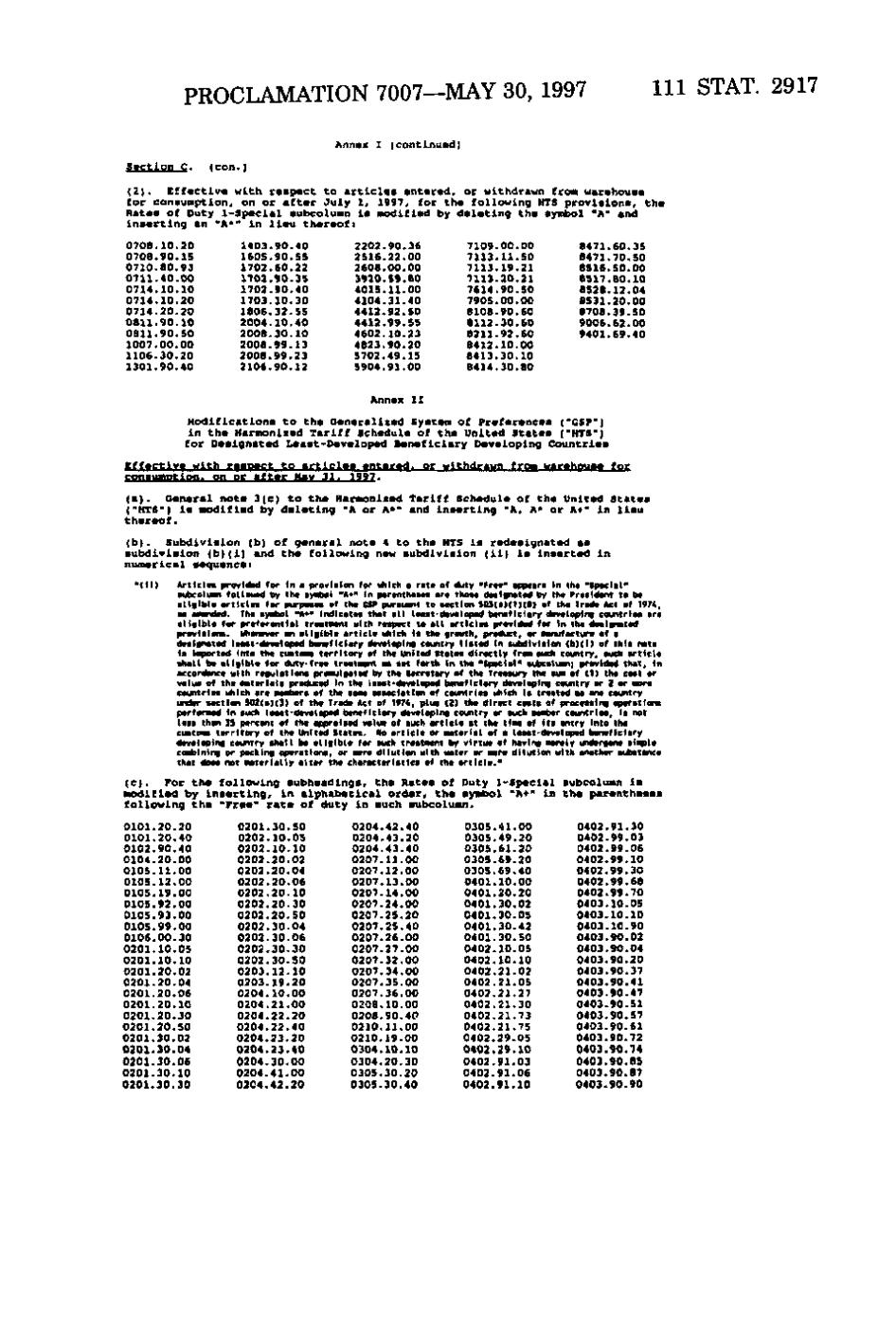

PROCLAMATION 7007—MAY 30, 1997 111 STAT. 2917 Annax I (contlnuad) Section C. (con.) (2). Effective with respect to articles entered, or withdrawn from warehouse for consumption, on or after July 1, 1997, for the following HTS provisions, the Rates of Duty 1-Special subcolumn is modified by delating the symbol "A" and inserting an "A*" in lieu thereof) 0708. 10. 20 0708.90. 15 0710.80.93 0711.4 0.00 0714. 10.1 0 0714.1 0.20 0714.20.20 0811. 90. 10 0811. 90.50 1007.00.00 11 06.30.2 0 13 01.9 0.4 0 1403.90.40 1605.90.55 1702.60.22 1702.90.35 1702.90.40 1703.10.30 1806.32.55 2004.10.40 2008.30.10 2008.99.13 2008.99.23 2106.90.12 2202.90.36 2516.22.00 2608.00.00 3920.59.80 4015.11.00 4104.31.40 4412.92.50 4412.99.55 4602.10.23 4823.90.20 5702.49.15 5904.91.00 7109.00.00 7113.11.50 7113.19.21 7113.20.21 7614.90.50 7905.00.00 8108.90.60 8112.30.60 8211.92.60 8412.10.00 8413.30.10 8414.30.80 8471.60.35 8471.70.50 8516.50.00 8517.80.10 8528.12.04 8531.20.00 8708.39.50 9006.62.00 9401.69.40 Modifications to the Generalized System of Preferences (*CSP*) in the Harmonized Tariff Schedule of the United States (-HTS*) for Designated Least-Developed Beneficiary Developing Countries Effective with respect to articles entered, or withdrawn from warehouse for consumption, on or after May 31. 1997. (a). General note 3|c) to the Harmonized Tariff Schedule of the United States ('HTS') is modified by deleting 'A or A*' and inserting *A, A* or A^' in lieu thereof. (b). Subdivision (b) of general note 4 to the HTS is redesignated as subdivision (b)(i) and the following new subdivision (ii) is inserted in numerical sequence: •(ii) Artidm provided for in • proviiion for Hhich • roti of duty 'Frc*' appcirt in the 'Sptciol" subcotuei follomd by th« tyi^ol 'A«' in porcnthtso* or* thott dvsignotod by th* Prttldont to be ttigibi* orticln for purposes of the e» puriuont to section S03(s)(1)(*) of the Trodc Act of 1974, •s aiMnded. The systet '*'»' indicates thst sll lees I-developed beneficiary developing countries are elltibte for preferential treatMnt yith respect to all articles provided for in the designated provisions. Whenever an eligible erticle which is the growth, product, or nenufacture of a designated least-developed beneficiary developing country listed in subdivision (b)(l> of this note Is laported into the custcas territory of the United States directly from such comtry, such article shall be eligible for duty-free treatmnt as set forth in the 'tpecial" sufacoluai; provided that. In accordance with regulations pronulgated by the Secretary of the Treasury ttte sua of (1) the cost or value of the aaterials produced in the least-developed beneficiary developing country or 2 or more countries which sre aenfaers of the saae association of countries which is treated as one country under section S02(a>(3) of the Trade Act of 1974, plus (2) the direct costs of processing operations perforated In such least-developed beneficiary developing cowitry or such aeaber countries, is not less than 35 percent of the appraised value of such article at the tiae of its entry into the custoaa territory of the United States. No article or aaterial of a least-developed beneficisry developing country shall be eligible for such trestacnt by virtue of having aerely i^idergonc siaple coeiiining or packing operations, or aere dilution with water or aere dilution with another aubatance that does not aaterially alter the characteristics of the article.* (c). For the following subheadings, the Rates of Duty 1-Special subcolumn is modified by inserting, in alphabetical order, the symbol 'A*' in the parentheses following the *Pra«' rata of duty in such subcolumn. 0101.20.20 0101.20.40 0102.90.40 0104.20.00 0105.11.00 0105.12.00 0105.19.00 0105.92.00 0105.93.00 0105.99.00 0106.00.30 0201.10.05 0201.10.10 0201.20.02 0201.20.04 0201.20.06 0201.20.10 0201.20.30 0201.20.50 0201.30.02 0201.30.04 0201.30.06 0201.30.10 0201.30.30 0201.30.50 0202.10.05 0202.10.10 0202.20.02 0202.20.04 0202.20.06 0202.20.10 0202.20.30 0202.20.50 0202.30.04 0202.30.06 0202.30.30 0202.30.50 0203.12.10 0203.19.20 0204.10.00 0204.21.00 0204.22.20 0204.22.40 0204.23.20 0204.23.40 0204.30.00 0204.41.00 0204.42.20 0204.42.40 0204.43.20 0204.43.40 0207.11.00 0207.12.00 0207.13.00 0207.14.00 0207.24.00 0207.25.20 0207.25.40 0207.26.00 0207.27.00 0207.32.00 0207.34.00 0207.35.00 0207.36.00 0208.10.00 0208.90.40 0210.11.00 0210.19.00 0304.10.10 0304.20.30 0305.30.20 0305.30.40 0305.41.00 0305.49.20 0305.61.20 0305.69.20 0305.69.40 0401.10.00 0401.20.20 0401.30.02 0401.30.05 0401.30.42 0401.30.50 0402.10.05 0402.10.10 0402.21.02 0402.21.05 0402.21.27 0402.21.30 0402.21.73 0402.21.75 0402.29.05 0402.29.10 0402.91.03 0402.91.06 0402.91.10 0402.91.30 0402.99.03 0402.99.06 0402.99.10 0402.99.30 0402.99.68 0402.99.70 0403.10.05 0403.10.10 0403.10.90 0403.90.02 0403.90.04 0403.90.20 0403.90.37 0403.90.41 0403.90.47 0403.90.51 0403.90.57 0403.90.61 0403.90.72 0403.90.74 0403.90.85 0403.90.87 0403.90.90

�