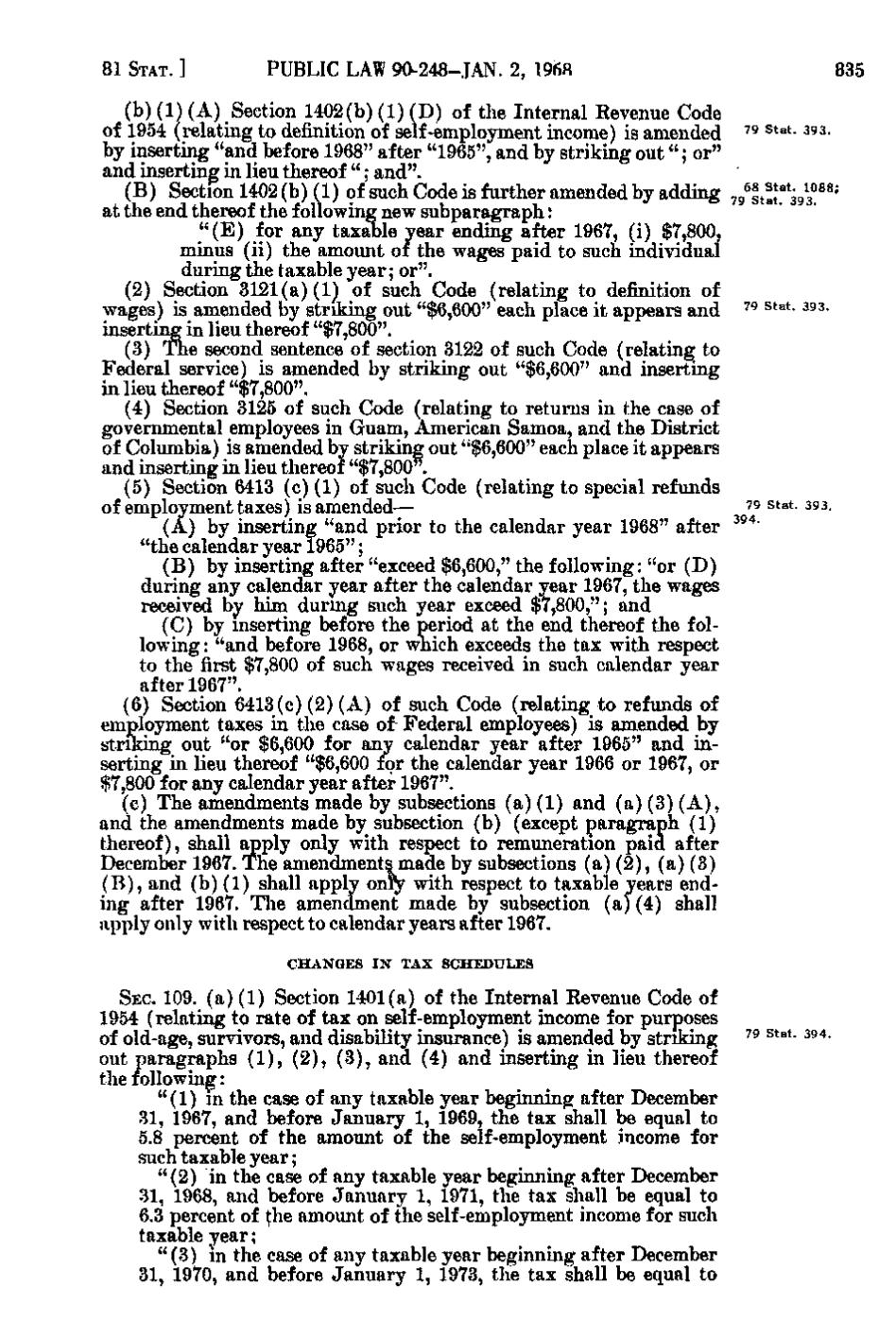

81 STAT. ]

PUBLIC LAW 90-248-JAN. 2, 1968

835

(b)(1)(A) Section 1402(b)(1)(D) of the Internal Revenue Code of 1954 (relating to definition of self-employment income) is amended ^^ ^^^*- Qs. by inserting "and before 1968" after "1965", and by striking o u t "; or" and inserting in lieu thereof "; and". (B) Section 1402(b)(1) of such Code is further amended by adding jg^tlu'^gT^ at the end thereof the following new subparagraph: " (E) for any taxable year ending after 1967, (i) $7,800, minus (ii) the amount of the wages paid to such individual during the taxable year; or". (2) Section 3121(a)(1) of such Code (relating to definition of wages) is amended by striking out "$6,600" each place it appears and ^^ ^*^^- ^^3. inserting in lieu thereof "$7,800". (3) The second sentence of section 3122 of such Code (relating to Federal service) is amended by striking out "$6,600" and inserting in lieu thereof "$7,800". (4) Section 3125 of such Code (relating to returns in the case of governmental employees in Guam, American Samoa, and the District of Columbia) is amended by striking out "$6,600" each place it appears and inserting in lieu thereof "$7,800". (5) Section 6413(c)(1) of such Code (relating to special refunds of employment taxes) is amended— ^J^ Stat. 393, 394. (A) by inserting "and prior to the calendar year 1968" after "the calendar year 1965"; (B) by inserting after "exceed $6,600," the following: "or (D) during any calendar year after the calendar year 1967, the wages received by him during such year exceed $7,800,"; and (C) by inserting before the period at the end thereof the following: "and before 1968, or which exceeds the tax with respect to the first $7,800 of such wages received in such calendar year after 1967". (6) Section 6413(c)(2)(A) of such Code (relating to refunds of employment taxes in the case of^ Federal employees) is amended by striking out "or $6,600 for any calendar year after 1965" and inserting in lieu thereof "$6,600 for the calendar year 1966 or 1967, or $7,800 for any calendar year after 1967". (c) The amendments made by subsections (a)(1) and (a)(3)(A), and the amendments made by subsection (b) (except paragraph (1) thereof), shall apply only with respect to remuneration paid after December 1967. The amendments made by subsections (a)(2), (a)(3) (B), and (b)(1) shall apply only with respect to taxable years ending after 1967. The amendment made by subsection (a)(4) shall apply only with respect to calendar years after 1967. C H A N G E S I N TAX SCHEDULES

SEC. 109. (a)(1) Section 1401(a) of the Internal Revenue Code of 1954 (relating to rate of tax on self-employment income for purposes of old-age, survivors, and disability insurance) is amended by striking out paragraphs (1), (2), (3), and (4) and inserting in lieu thereof the following: "(1) in the case of any taxable year beginning after December 31, 1967, and before January 1, 1969, the tax shall be equal to 5.8 percent of the amount of the self-employment income for such taxable year; "(2) in the case of any taxable year beginning after December 31, 1968, and before January 1, 1971, the tax shall be equal to 6.3 percent of the amount of the self-employment income for such taxable year; "(3) in the case of any taxable year beginning after December 31, 1970, and before January 1, 1973, the tax shall be equal to

79 Stat. 394.

�