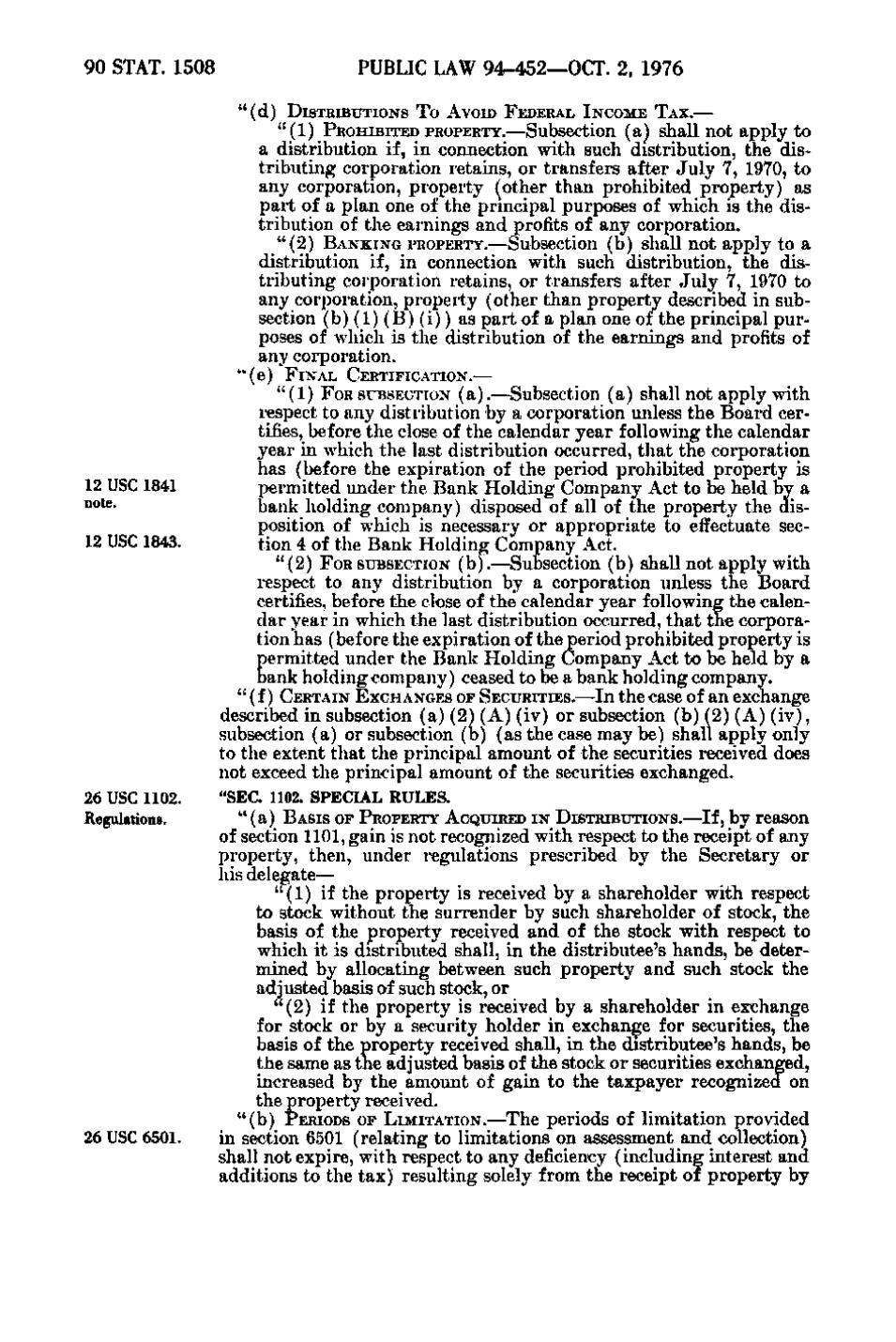

90 STAT. 1508

PUBLIC LAW 94-452—OCT. 2, 1976 "(d)

DISTRIBUTIONS TO AVOID FEDERAL INCOME TAX.—

" (1) PROHIBITED PROPERTY.—Subsection (a) shall not apply to a distribution if, in connection with such distribution, the dist r i b u t i n g corporation retains, or transfers after July 7, 1970, to any corporation, property (other than prohibited property) as part of a plan one of the principal purposes of which is the distribution of the earnings and profits of any corporation. " (2) B A N K I N G PROPERTY,—Subsection (b) shall not apply to a distribution if, in connection with such distribution, the dist r i b u t i n g corporation retains, or transfers after July 7, 1970 to any corporation, property (other than property described in subsection (b)(1)(B)(i)) as part of a plan one of the principal purposes of which is the distribution of the earnings and profits of any corporation. " (e) F I N A L CERTIFICATION.—

12 USC 1841 °°*®12 USC 1843.

" (1) FOR SUBSECTION (a).—Subsection (a) shall not apply with respect to any distribution by a corporation unless the B o a r d certifies, before the close of the calendar year following the calendar year in which the last distribution occurred, that the corporation has (before the expiration of the period prohibited property is permitted under the Bank H o l d i n g Company Act to be held by a bank holding company) disposed of all of the property the disposition of which is necessary or appropriate to effectuate section 4 of the Bank H o l d i n g Company Act. " (2) FOR SUBSECTION (b).—Subsection (b) shall not apply with respect to any distribution by a corporation unless the B o a r d certifies, before the close of the calendar year following the calend a r year in which the last distribution occurred, that the corporation has (before the expiration of the period prohibited property is permitted under the B a n k H o l d i n g Company Act to be held by a bank holding company) ceased to be a bank holding company. " (f) CERTAIN EXCHANGES OF S E C U R I T I E S. — I n the case of an exchange

described in subsection (a)(2)(A) ( i v) or subsection (b)(2)(A) ( i v), subsection (a) or subsection (b) (as the case may be) shall apply only to the extent that the principal amount of the securities received does not exceed the principal amount of the securities exchanged. 26 USC 1102. Regulations.

26 USC 6501.

"SEC. 1102. SPECIAL RULES. " (a) B A S I S OF PROPERTY ACQUIRED I N DISTRIBUTIONS.—If, by reason

of section 1101, gain is not recognized with respect to the receipt of any property, then, under regulations prescribed by the Secretary or his delegate— " (1) if the property is received by a shareholder with respect to stock without the surrender by such shareholder of stock, the basis of the property received and of the stock with respect to which it is distributed shall, in the distributee's hands, be determined by allocating between such property and such stock the adjusted basis of such stock, or " (2) if the property is received by a shareholder in exchange for stock or by a security holder in exchange for securities, the basis of the property received shall, in the distributee's hands, be the same as the adjusted basis of the stock or securities exchanged, increased by the amount of gain to the taxpayer recognized on the property received. " (b) PERIODS OF LIMITATION.—The periods of limitation provided in section 6501 (relating to limitations on assessment and collection) shall not expire, with respect to any deficiency (including interest and additions to the tax) resulting solely from the receipt of property by

�