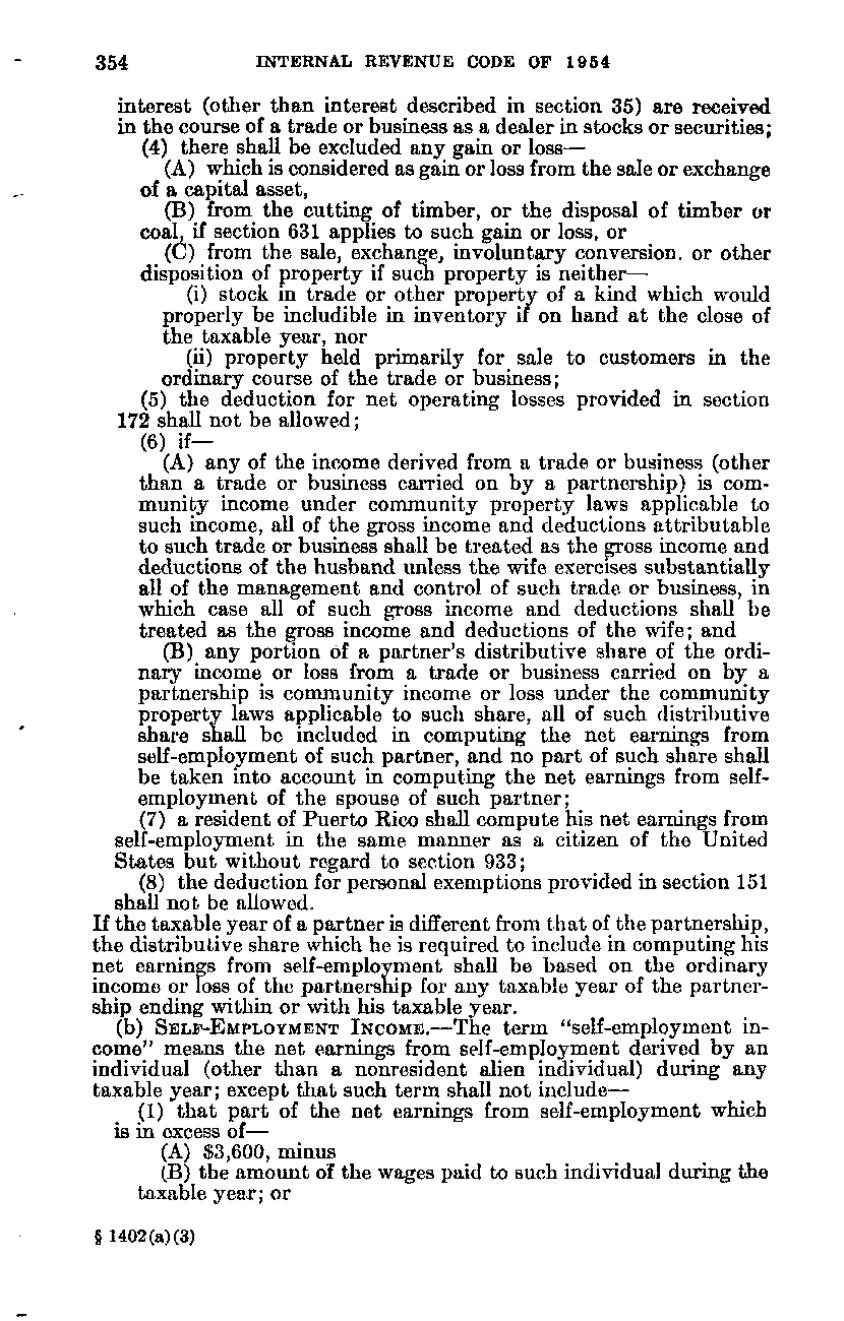

354

INTERNAL REVENUE CODE OF 1954

interest (other than interest described in section 35) are received in the course of a trade or business as a dealer in stocks or securities; (4) there shall be excluded any gain or loss— (A) which is considered as gain or loss from the sale or exchange of a capital asset, (B) from the cutting of timber, or the disposal of timber or coal, if section 631 applies to such gain or loss, or (C) from the sale, exchange, involuntary conversion, or other disposition of property if such property is neither— (i) stock in trade or other property of a kind which would properly be includible in inventory if on hand a t the close of the taxable year, nor (ii) property held primarily for sale to customers in the ordinary course of the trade or business; (5) the deduction for net operating losses provided in section 172 shall not be allowed; (6) i f (A) any of the income derived from a trade or business (other than a trade or business carried on by a partnership) is community income under community property laws applicable to such income, all of the gross income and deductions attributable to such trade or business shall be treated as the gross income and deductions of the husband unless the wife exercises substantially all of the management and control of such trade or business, in which case all of such gross income and deductions shall be treated as the gross income and deductions of the wife; and (B) any portion of a partner's distributive share of the ordinary income or loss from a trade or business carried on by a partnership is community income or loss under the community property laws applicable to such share, all of such distributive share shall be included in computing the net earnings from self-employment of such partner, and no part of such share shall be taken into account in computing the net earnings from selfemployment of the spouse of such partner; (7) a resident of Puerto Rico shall compute his net earnings from self-employment in the same manner as a citizen of the United States but without regard to section 933; (8) the deduction for personal exemptions provided in section 151 shall not be allowed. If the taxable year of a partner is different from that of the partnership, the distributive share which he is required to include in computing his net earnings from self-employment shall be based on the ordinary income or loss of the partnership for any taxable year of the partnership ending within or with his taxable year. (b) SELF-EMPLOYMENT INCOME.—The term "self-employment income" means the net earnings from self-employment derived by an individual (other than a nonresident alien individual) during any taxable year; except that such term shall not include— (1) that part of the net earnings from self-employment which is in excess of— (A) $3,600, minus (B) the amount of the wages paid to such individual during the taxable year; or § 1402(a)(3)

�