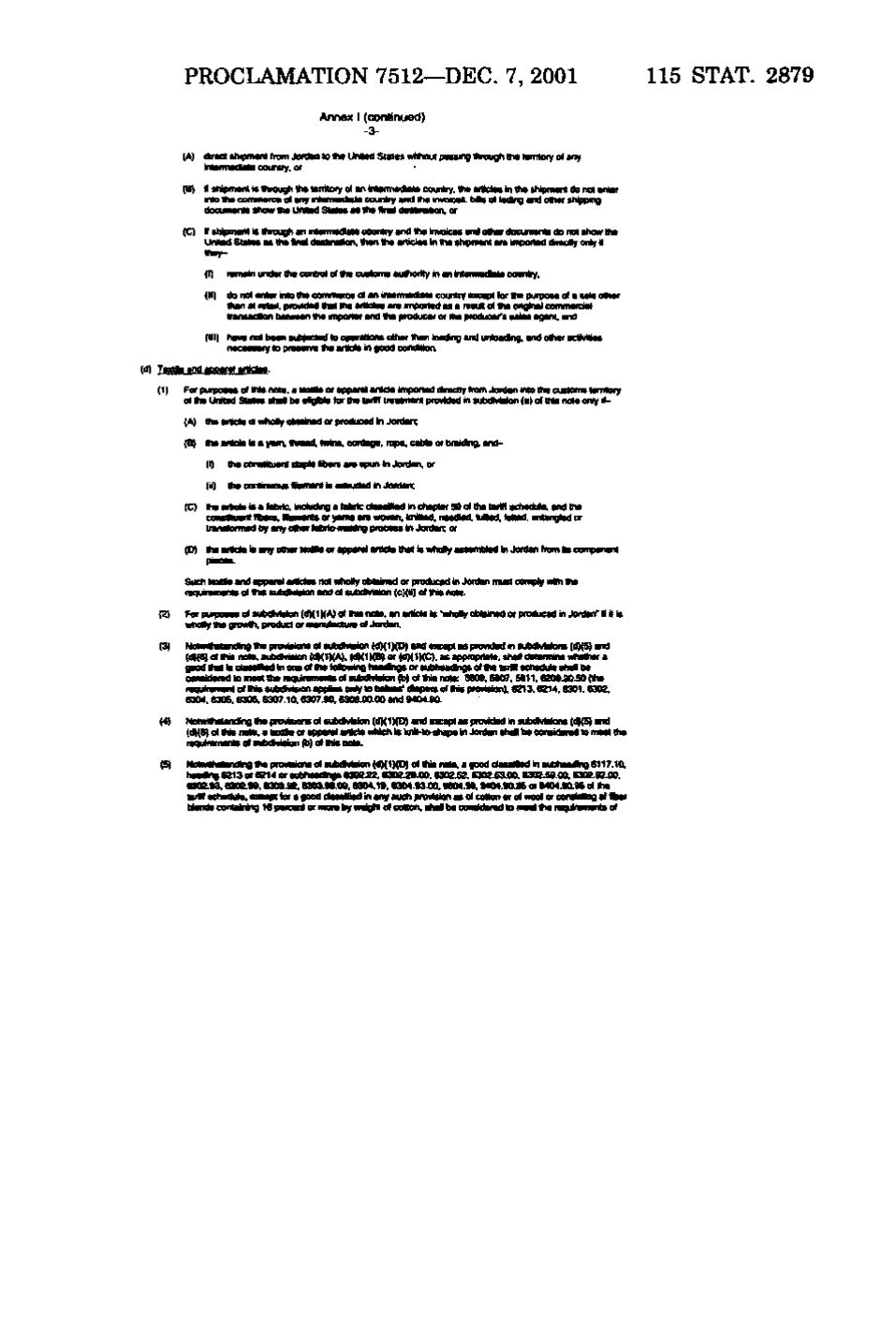

PROCLAMATION 7512—DEC. 7, 2001 115 STAT. 2879 Annex I (continued) -3- (A) direct shipnieni from JonlBUi to the United States wittxiut passing through the territocy 01 any inlemiadiate couniiy, or (B) it shipment is through the tenitory ol an intennedlale country,the articlasin the shipment do not enter into the commerce of ariymtermedute country and the invoices. t3ill5oflading and other shipping documents show the Unilad States as Itie final destinamn. or (C) itshipment is through an mlecmsdlata coumry and the invoicBSand oOwrdocuments do not show the United States as ttw finaldettinaticn, than Vm articles in the shipment am iinpoilad directly onlyK the y- (I) remain under the control ol the customs authority in an intarmedtale counUy, (H) do not enter into the commerce ol an inlennediate country excapl lor thepurpose of a sale other than at retail, provided the!the aitides are imponed as a result ol the original commercial trantacMon betvwen the importer and ttw producer or ttw producer's sales agent, and (III) have not tiaen subjected to oparationG other ttien loading and unloading, and other activities necessary to pivaetva the artida in good condition. (d) TexWe and aooarel artidae. (1) For purposes of this note, a lentlla orapparsi article imponed dractty from Jordan intothe custcnisterntory of Iha United Sttles she! be eligible for thetatW treaanent provided in subdhiision (a) o(this note only 11- (A) the article is wtwily obtained or producadin Jordan; (B) the artde ie a yam, thread, twina, cordage, rope, caMe or braiding, and- (i) the constitueni stapleB>ers are spun inJontan, or (ii) the oontinuauE filament is extruded in Jordan; (C) the article is a fabric, including a fabric dassllled in chapter 59 olthetaiifl schedule, and the consWuent fibers, tlaments or yams are woven, Icnitted, needled, tufted, felled, entangled or transformed by any other fabrlc-maldng process in Jordan; or (D) theartde ia any other MiMe or ^iparalartlcla that is wholyassembM inJordan from its component SuchteiMe and apparal ailldes not whollyoMained or produced in Jordanmust compiywith the requremems of Ihis subdmsion and of subdivision (c)(ii) of this note. (2) For puiposesdsubdiyla)on(d)(lMA)Ofthis note, an artida Is *whoHy obtained orproduced in Jonlanr Kit is whollyttw growth, product or marvitacture ol Jonlan. (3) Molwithstandingthe provisions of stixfvision (dHIMD) and except asprovided in sutxiivlsions (d)(5) and (dK6) of this note, subdivision (d)(1HA). (d)(1)(B) or (dK1)(C). as appiopiiate, shall detemiine whether a goodthat Is classified In one of the fotowlrtg headktgs or subheadings of the tarift schedule shallbe considered to meet the requirements of sukxiivision (b) of this note: 5609,5807,5811,6209,20.50 (the requiremeni of ttiis sutxiivision applies only to twiiias' dupers of this provision), 6213,6214, 6301.6302, 6304, 6305.6306, 6307.10, 6307.90. 6306.00.00 and 9404.90. (4) Molwithstanding the provisions of subdMsion(dK1)(D) and except as provided in subdivisions (d)(5) wid (dH6) of this note, a taxHe or apparsi article «Mch is knit-lo-shapein Jordan shall be consideredto meet ttie requirements of siixfvision (b) of this note. (5) t4otwithstanding the provisions o( subdMaion (d)(IKD) o*tt<isnote, a good dassHM In subheading 6117.10; heading6213 or 6214 or subheadinos 6302.22.6302,29.00,6302.52,6302.53.00,6302.59.00, 6302.92.00, 6302.93.6302.99. 6303.92.6303.99.00. 6304,19, 6304.93.00, 6304.99. 94O4.90.8& or 9404.90.95 of the tariff BChadula, except lor a good dasaXiad in any such provision as of cotton or of wad or consisting oi fliat blanda containing 16 paicenl or nwre byVMight ol canon, thai baoonsidsnMl to maal the raquiiamaitt of

�