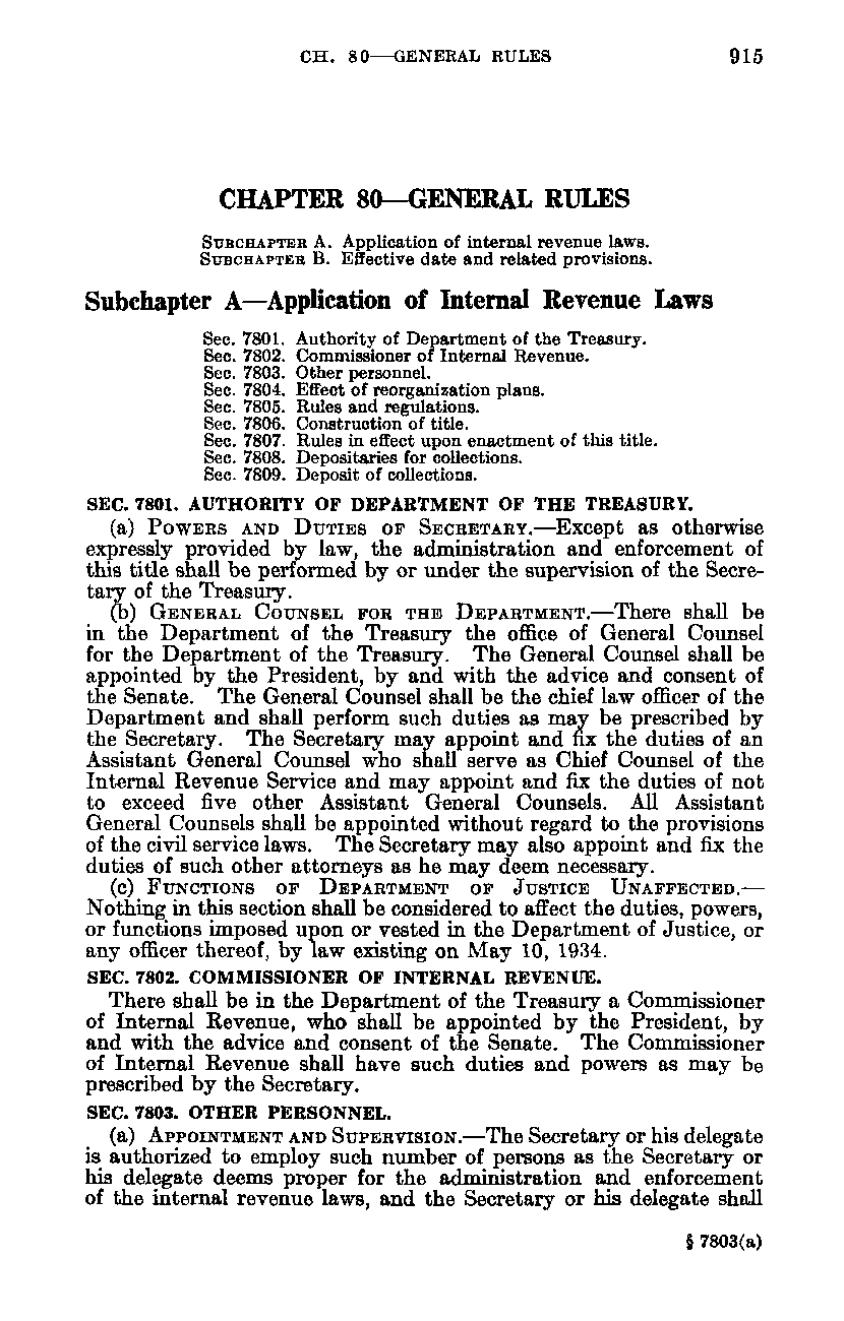

CH. 80—GENERAL RULES

915

CHAPTER 80—GENERAL RULES SUBCHAPTER A. Application of internal revenue laws. SUBCHAPTER B. Effective date and related provisions.

Subchapter A—Application of Internal Revenue Laws Sec. Sec. Sec. Sec. Sec. Sec. Sec. Sec. Sec.

7801. 7802. 7803. 7804. 7805. 7806. 7807. 7808. 7809.

Authority of Department of the Treasury. Commissioner of Internal Revenue. Other personnel. Effect of reorganization plans. Rules and regulations. Construction of title. Rules in effect upon enactment of this title. Depositaries for collections. Deposit of collections.

SEC. 7801. AUTHORITY OF DEPARTMENT OF THE TREASURY. (a) POWERS AND D U T I E S OF SECRETARY.—Except as otherwise

expressly provided by law, the administration and enforcement of this title shall be performed by or under the supervision of the Secretary of the Treasury. (b) GENERAL COUNSEL FOR THE DEPARTMENT.—There shall be in the Department of the Treasury the office of General Counsel for the Department of the Treasury. The General Counsel shall be appointed by the President, by and with the advice and consent of the Senate. The General Counsel shall be the chief law officer of the Department and shall perform such duties as may be prescribed by the Secretary. The Secretary may appoint and fix the duties of an Assistant General Counsel who shall serve as Chief Counsel of the Internal Revenue Service and may appoint and fix the duties of not to exceed five other Assistant General Counsels. All Assistant General Counsels shall be appointed without regard to the provisions of the civil service laws. The Secretary may also appoint and fix the duties of such other attorneys as he may deem necessary. (c) FUNCTIONS

OF DEPARTMENT

OF JUSTICE

UNAFFECTED.—

Nothing in this section shall be considered to affect the duties, powers, or functions imposed upon or vested in the Department of Justice, or any officer thereof, by law existing on May 10, 1934. SEC. 7802. COMMISSIONER OF INTERNAL REVENUE.

There shall be in the Department of the Treasury a Commissioner of Internal Revenue, who shall be appointed by the President, by and with the advice and consent of the Senate. The Commissioner of Internal Revenue shall have such duties and powers as may be prescribed by the Secretary. SEC. 7803. OTHER PERSONNEL. (a) APPOINTMENT AND SUPERVISION.—The Secretary or his delegate

is authorized to employ such number of persons as the Secretary or his delegate deems proper for the administration and enforcement of the internal revenue laws, and the Secretary or his delegate shall § 7803(a)

�