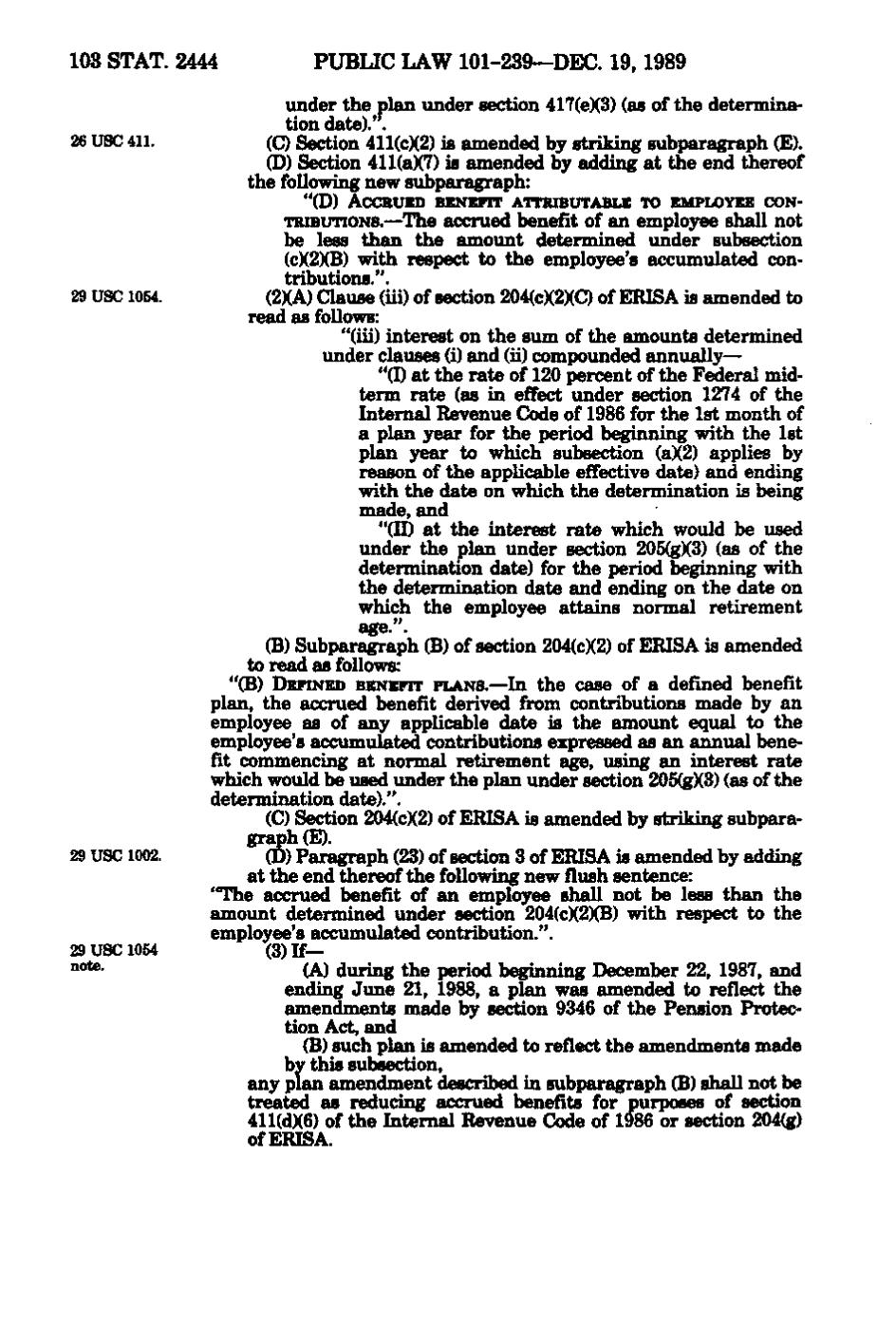

103 STAT. 2444 PUBLIC LAW 101-239—DEC. 19, 1989 under the plan under section 417(e)(3) (as of the determina- tion date).". 26 USC 411. (C) Section 411(c)(2) is amended by striking subparagraph (E). (D) Section 411(a)(7) is amended by adding at the end thereof the following new subparagraph: "(D) ACCRUED BENEFIT ATTRIBUTABLE TO EMPLOYEE CON- TRIBUTIONS.—The accrued benefit of an employee shall not be less than the amount determined under subsection (c)(2)(B) with respect to the employee's accumulated con- tributions. ". 29 USC 1054. (2)(A) Clause (ui) of section 204(c)(2)(C) of ERISA is amended to read as follows: "(iii) interest on the sum of the amounts determined under clauses (i) and (ii) compounded annually— "(I) at the rate of 120 percent of the Federal mid- term rate (as in effect under section 1274 of the Internal Revenue Code of 1986 for the 1st month of a plan year for the period beginning with the 1st plan year to which subsection (a)(2) applies by reason of the applicable effective date) and ending with the date on which the determination is being made, and "(II) at the interest rate which would be used under the plan under section 205(g)(3) (as of the determination date) for the period beginning with the determination date and ending on the date on which the employee attains normal retirement age.". (B) Subparagraph (B) of section 204(c)(2) of ERISA is amended to read as follows: "(B) DEFINED BENEFTT PLANS.— In the case of a defined benefit plan, the accrued benefit derived from contributions made by an employee as of any applicable date is the amount equal to the employee's accumulated contributions expressed as an annual bene- fit commencing at normal retirement age, using an interest rate which would be used under the plan under section 205(g)(3) (as of the determination date).". (C) Section 204(c)(2) of ERISA is amended by striking subpara- graph (E). 29 USC 1002. (D) Paragraph (23) of section 3 of ERISA is amended by adding at the end thereof the following new flush sentence: "The accrued benefit of an employee shall not be less than the amount determined under section 204(c)(2)(B) with respect to the employee's accumulated contribution.". 29 USC 1054 (3)If—

- °*®'

(A) during the period beginning December 22, 1987, and ending June 21, 1988, a plan was amended to reflect the amendments made by section 9346 of the Pension Protec- tion Act, and (B) such plan is amended to reflect the amendments made by this subsection, any plan amendment described in subparcigraph (B) shall not be treated as reducing accrued benefits for purposes of section 411(d)(6) of the Internal Revenue Code of 1986 or section 204(g) of ERISA.

�