CH. 1-—NORMAL TAXES AND SURTAXES

223

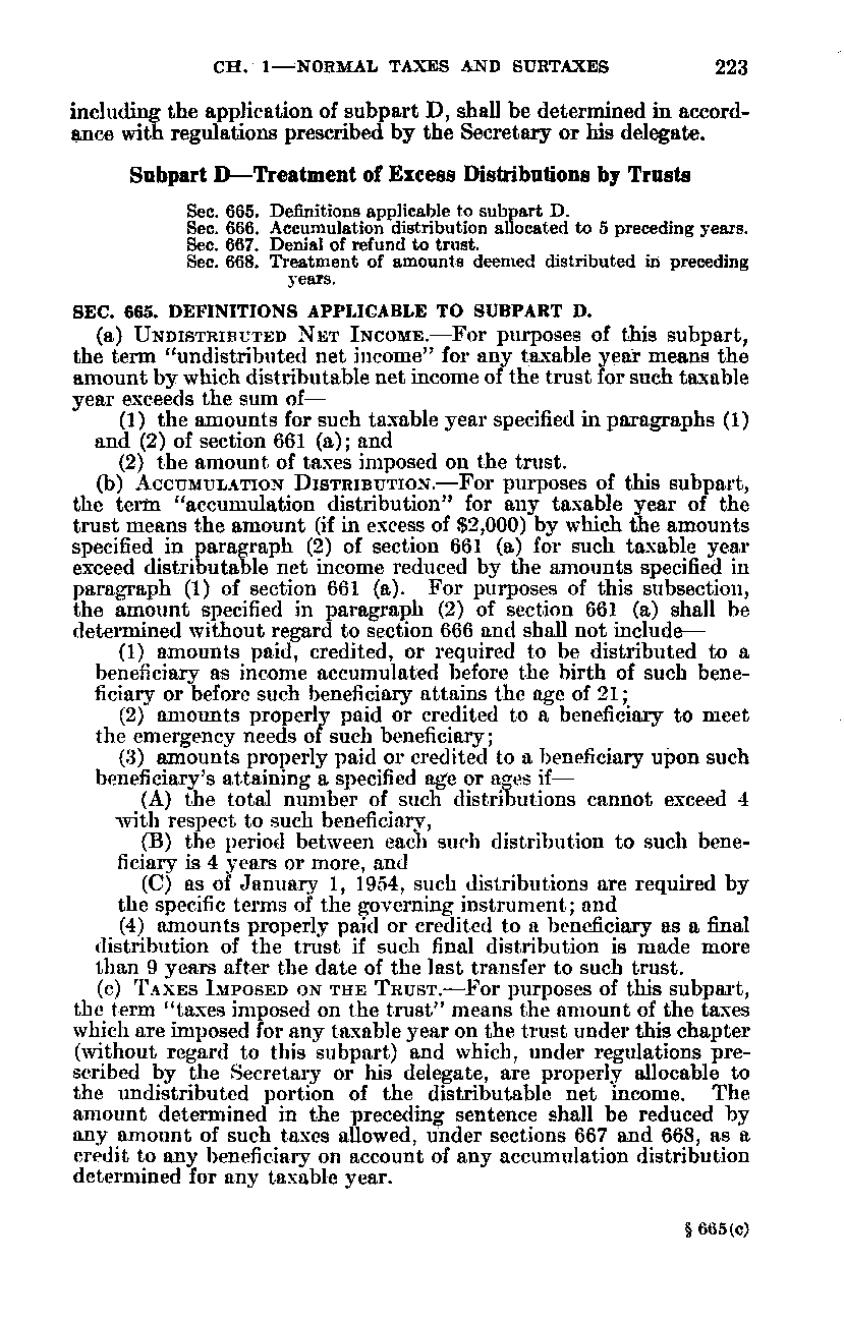

including the application of subpart D, shall be determined in accordance with regulations prescribed by the Secretary or his delegate. Subpart D—Treatment of Excess Distributions by Trusts Sec. Sec. Sec. Sec.

665. 666. 667. 668.

Definitions applicable to subpart D. Accumulation distribution allocated to 5 preceding years. Denial of refund to trust. Treatment of amounts deemed distributed in preceding years.

SEC. 665. DEFINITIONS APPLICABLE TO SUBPART D. (a) UNDISTRIBUTED N E T INCOME.—For purposes of this subpart,

the term "undistributed net income" for any taxable year means the amount by which distributable net income of the trust for such taxable year exceeds the sum o^ f— (1) the amounts for such taxable year specified in paragraphs (1) and (2) of section 661(a); and (2) the amount of taxes imposed on the trust. (b) ACCUMULATION DISTRIBUTION.—For purposes of this subpart, the term "accumulation distribution" for any taxable year of the trust means the amount (if in excess of $2,000) by which the amounts specified in paragraph (2) of section 661(a) for such taxable year exceed distributable net income reduced by the amounts specified in paragraph (1) of section 661(a). For purposes of this subsection, the amount specified in paragraph (2) of section 661(a) shall be determined without regard to section 666 and shall not include— (1) amounts paid, credited, or required to be distributed to a beneficiary as income accumulated before the birth of such beneficiary or before such beneficiary attains the age of 2 1; (2) amounts properly paid or credited to a beneficiary to meet the emergency needs of such beneficiary; (3) amounts properly paid or credited to a beneficiary upon such beneficiary's attaining a specified age or ages if— (A) the total number of such distributions cannot exceed 4 •with respect to such beneficiary, (B) the period between each such distribution to such beneficiary is 4 years or more, and (C) as of January 1, 1954, such distributions are required by the specific terms of the governing instrument; and (4) amounts properly paid or credited to a beneficiary as a final distribution of the trust if such final distribution is made more than 9 years after the date of the last transfer to such trust, (c) T A X E S IMPOSED ON THE T R U S T. — For purposes of this subpart, the term "taxes imposed on the trust" means the amount of the taxes which are imposed for any taxable year on the trust under this chapter (without regard to this subpart) and which, under regulations prescribed by the Secretary or his delegate, are properly allocable to the undistributed portion of the distributable net income. The amount determined in the preceding sentence shall be reduced by any amount of such taxes allowed, under sections 667 and 668, as a credit to any beneficiary on account of any accumulation distribution determined for any taxable year. § 665(c)

�