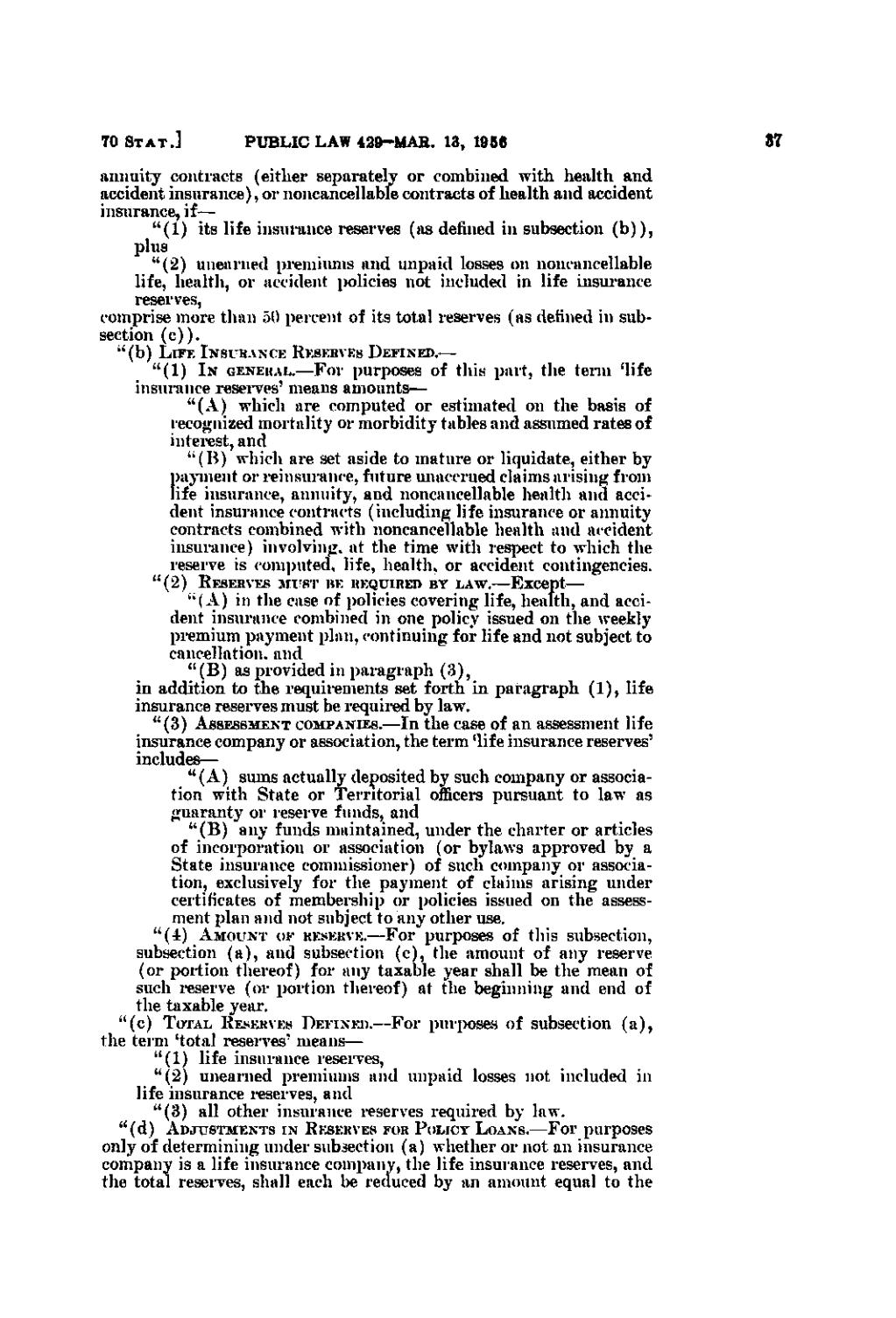

70 S T A T. ]

PUBLIC LAW 4 2 9 - M A R. 13, 1966

annuity contracts (either separately or combined with health and accident insurance), or noncancellable contracts of health and accident insurance, if— "(1) its life insurance reserves (as defined in subsection (b)), plus "(2) unearned premiums and unpaid losses on noncancellable life, health, or accident policies not included in life insurance reserves, comprise more than 50 percent of its total reserves (as defined in subsection (c)). " (b) L I F E INSURANCE RESERVES DEFINED.—

"(1) IN GENERAL.—For purposes of this part, the term 'life insurance reserves' means amounts— " (A) which are computed or estimated on the basis of recognized mortality or morbidity tables and assumed rates of interest, and " (B) which are set aside to mature or liquidate, either by payment or reinsurance, future unaccrued claims arising from life insurance, annuity, and noncancellable health and accident insurance contracts (including life insurance or annuity contracts combined with noncancellable health and accident insurance) involving, at the time with respect to which the reserve is computed, life, health, or accident contingencies. "(2)

RESERVES MTTST HE REQUIRED BY LAW.—Except—

" (A) in the case of policies covering life, health, and accident insurance combined in one policy issued on the weekly premium payment plan, continuing for life and not subject to cancellation, and " (B) as provided in paragraph (3), in addition to the requirements set forth in paragraph (1), life insurance reserves must be required by law. "(3) ASSESSMENT COMPANIES.—In the case of an assessment life insurance company or association, the term 'life insurance reserves' includes— " (A) sums actually deposited by such company or association with State or Territorial officers pursuant to law as guaranty or reserve funds, and " (B) any funds maintained, under the charter or articles of incorporation or association (or bylaws approved by a State insurance commissioner) of such company or association, exclusively for the payment of claims arising under certificates of membership or policies issued on the assessment plan and not subject to any other use. "(4) AMOUNT OF RESERVE.—For purposes of this subsection, subsection (a), and subsection (c), the amount of any reserve (or portion thereof) for any taxable year shall be the mean of such reserve (or portion thereof) at the beginning and end of the taxable year. "(c) TOTAL RESERVES DEFINED.—For purposes of subsection (a), the term 'total reserves' means— "(1) life insurance reserves, "(2) unearned premiums and unpaid losses not included in life insurance reserves, and "(3) all other insurance reserves required by law. "(d)

ADJUSTMENTS IN RESERVES FOR POLICY LOANS.—For purposes

only of determining under subsection (a) whether or not an insurance company is a life insurance company, the life insurance reserves, and the total reserves, shall each be reduced by an amount equal to the

37

�