102 STAT. 3758

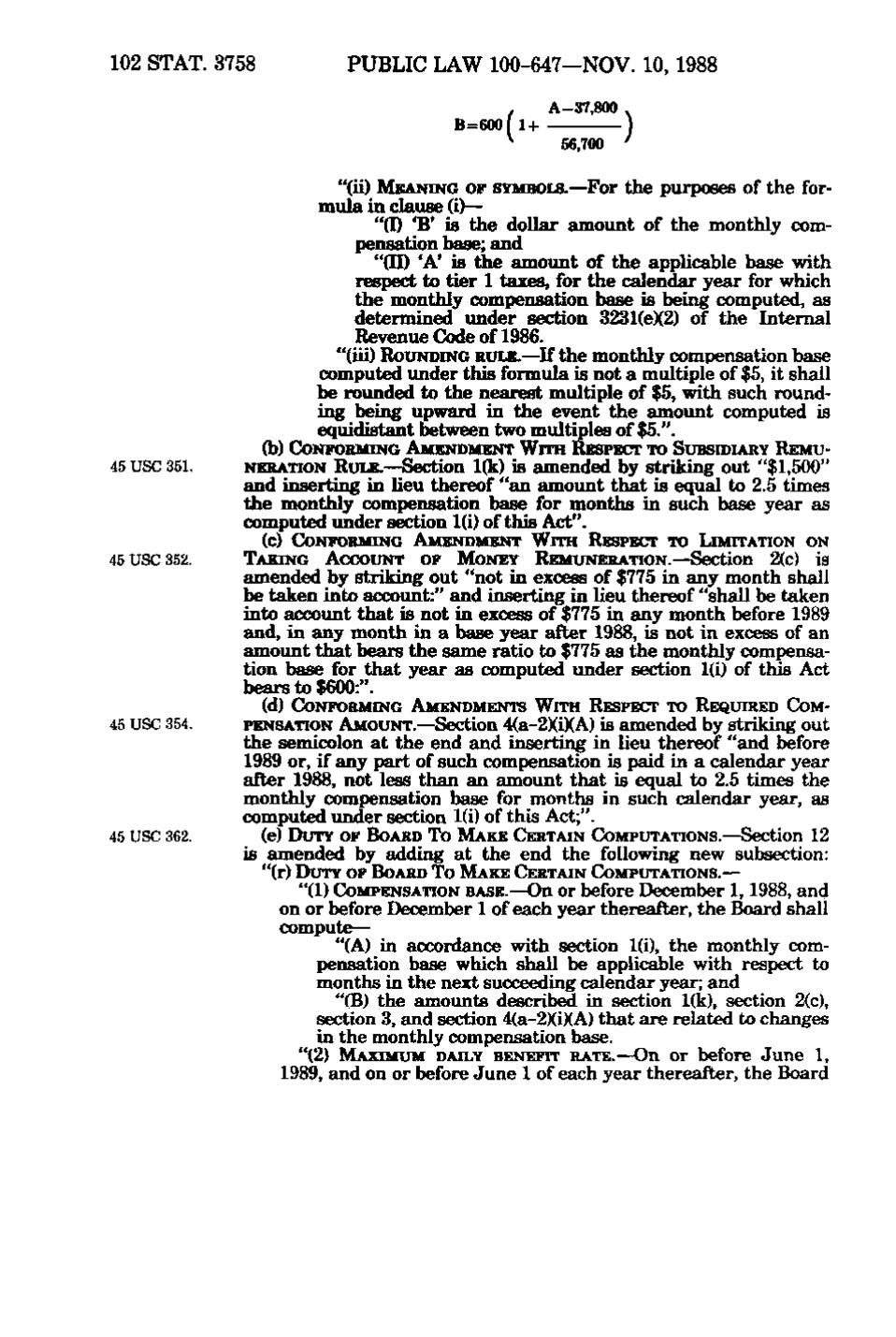

PUBLIC LAW 100-647—NOV. 10, 1988 A-37,800. J=600( 1 +

45 USC 351.

45 USC 352.

56,700

"(ii) MEANING OP SYMBOLS.—For the purposes of the formula in clause (i)— "(I) 'B' is the dollar amount of the monthly compensation base; and "(II) 'A' is the amount of the applicable base with respect to tier 1 taxes, for the calendar year for which the monthly compensation base is being computed, as determined under section 3231(e)(2) of the Internal Revenue Code of 1986. "(iii) ROUNDING RULE.—If the monthly compensation base computed under this formula is not a multiple of $5, it shall be rounded to the nearest multiple of $5, with such rounding being upward in the event the amount computed is equidistant between two multiples of $5.". (b) CoNFOR&oNG AMENDMENT WITH RESPECT TO SuBsroiARY REMUNERATION RULE.—Section l(k) is amended by striking out "$1,500" and inserting in lieu thereof "an amount that is equal to 2.5 times the monthly compensation base for months in such base year as computed under section l(i) of this Act". (c) CONFORMING AMENDBIIENT WITH RESPECT TO LIMITATION ON TAKING ACCOUNT OF MONEY REMUNERATION.—Section 2(c) is

amended by striking out "not in excess of $775 in any month shall be taken into account:" and inserting in lieu thereof "shall be taken into account that is not in excess of $775 in any month before 1989 and, in any month in a base year after 1988, is not in excess of an amount that bears the same ratio to $775 as the monthly compensation base for that year as computed under section l(i) of this Act bears to $600:". 45 USC 354.

(d) CONFORMING AMENDMENTS WITH RESPECT TO REQUIRED 0) M PENSATION AMOUNT.—Section 4(a-2XiXA) is amended by striking out

the semicolon at the end and inserting in lieu thereof "and before 1989 or, if any part of such compensation is paid in a calendar year after 1988, not less than an amount that is equal to 2.5 times the monthly compensation base for months in such calendar year, as computed under section l(i) of this Act;". 45 USC 362.

(e) DUTY OF BOARD TO MAKE CERTAIN COMPUTATIONS.—Section 12

is amended by adding at the end the following new subsection: "(r) DUTY OF BOARD TO MAKE CERTAIN (COMPUTATIONS.—

"(1) COMPENSATION BASE.—On or before December 1, 1988, and on or before December 1 of each year thereafter, the Board shall compute— "(A) in accordance with section l(i), the monthly compensation base which shall be applicable with respect to months in the next succeeding calendar year; and "(B) the amounts described in section l(k), section 2(c), section 3, and section 4(a-2XiXA) that are related to changes in the monthly compensation base. "(2) MAXIMUM DAILY BENEFIT RATE.—On or before June 1, 1989, and on or before June 1 of each year thereafter, the Board

�