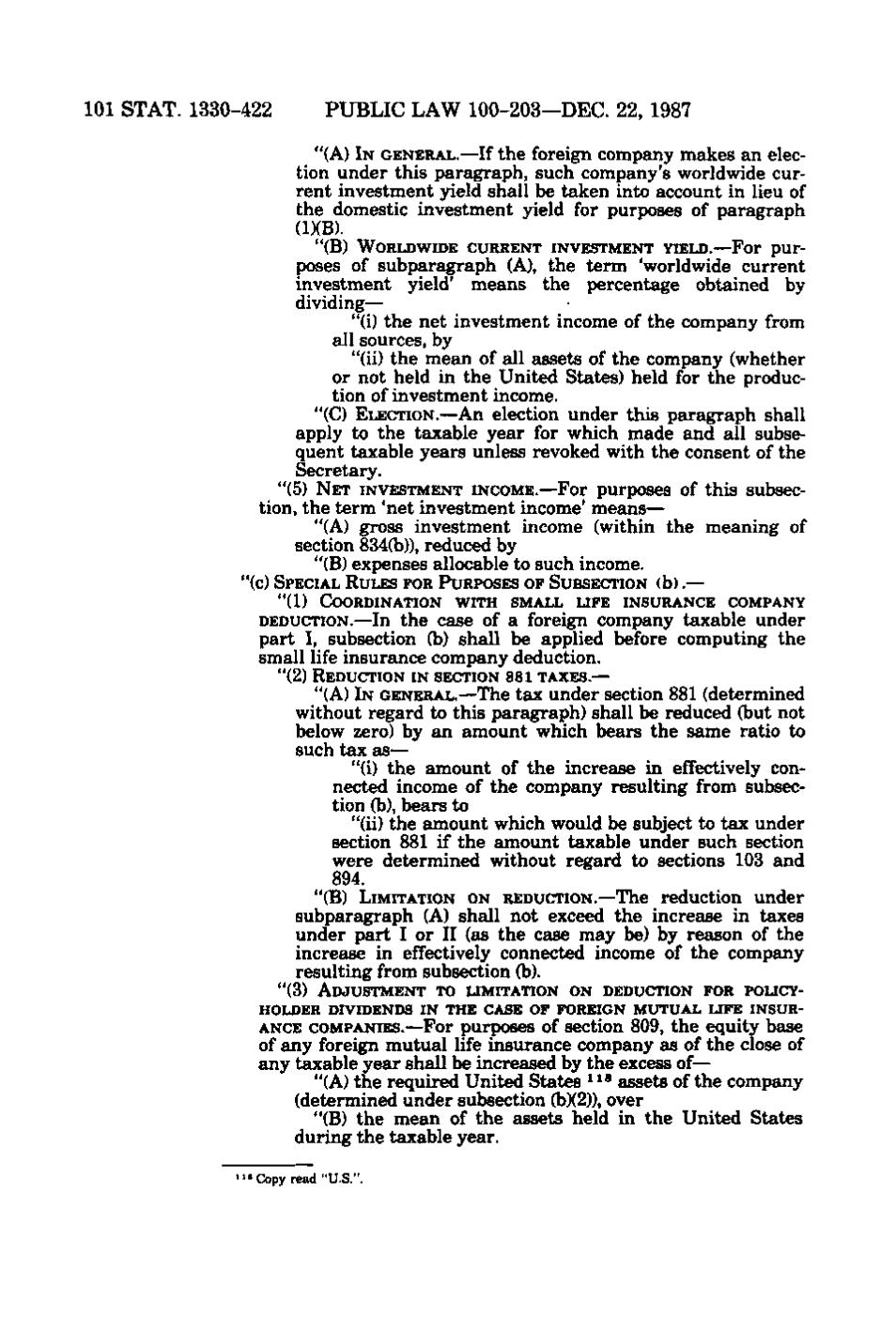

101 STAT. 1330-422

PUBLIC LAW 100-203—DEC. 22, 1987

"(A) IN GENERAL.—If the foreign company makes an election under this paragraph, such company's worldwide current investment yield shall be taken into account in lieu of the domestic investment yield for purposes of paragraph - - N - (I)(B). >-; "(B) WORLDWIDE CURRENT INVESTMENT YIELD.—For purposes of subparagraph (A), the term 'worldwide current ,;-.*.: investment yield' means the percentage obtained by dividing— "(i) the net investment income of the company from all sources, by "(ii) the mean of all assets of the company (whether ••.•>,\, • or not held in the United States) held for the produc.. tion of investment income. }' "(C) ELECTION.—An election under this paragraph shall - i; '. apply to the taxable year for which made and all subsequent taxable years unless revoked with the consent of the Secretary. "(5) NET INVESTMENT INCOME.—For purposes of this subseci, tion, the term 'net investment income' means— "(A) gross investment income (within the meaning of

- r„i J

section 834(b)), reduced by "(B) expenses allocable to such income. "(c) SPECIAL RULES FOR PURPOSES OF SUBSECTION (b).— "(1) COORDINATION WITH SMALL LIFE INSURANCE COMPANY

DEDUCTION.—In the case of a foreign company taxable under part I, subsection (b) shall be applied before computing the small life insurance company deduction. ^^,

"(2) REDUCTION IN SECTION 8 8 1 TAXES.—

.J,,

"(A) IN GENERAL.—The tax under section 881 (determined without regard to this paragraph) shall be reduced (but not ...,, below zero) by an amount which bears the same ratio to -' such tax as— . J "(i) the amount of the increase in effectively con.,.^V,, nected income of the company resulting from subsection (b), bears to y^^ , "(ii) the amount which would be subject to tax under I ' section 881 if the amount taxable under such section Jfi . ' were determined without regard to sections 103 and 894. "(B) LIMITATION ON REDUCTION.—The reduction under subparagraph (A) shall not exceed the increase in taxes under part I or II (as the case may be) by reason of the increase in effectively connected income of the company resulting from subsection (b). "(3) ADJUSTMENT TO LIMITATION ON DEDUCTION FOR POLICYHOLDER DIVIDENDS IN THE CASE OF FOREIGN MUTUAL LIFE INSUR-

ANCE COMPANIES.—For purposes of section 809, the equity base of any foreign mutual life insurance company as of the close of any taxable year shall be increased by the excess of— "(A) the required United States ^ ** assets of the company (determined under subsection (b)(2)), over "(B) the mean of the sissets held in the United States during the taxable year. "•Copy read "U.S.".

�