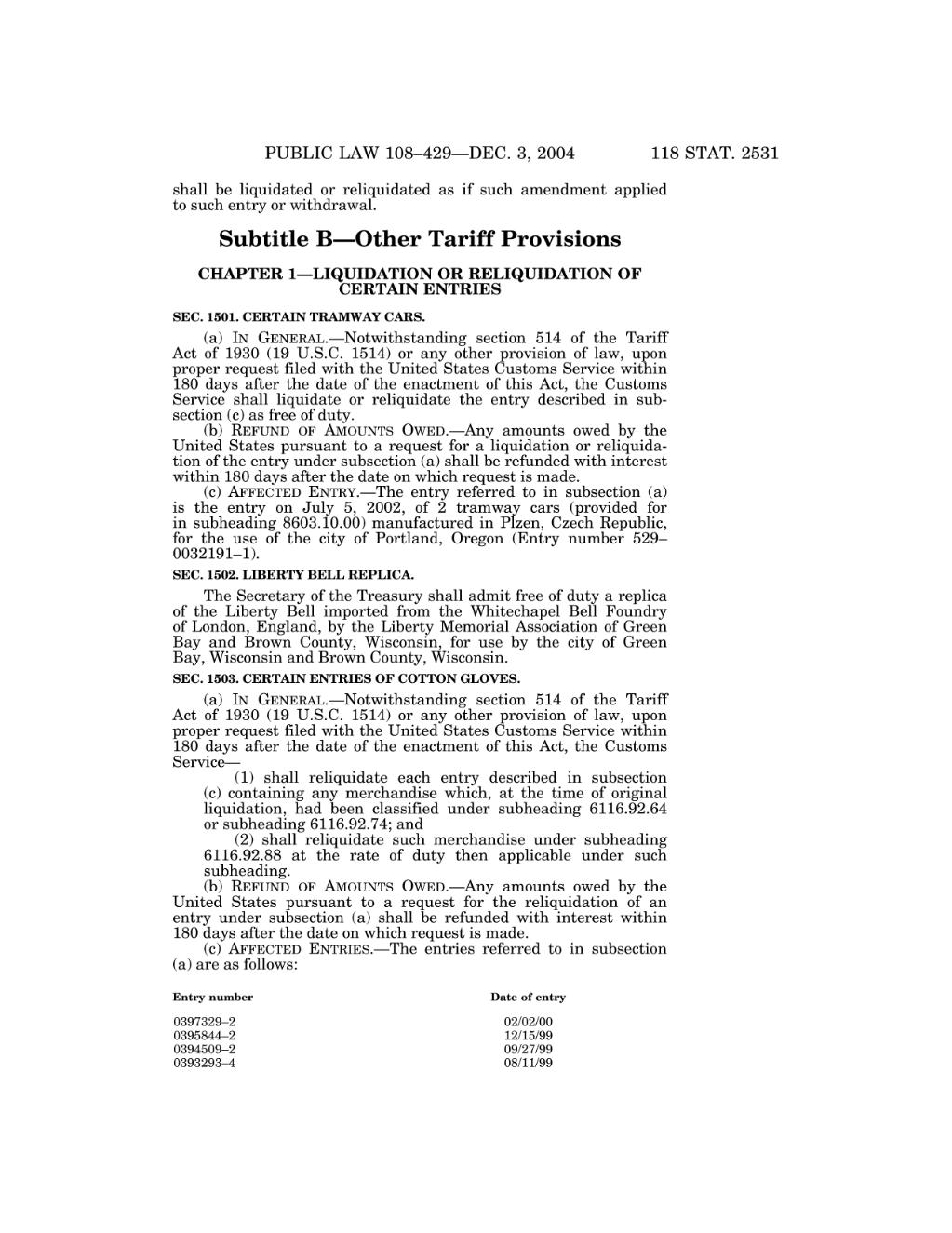

118 STAT. 2531 PUBLIC LAW 108–429—DEC. 3, 2004 shall be liquidated or reliquidated as if such amendment applied to such entry or withdrawal. Subtitle B—Other Tariff Provisions CHAPTER 1—LIQUIDATION OR RELIQUIDATION OF CERTAIN ENTRIES SEC. 1501. CERTAIN TRAMWAY CARS. (a) IN GENERAL.—Notwithstanding section 514 of the Tariff Act of 1930 (19 U.S.C. 1514) or any other provision of law, upon proper request filed with the United States Customs Service within 180 days after the date of the enactment of this Act, the Customs Service shall liquidate or reliquidate the entry described in sub section (c) as free of duty. (b) REFUND OF AMOUNTS OWED.—Any amounts owed by the United States pursuant to a request for a liquidation or reliquida tion of the entry under subsection (a) shall be refunded with interest within 180 days after the date on which request is made. (c) AFFECTED ENTRY.—The entry referred to in subsection (a) is the entry on July 5, 2002, of 2 tramway cars (provided for in subheading 8603.10.00) manufactured in Plzen, Czech Republic, for the use of the city of Portland, Oregon (Entry number 529– 0032191–1). SEC. 1502. LIBERTY BELL REPLICA. The Secretary of the Treasury shall admit free of duty a replica of the Liberty Bell imported from the Whitechapel Bell Foundry of London, England, by the Liberty Memorial Association of Green Bay and Brown County, Wisconsin, for use by the city of Green Bay, Wisconsin and Brown County, Wisconsin. SEC. 1503. CERTAIN ENTRIES OF COTTON GLOVES. (a) IN GENERAL.—Notwithstanding section 514 of the Tariff Act of 1930 (19 U.S.C. 1514) or any other provision of law, upon proper request filed with the United States Customs Service within 180 days after the date of the enactment of this Act, the Customs Service— (1) shall reliquidate each entry described in subsection (c) containing any merchandise which, at the time of original liquidation, had been classified under subheading 6116.92.64 or subheading 6116.92.74; and (2) shall reliquidate such merchandise under subheading 6116.92.88 at the rate of duty then applicable under such subheading. (b) REFUND OF AMOUNTS OWED.—Any amounts owed by the United States pursuant to a request for the reliquidation of an entry under subsection (a) shall be refunded with interest within 180 days after the date on which request is made. (c) AFFECTED ENTRIES.—The entries referred to in subsection (a) are as follows: Entry number Date of entry 0397329–2 02/02/00 0395844–2 12/15/99 0394509–2 09/27/99 0393293–4 08/11/99

�