88 STAT. ]

PUBLIC LAW 93-406-SEPT. 2, 1974

883

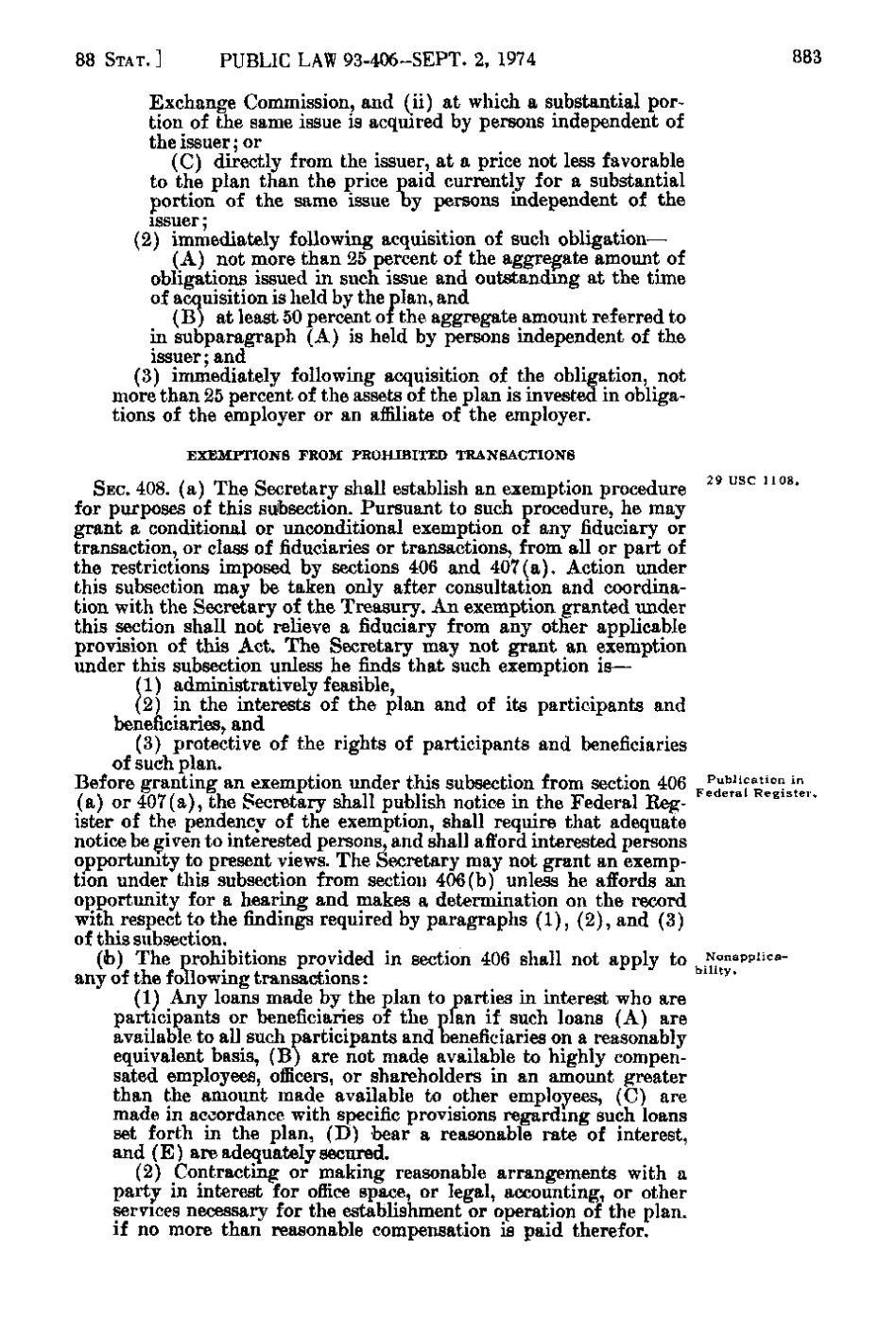

Exchange Commission, and (ii) at which a substantial portion of the same issue is acquired by persons independent of the issuer; or (C) directly from the issuer, at a price not less favorable to the plan than the price paid currently for a substantial portion of the same issue by persons independent of the issuer; (2) immediately following acquisition of such obligation— (A) not more than 25 percent of the aggregate amount of obligations issued in such issue and outstanding at the time of acquisition is held by the plan, and (B) at least 50 percent or the aggregate amount referred to in subparagraph (A) is held by persons independent of the issuer; and (3) immediately following acquisition of the obligation, not more than 25 percent of the assets of the plan is invested in obligations of the employer or an affiliate of the employer. E X E M P T I O N S FROM P R O H I B I T E D

TRANSACTIONS

SEC. 408. (a) The Secretary shall establish an exemption procedure 29 USC 1108. for purposes of this subsection. Pursuant to such procedure, he may grant a conditional or unconditional exemption of any fiduciary or transaction, or class of fiduciaries or transactions, from all or part of the restrictions imposed by sections 406 and 407(a). Action under this subsection may be taken only after consultation and coordination with the Secretary of the Treasury. An exemption granted under this section shall not relieve a fiduciary from any other applicable provision of this Act. The Secretary may not grant an exemption under this subsection unless he finds that such exemption is— (1) administratively feasible, (2) in the interests of the plan and of its participants and beneficiaries, and (3) protective of the rights of participants and beneficiaries of such plan. Before granting an exemption under this subsection from section 406 Publication in (a) or 407(a), the b'ecretary shall publish notice in the Federal Reg- Federal R e g i s t e r, ister of the pendency of the exemption, shall require that adequate notice be given to interested persons, and shall aft'ord interested persons opportunity to present views. The Secretary may not grant an exemption under this subsection from section 406(b) unless he affords an opportunity for a hearing and makes a determination on the record with respect to the findings required by paragraphs (1), (2), and (3) of this subsection. (b) The prohibitions provided in section 406 shall not apply to Nonappucability. any of the following transactions: (1) Any loans made by the plan to parties in interest who are participants or beneficiaries of the plan if such loans (A) are available to all such participants and beneficiaries on a reasonably equivalent basis, (B) are not made available to highly compensated employees, officers, or shareholders in an amount greater than the amount made available to other employees, (C) are made in accordance with specific provisions regarding such loans set forth in the plan, (D) bear a reasonable rate of interest, and (E) are adequately secured. (2) Contracting or making reasonable arrangements with a party in interest for office space, or legal, accounting, or other services necessary for the establishment or operation of the plan, if no more than reasonable compensation is paid therefor.

�