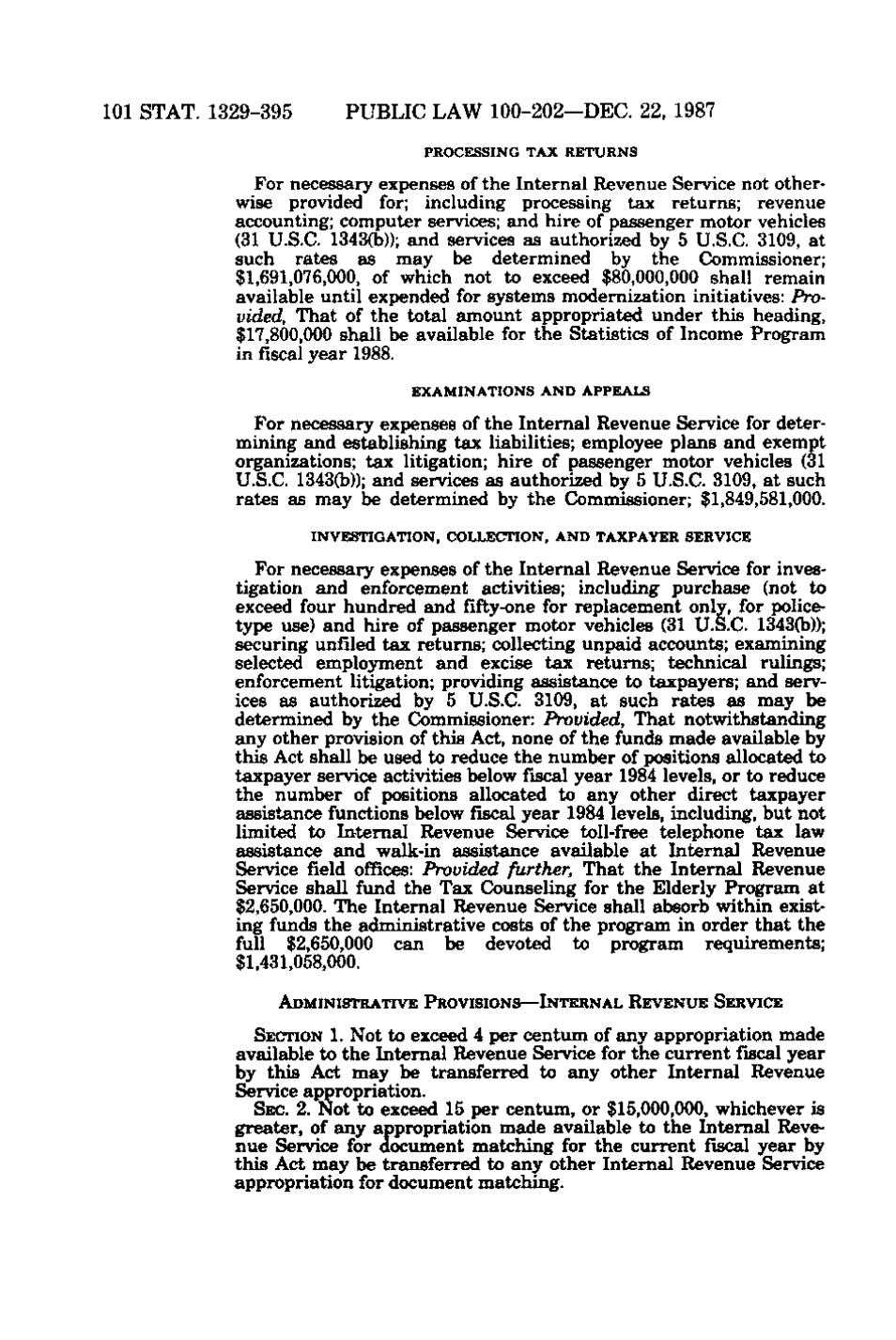

101 STAT. 1329-395

PUBLIC LAW 100-202—DEC. 22, 1987 PROCESSING TAX R E T U R N S

For necessary expenses of the Internal Revenue Service not otherwise provided for; including processing tax returns; revenue accounting; computer services; and hire of passenger motor vehicles (31 U.S.C. 1343(b)); and services as authorized by 5 U.S.C. 3109, at such rates as may be determined by the Commissioner; $1,691,076,000, of which not to exceed $80,000,000 shall remain available until expended for systems modernization initiatives: Provided, That of the total amount appropriated under this heading, $17,800,000 shall be available for the Statistics of Income Program in fiscal year 1988. EXAMINATIONS A N D APPEALS

For necessary expenses of the Internal Revenue Service for determining and establishing tax liabilities; employee plans and exempt organizations; tax litigation; hire of passenger motor vehicles (31 U.S.C. 1343(b)); and services as authorized by 5 U.S.C. 3109, at such rates as may be determined by the Commissioner; $1,849,581,000, INVESTIGATION, COLLECTION, A N D TAXPAYER SERVICE

For necessary expenses of the Internal Revenue Service for investigation and enforcement activities; including purchase (not to exceed four hundred and fifty-one for replacement only, for policetype use) and hire of passenger motor vehicles (31 U.S.C. 1343(b)); securing unfiled tax returns; collecting unpaid accounts; examining selected employment and excise tax returns; technical rulings; enforcement litigation; providing assistance to taxpayers; and services as authorized by 5 U.S.C. 3109, at such rates as may be determined by the Commissioner: Provided, That notwithstanding any other provision of this Act, none of the funds made available by this Act shall be used to reduce the number of positions allocated to taxpayer service activities below fiscal year 1984 levels, or to reduce the number of positions allocated to any other direct tsixpayer assistance functions below fiscal year 1984 levels, including, but not limited to Internal Revenue Service toll-free telephone tax law assistance and walk-in assistance available at Internal Revenue Service field offices: Provided further, That the Internal Revenue Service shall fund the Tax Counseling for the Elderly Program at $2,650,000. The Internal Revenue Service shall absorb within existing funds the administrative costs of the program in order that the full $2,650,000 can be devoted to program requirements; $1,431,058,000. ADMINISTRATIVE PROVISIONS—INTERNAL REVENUE SERVICE

1. Not to exceed 4 per centum of any appropriation made available to the Internal Revenue Service for the current fiscal year by this Act may be transferred to any other Internal Revenue Service appropriation. SEC. 2. Not to exceed 15 per centum, or $15,000,000, whichever is greater, of any appropriation made available to the Internal Revenue Service for document matching for the current fiscal year by this Act may be transferred to any other Internal Revenue Service appropriation for document matching. SECTION

�