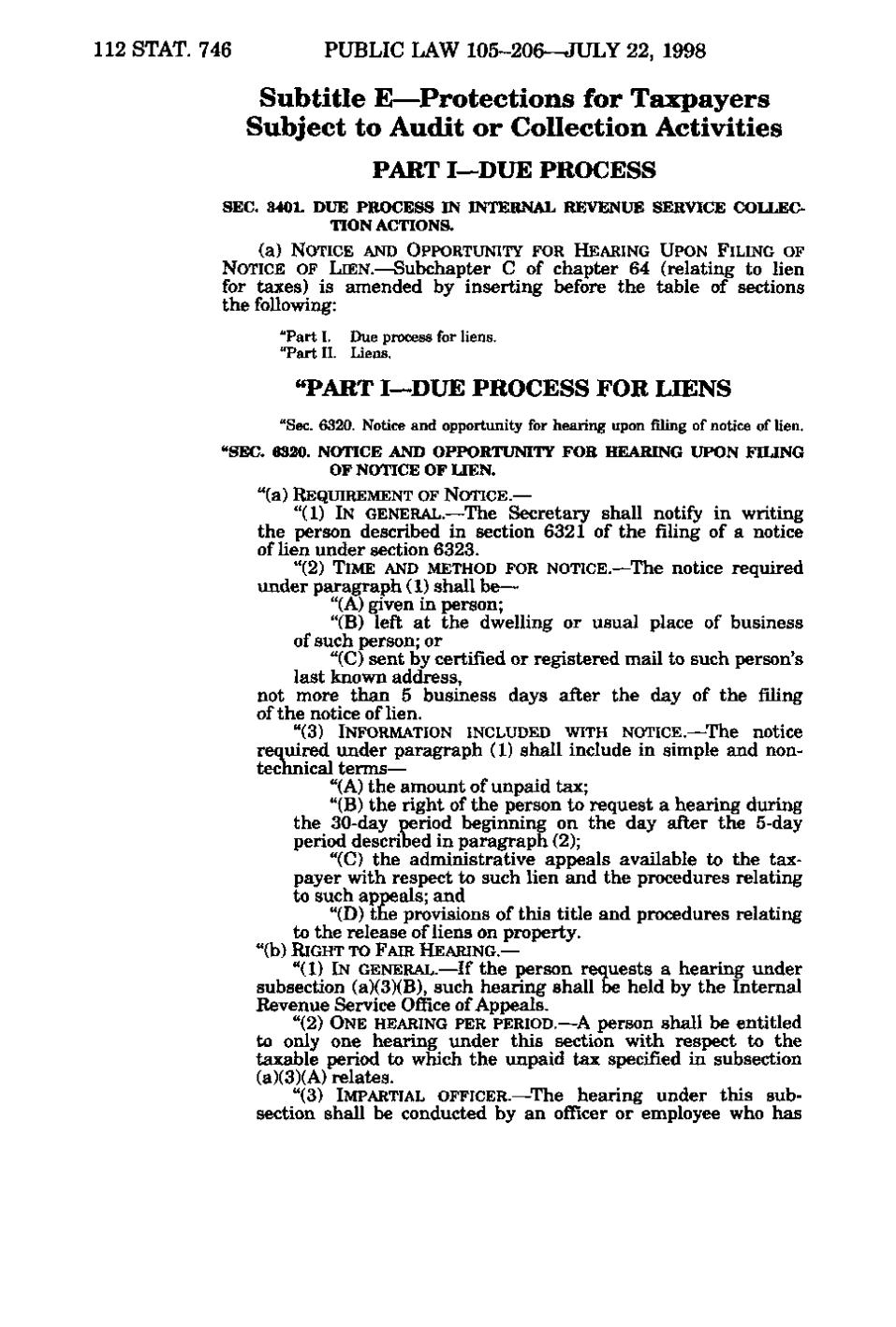

112 STAT. 746 PUBLIC LAW 105-206-JULY 22, 1998 Subtitle E—Protections for Taxpayers Subject to Audit or Collection Activities PART I—DUE PROCESS SEC. 3401. DUE PROCESS IN INTERNAL REVENUE SERVICE COLLEC- TION ACTIONS. (a) NOTICE AND OPPORTUNITY FOR HEARING UPON FILING OF NOTICE OF LIEN. — Subchapter C of chapter 64 (relating to lien for taxes) is amended by inserting before the table of sections the following: "Part I. Due process for liens. "Part II. Liens. " PART I—DUE PROCESS FOR LIENS "Sec. 6320. Notice and opportunity for hearing upon filing of notice of lien. "SEC. 6320. NOTICE AND OPPORTUNITY FOR HEARING UPON FIUNG OF NOTICE OF UEN. " (a) REQUIREMENT OF NOTICE. — "(1) IN GENERAL.— The Secretary shall notify in writing the person described in section 6321 of the filing of a notice of lien under section 6323. "(2) TIME AND METHOD FOR NOTICE. —The notice required under paragraph (1) shall be— "(A) given in person; "(B) left at the dwelling or usual place of business of such person; or "(C) sent by certified or registered mail to such person's last known address, not more than 5 business days after the day of the filing of the notice of lien. "(3) INFORMATION INCLUDED WITH NOTICE.— The notice required under paragraph (1) shall include in simple and nontechnical terms— "(A) the amount of unpaid tax; "(B) the right of the person to request a hearing during the 30-day period beginning on the day after the 5-day period described in paragraph (2); "(C) the administrative appeals available to the taxpayer with respect to such lien and the procedures relating to such appeals; and "(D) the provisions of this title and procedures relating to the release of liens on property. "(b) RIGHT TO FAIR HEARING.— "(1) IN GENERAL. —I f the person requests a hearing under subsection (a)(3)(B), such hearing shall be held by the Internal Revenue Service Office of Appeals. "(2) ONE HEARING PER PERIOD.—^A person shall be entitled to only one hearing under this section with respect to the taxable period to which the unpaid tax specified in subsection (a)(3)(A) relates. "(3) IMPARTIAL OFFICER. —The hearing under this subsection shall be conducted by an officer or employee who has

�