C H. 1—NORMAL TAXES AND SURTAXES

241

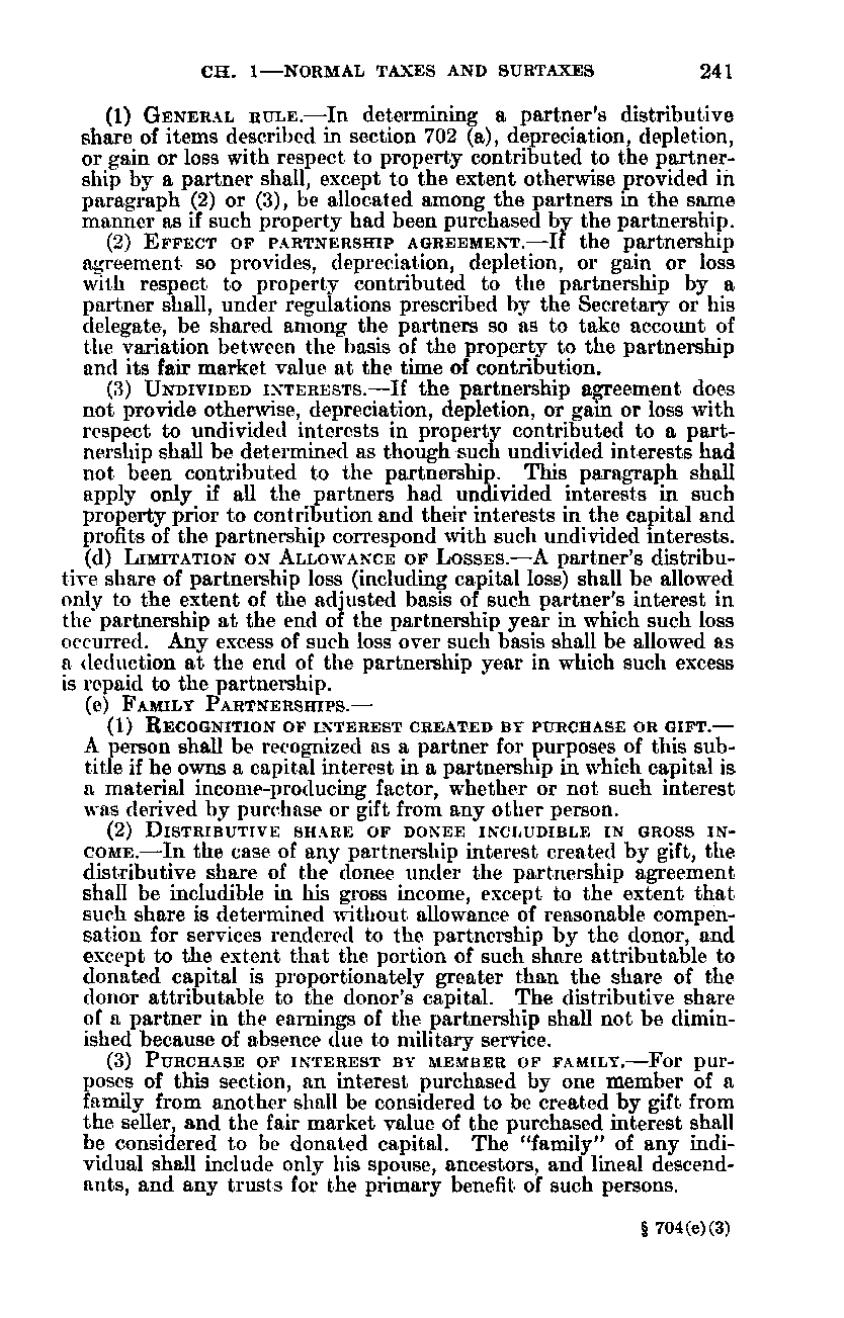

(1) G E N E E A L RULE. — I n determining a partner's distributive share of items described in section 702(a), depreciation, depletion, or gain or loss with respect to property contributed to the partnership by a partner shall, except to the extent otherwise provided in paragraph (2) or (3), be allocated among the partners in the same manner as if such property had been purchased by the partnership. (2) E F F E C T OF PARTNERSHIP AGREEMENT.—If the partnership agreement so provides, depreciation, depletion, or gain or loss with respect to property contributed to the partnership by a partner shall, under regulations prescribed by the Secretary or his delegate, be shared among the partners so as to take account of the variation between the basis of the property to the partnership and its fair market value at the time of contribution. (3) UNDIVIDED INTERESTS.—If the partnership agreement does not provide otherwise, depreciation, depletion, or gain or loss with respect to undivided interests in property contributed to a partnership shall be determined as though such undivided interests had not been contributed to the partnership. This paragraph shall apply only if all the partners had undivided interests in such property prior to contribution and their interests in the capital and profits of the partnership correspond with such undivided interests. (d) LIMITATION ON ALLOWANCE OF LOSSES.—A partner's distribu-

tive share of partnership loss (including capital loss) shall be allowed only to the extent of the adjusted basis of such partner's interest in the partnership a t the end of the partnership year in which such loss occurred. Any excess of such loss over such basis shall be allowed as a deduction at the end of the partnership year in which such excess is repaid to the partnership. (e) FAMILY PARTNERSHIPS.— (1) RECOGNITION OF INTEREST CREATED BY PURCHASE OR GIFT.—

A person shall be recognized as a partner for purposes of this subtitle if he owns a capital interest in a partnership in which capital is a material income-producing factor, whether or not such interest was derived by purchase or gift from any other person. (2) DISTRIBUTIVE SHARE OF DONEE INCLUDIBLE IN GROSS I N -

COME.—In the case of any partnership interest created by gift, the distributive share of the donee under the partnership agreement shall be includible in his gross income, except to the extent that such share is determined without allowance of reasonable compensation for services rendered to the partnership by the donor, and except to the extent that the portion of such share attributable to donated capital is proportionately greater than the share of the donor attributable to the donor's capital. The distributive share of a partner in the earnings of the partnership shall not be diminished because of absence due to military service. (3) PURCHASE OF INTEREST BY MEMBER OF FAMILY.—For purposes of this section, an interest purchased by one member of a family from another shall be considered to be created by gift from the seller, and the fair market value of the purchased interest shall be considered to be donated capital. The "family" of any individual shall include only his spouse, ancestors, and lineal descendants, and any trusts for the primary benefit of such persons. § 704(e)(3)

�