72

PUBLIC LAW 8 5 - 8 5 7 - S E P T. 2, 1958

STAT.]

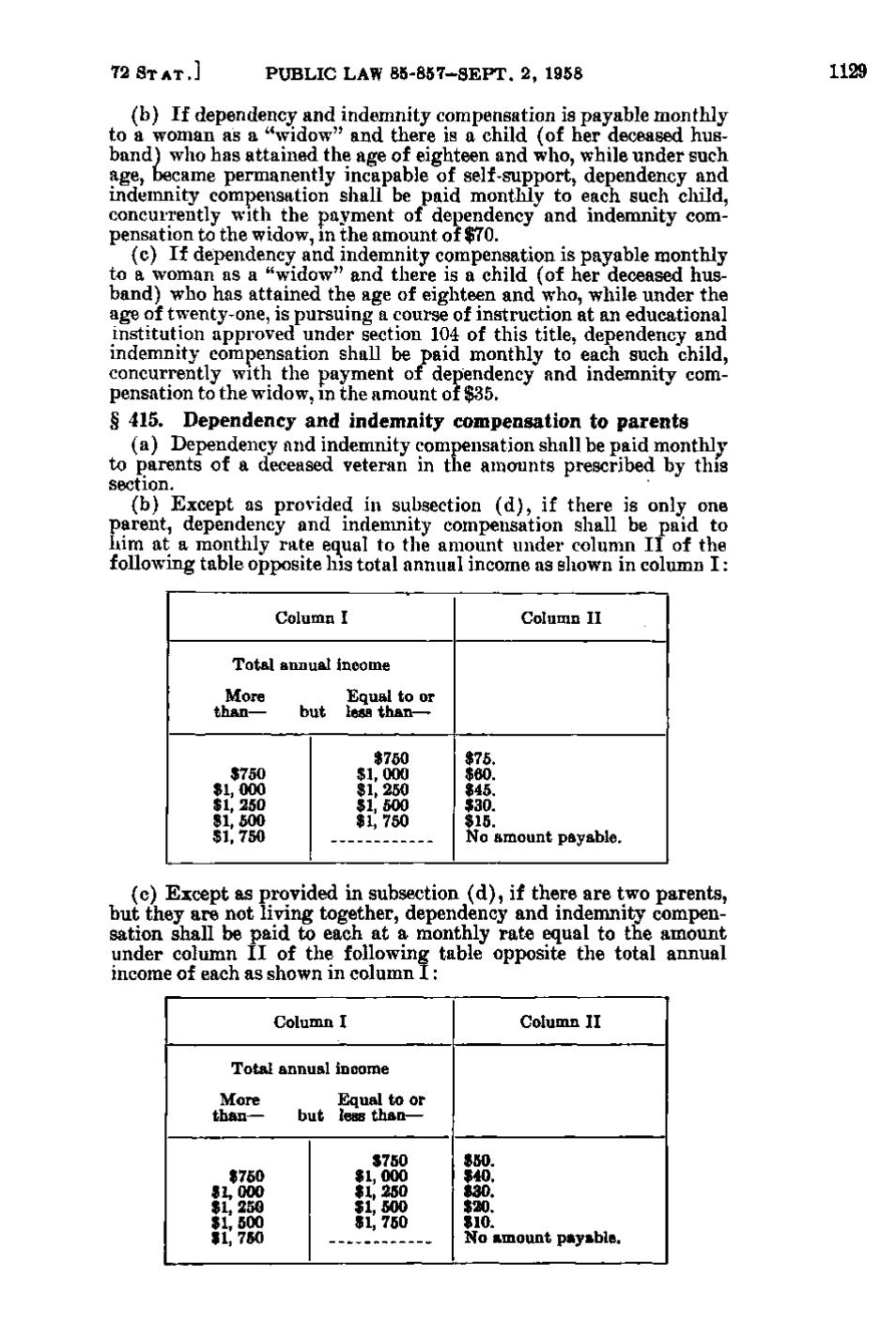

(b) If dependency and indemnity compensation is payable monthly to a woman as a "widow" and there is a child (of her deceased husband) who has attained the age of eighteen and who, while under such age, became permanently incapable of self-support, dependency and indemnity compensation shall be paid monthly to each such child, concurrently with the payment of dependency and indemnity compensation to the widow, in the amount of $70. (c) If dependency and indemnity compensation is payable monthly to a woman as a "widow" and there is a child (of her deceased husband) who has attained the age of eighteen and who, while under the age of twenty-one, is pursuing a course of instruction at an educational institution approved under section 104 of this title, dependency and indemnity compensation shall be paid monthly to each such child, concurrently with the payment of dependency and indemnity compensation to the widow, in the amount of $35. § 415. Dependency and indemnity compensation to parents (a) Dependency and indemnity compensation shall be paid monthly to parents of a deceased veteran in the amounts prescribed by this section. (b) Except as provided in subsection (d), if there is only one parent, dependency and indemnity compensation shall be paid to him at a monthly rate equal to the amount under column II of the following table opposite his total annual income as shown in column I: Column I

Column II

Total annual income More than—

but

Equal to or less than— $750 $1, 000 $1, 250 $1, 500 $1, 750

$750 $1, 000 $1, 250 $1, 500 $1, 750

$75. $60. $45. $30. $15. No amount payable.

(c) Except as provided in subsection (d), if there are two parents, but they are not living together, dependency and indemnity compensation shall be paid to each at a monthly rate equal to the amount under column II of the following table opposite the total annual income of each as shown in column I: Column I

Column II

Total annual income More than—

$750 $1, 000 $1, 250 $1,500 $1, 750

Equal to or but less than— $750 $1,000 $1, 250 $1, 500 $1, 750

$50. $40. $30. $20. $10. No amount payable.

1129

�