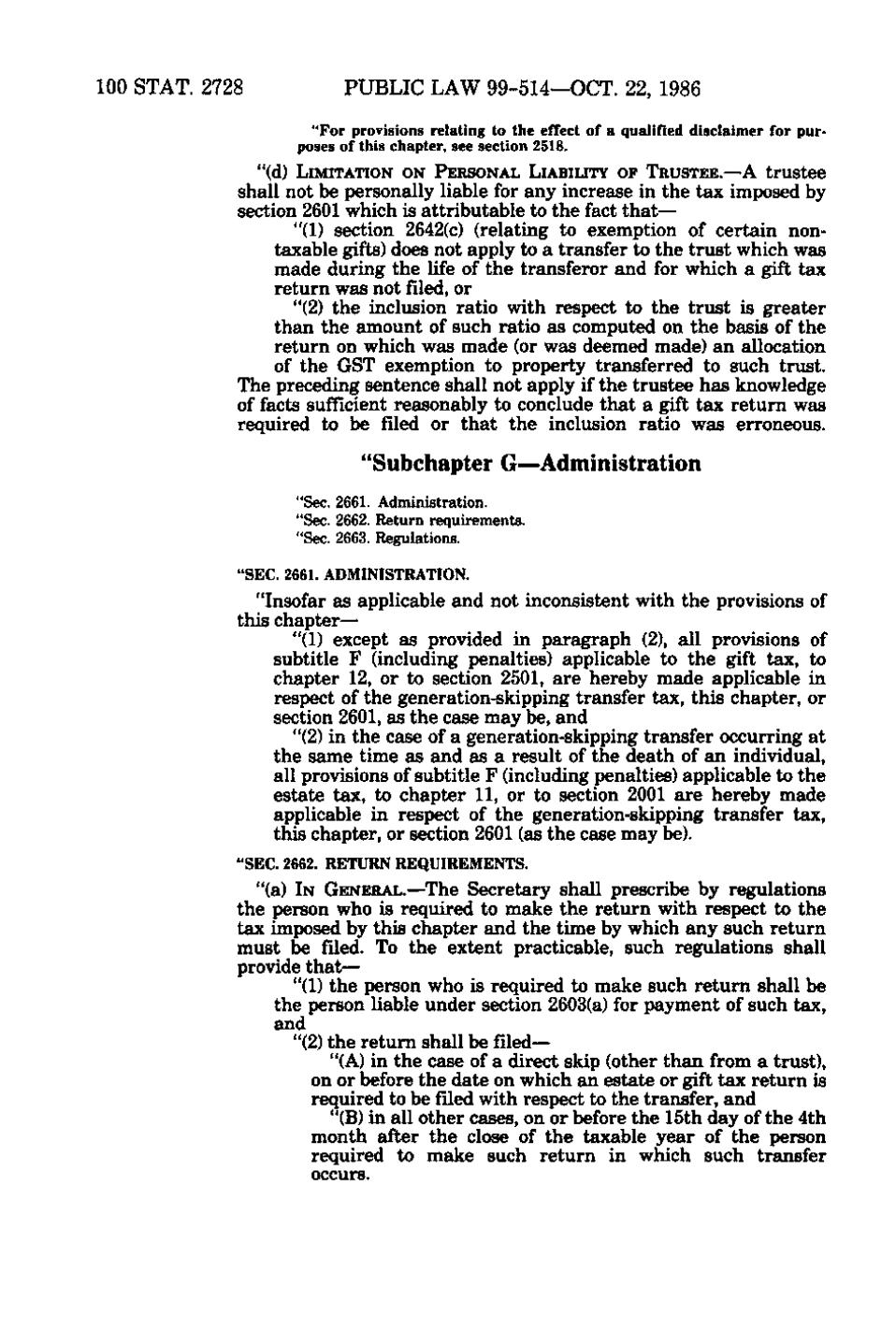

100 STAT. 2728

PUBLIC LAW 99-514—OCT. 22, 1986 "For provisions relating to the effect of a qualified disclaimer for purposes of this chapter, see section 2518.

"(d) LIMITATION ON PERSONAL LIABILITY OF TRUSTEE.—A trustee shall not be personally liable for any increase in the tax imposed by section 2601 which is attributable to the fact that— "(1) section 2642(c) (relating to exemption of certain nontaxable gifts) does not apply to a transfer to the trust which was made during the life of the transferor and for which a gift tax return was not filed, or "(2) the inclusion ratio with respect to the trust is greater than the amount of such ratio as computed on the basis of the return on which was made (or was deemed made) an allocation of the GST exemption to property transferred to such trust. The preceding sentence shall not apply if the trustee has knowledge of facts sufficient reasonably to conclude that a gift tax return was required to be filed or that the inclusion ratio was erroneous.

"Subchapter G—Administration "Sec. 2661. Administration. "Sec. 2662. Return requirements. "Sec. 2663. Regulations. "SEC. 2661. ADMINISTRATION.

"Insofar as applicable and not inconsistent with the provisions of this chapter— "(1) except as provided in paragraph (2), all provisions of subtitle F (including penalties) applicable to the gift tax, to chapter 12, or to section 2501, are hereby made applicable in respect of the generation-skipping transfer tax, this chapter, or section 2601, as the case may be, and "(2) in the case of a generation-skipping transfer occurring at the same time as and as a result of the death of an individual, all provisions of subtitle F (including penalties) applicable to the estate tax, to chapter 11, or to section 2001 are hereby made applicable in respect of the generation-skipping transfer tax, this chapter, or section 2601 (as the case may be). "SEC. 2662. RETURN REQUIREMENTS.

"(a) IN GENERAL.—The Secretary shall prescribe by regulations the person who is required to make the return with respect to the tax imposed by this chapter and the time by which any such return must be filed. To the extent practicable, such regulations shall provide that— "(1) the person who is required to make such return shall be the person liable under section 2603(a) for payment of such tax, and "(2) the return shall be filed— "(A) in the case of a direct skip (other than from a trust), on or before the date on which an estate or gift tax return is required to be filed with respect to the transfer, and "(B) in all other cases, on or before the 15th day of the 4th month after the close of the taxable year of the person required to make such return in which such transfer occurs.

�