1644

^n'^^ Y ^?om m 1351, 1381, 1396.

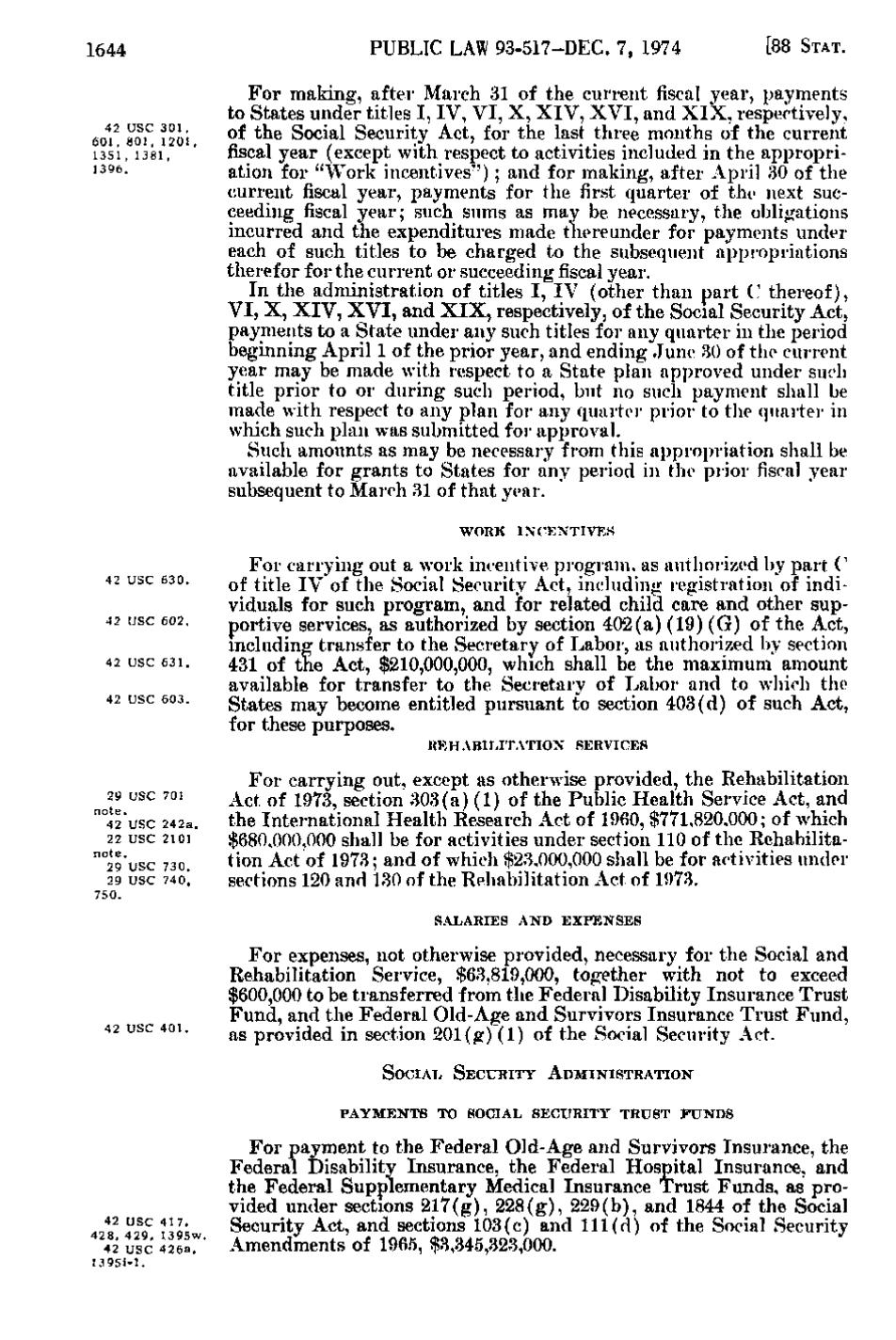

PUBLIC LAW 93-517-DEC. 7, 1974

For making, after March 31 of the current fiscal year, payments to States under titles I, IV, VI, X, X IV, X VI, and X IX, respectively, of the Soclal Security Act, for the last three months of the current nscal year (except with respect to activities included m the appropriation for "Work incentives-'); and for making, after April 30 of the current fiscal year, payments for the first quarter of the next succeeding fiscal year; such sums as may be necessary, the obligations incurred and the expenditures made thereunder for payments under each of such titles to be charged to the subsequent appropriations therefor for the current or succeeding fiscal year. In the administration of titles I, IV (other than part C thereof), VI, X, X IV, X VI, and X IX, respectively, of the Social Security Act, payments to a State under any such titles for any quarter in the period beginning April 1 of the prior year, and ending June 30 of the current year may be made with respect to a State plan approved under such title prior to or during such period, but no such payment shall be made with respect to any plan for any quartei" prior to the quarter in which such plan was submitted for approval. Such amounts as may be necessary fiom this appropriation shall be available for grants to States for any period in the piior fiscal year subsequent to March 31 of that year. WORK

42 USC 630. 42 USC 602. 42 USC 631. 42 USC 6 0 3.

IN(ENTIVES

For carrying out a work incentive program, as authorized by part C Q^ ^j^ig JY ^f ^j^g Social Security Act, including registration of individuals for such program, and for related child care and other supportive services, as authorized by section 402(a) (19)(G) of the Act, including transfer to the Secretary of Labor, as authorized by section 431 of the Act, $210,000,000, which shall be the maximum amount available for transfer to the Secretary of Labor and to which the States may become entitled pursuant to section 403(d) of such Act, for these purposes. REHABILITATION

29 USC 701 "°42 USC 242a. 22 USC 2101 "°29*use 730. 29 USC 74o[

[88 STAT.

SERVICES

For carrying out, except as otherwise provided, the Rehabilitation j^^^ of 1973^ section 303(a)(1) of the Public Health Service Act, and the International Health Research Act of 1960, $771,820,000; of which $680,000,000 shall be for activities under section 110 of the Rehabilitation Act of 1973; and of which $23,000,000 shall be for activities under sections 120 and 130 of the Rehabilitation Act of 1973.

750. SALARIES A N D E X P E N S E S

42 USC 4 0 1.

For expenses, not otherwise provided, necessary for the Social and Rehabilitation Service, $63,819,000, together with not to exceed $600,000 to be transferred from the Federal Disability Insurance Trust Fund, and the Federal Old-Age and Survivors Insurance Trust Fund, as provided in section 201(g)(1) of the Social Security Act. SOCIAL SECURITY

ADMINISTRATION

P A Y M E N T S TO SOCIAL SECURITY TRUST

AoV ^f^ 1\lk 42 USC 426ar' 1395i-l.

FUNDS

For payment to the Federal Old-Age and Survivors Insurance, the Federal Disability Insurance, the Federal Hospital Insurance, and the Federal Supplementary Medical Insurance Trust Funds, as provided under sections 217(g), 228(g), 229(b), and 1844 of the Social Security Act, and sections 103(c) and 111(d) of the Social Security Amendments of 1965, $3,345,323,000.

�