred to the extent necessary to make the inclusion ratio for such property zero. If the amount of the direct skip exceeds such unused

�