78 STAT. ]

PUBLIC LAW 88-563-SEPT. 2, 1964

827

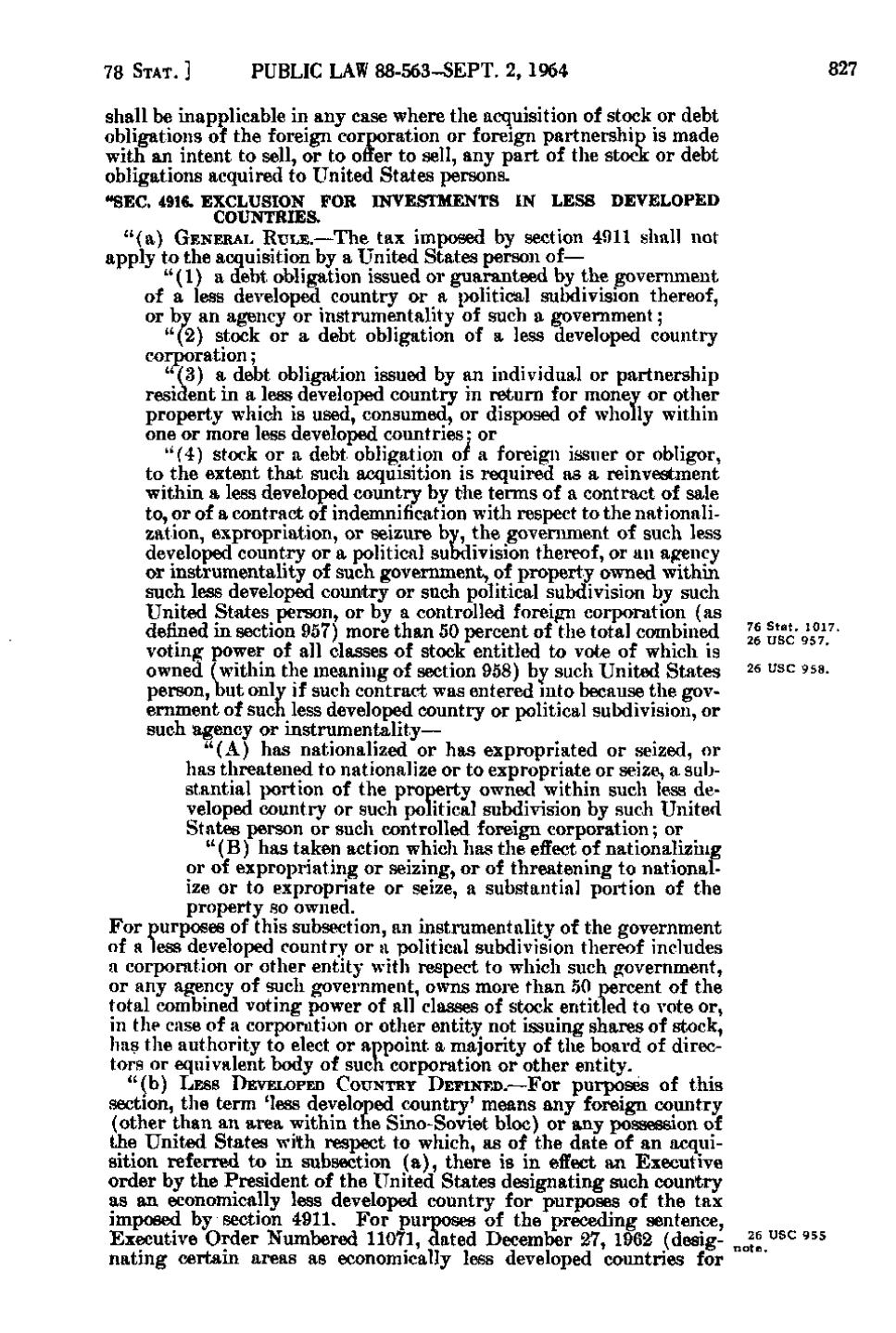

shall be inapplicable in any case where the acquisition of stock or debt obligations of the foreign corporation or foreign partnership is made with an intent to sell, or to offer to sell, any part of the stock or debt obligations acquired to United States persons. "SEC. 4916. EXCLUSION FOR INVESTMENTS IN LESS DEVELOPED COUNTRIES. " (a) GENERAL RULE.—The tax imposed by section 4911 shall not

apply to the acquisition by a United States person of— " (1) a debt obligation issued or guaranteed by the government of a less developed country or a political subdivision thereof, or by an agency or instrumentality of such a government; "(2) stock or a debt obligation of a less developed country corporation; "(3) a debt obligation issued by an individual or partnership resident in a less developed country in return for money or other property which is used, consumed, or disposed of wholly within one or more less developed countries; or "(4) stock or a debt obligation of a foreign issuer or obligor, to the extent that such acquisition is required as a reinvestment within a less developed country by the tenns of a contract of sale to, or of a contract of indemnification with respect to the nationalization, expropriation, or seizure by, the government of such less developed country or a political subdivision thereof, or an agency or instrumentality of such government, of property owned within such less developed country or such political subdivision by such United States person, or by a controlled foreign corporation (as Stat. ]1017. defined in section 957) more than 50 percent of the total combined 76 USC 957. 26 voting power of all classes of stock entitled to vote of which is owned (within the meaning of section 958) by such United States ^e use 958. person, but only if such contract was entered into because the government of such less developed country or political subdivision, or such agency or instrumentality— " (A) has nationalized or has expropriated or seized, or has threatened to nationalize or to expropriate or seize, a substantial portion of the property owned within such less developed country or such political subdivision by such United States person or such controlled foreign corporation; or " (B) has taken action which has the effect of nationalizing or of expropriating or seizing, or of threatening to nationalize or to expropriate or seize, a substantial portion of the property so owned. For purposes of this subsection, an instrumentality of the government of a less developed country or a political subdivision thereof includes a corporation or other entity with respect to which such government, or any agency of such government, owns more than 50 percent of the total combined voting power of all classes of stock entitled to vote or, in the case of a corporation or other entity not issuing shares of stock, has the authority to elect or appoint a majority of the board of directors or equivalent body of such corporation or other entity. " (b) LESS DEVELOPED COUNTRY DEFINED.—For purposes of this section, the term 'less developed country' means any foreign country (other than an area within the Sino-Soviet bloc) or any possession of the United States with respect to which, as of the date of an acquisition referred to in subsection (a), there is in effect an Executive order by the President of the United States designating such country as an economically less developed country for purposes of the tax imposed by section 4911. For purposes of the preceding sentence, Executive Order Numbered 11071, dated December 27, 1962 (desig- „„?f,"^*^ ^"'^ nating certain areas as economically less developed countries for

�