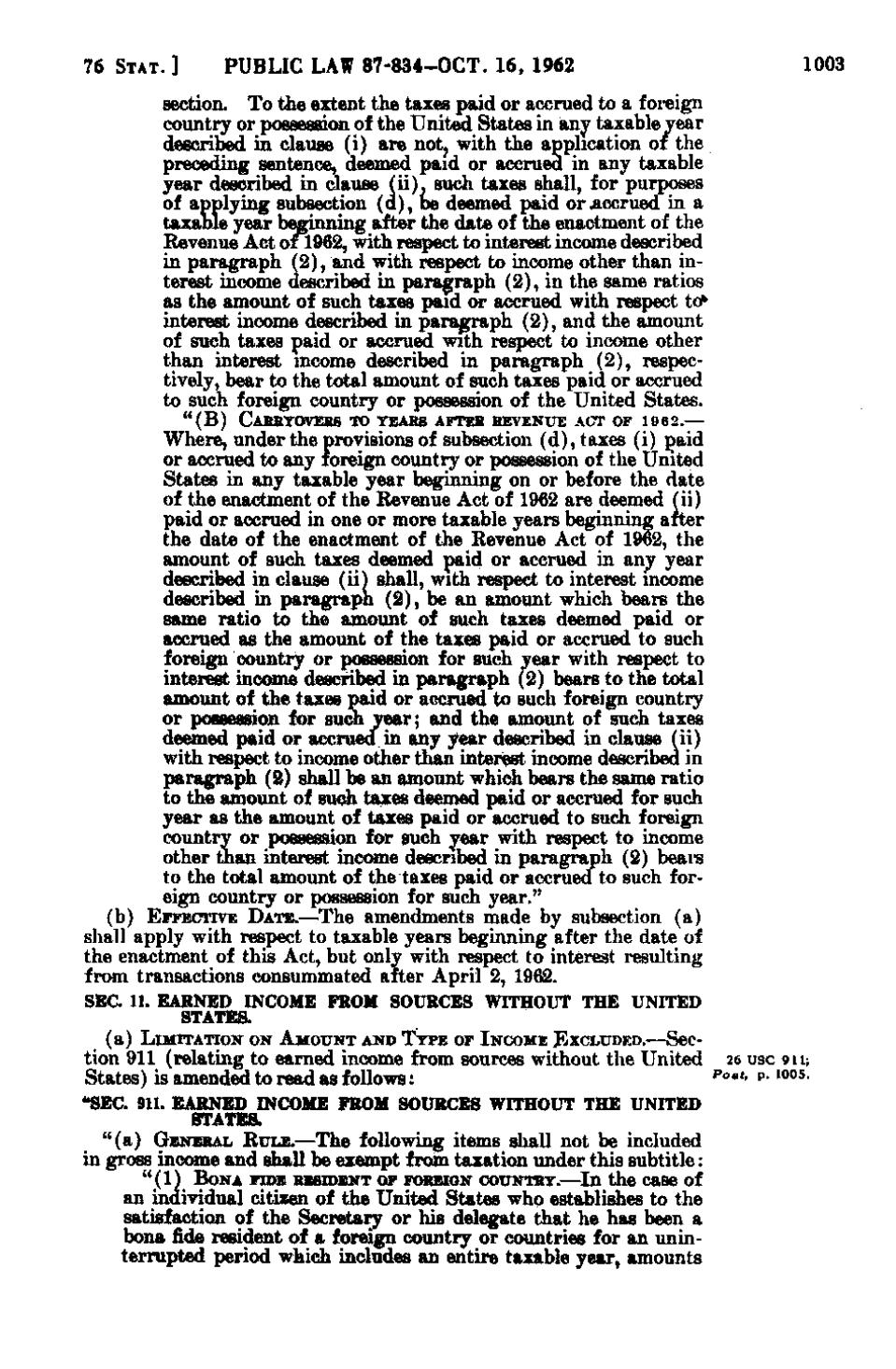

76 STAT. ]

PUBLIC LAW 8 7 - 8 3 4 - O C T. 16, 1962

1003

section. To the extent the taxes paid or accrued to a foreign country or possession of the United States in any taxable year described in clause (i) are not, with the application of the preceding sentence, deemed paid or accrued in any taxable year described in clause (ii), such taxes shall, for purposes of applying subsection (d), be deemed paid or.accrued in a taxable year beginning after the date of the enactment of the Revenue Act of 1962, with respect to interest income described in paragraph (2), and with respect to income other than interest income described in paragraph (2), in the same ratios as the amount of such taxes paid or accrued with respect to^ interest income described in paragraph (2), and the amount of such taxes paid or accrued with respect to income other than interest income described in paragraph (2), respectively, bear to the total amount of such taxes paid or accrued to such foreign country or possession of the United States. " (B) CARRYOVERS TO YEARS AFTER REVENUE ACT or 1962.— Where, under the provisions of subsection (d), taxes (i) paid or accrued to any foreign country or possession of the United States in any taxable year beginning on or before the date of the enactment of the Revenue Act of 1962 are deemed (ii) paid or accrued in one or more taxable years beginning after the date of the enactment of the Revenue Act of 1962, the amount of such taxes deemed paid or accrued in any year described in clause (ii) shall, with respect to interest income described in paragraph (2), be an amount which bears the same ratio to the amount of such taxes deemed paid or accrued as the amount of the taxes paid or accrued to such foreign country or possession for such year with respect to interest income described in paragraph (2) bears to the total amount of the taxes paid or accrued to such foreign country or possession for such year; and the amount of such taxes deemed paid or accrued in any year described in clause (ii) with respect to income other than interest income described in paragraph (2) shall be an amount which bears the same ratio to the amount of such taxes deemed paid or accrued for such year as the amount of taxes paid or accrued to such foreign country or possession for such year with respect to income other than interest income described in paragraph (2) bears to the total amount of the taxes paid or accrued to such foreign country or possession for such year." (b) EFFECTIVE DATE.—The amendments made by subsection (a) shall apply with respect to taxable years beginning after the date of the enactment of this Act, but only with respect to interest resulting from transactions consummated after April 2, 1962. SEC. 11. EARNED INCOME FROM SOURCES WITHOUT THE UNITED STATES. (a) LIMITATION ON AMOUNT AND T Y P E o r INCOME EXCLUDED.—Sec-

tion 911 (relating to earned income from sources without the United 26 USC 9ii; States) is amendwi to read as follows: Post. p. 1005. "SEC. 911. EARNED INCOME FROM SOURCES WITHOUT THE UNITED STATES. " (a) GENERAL RULE.—The following items shall not be included in gross income and shall be exempt from taxation under this subtitle: "(1) BONA FIDE RESIDENT OF FOREIGN COUNTRY.—In the case of an individual citizen of the United States who establishes to the satisfaction of the Secretary or his delegate that he has been a bona fide resident of a foreign country or countries for an uninterrupted period which includes an entire taxable year, amounts

�