90 STAT. 1838 26 USC 171 note.

•

,»,

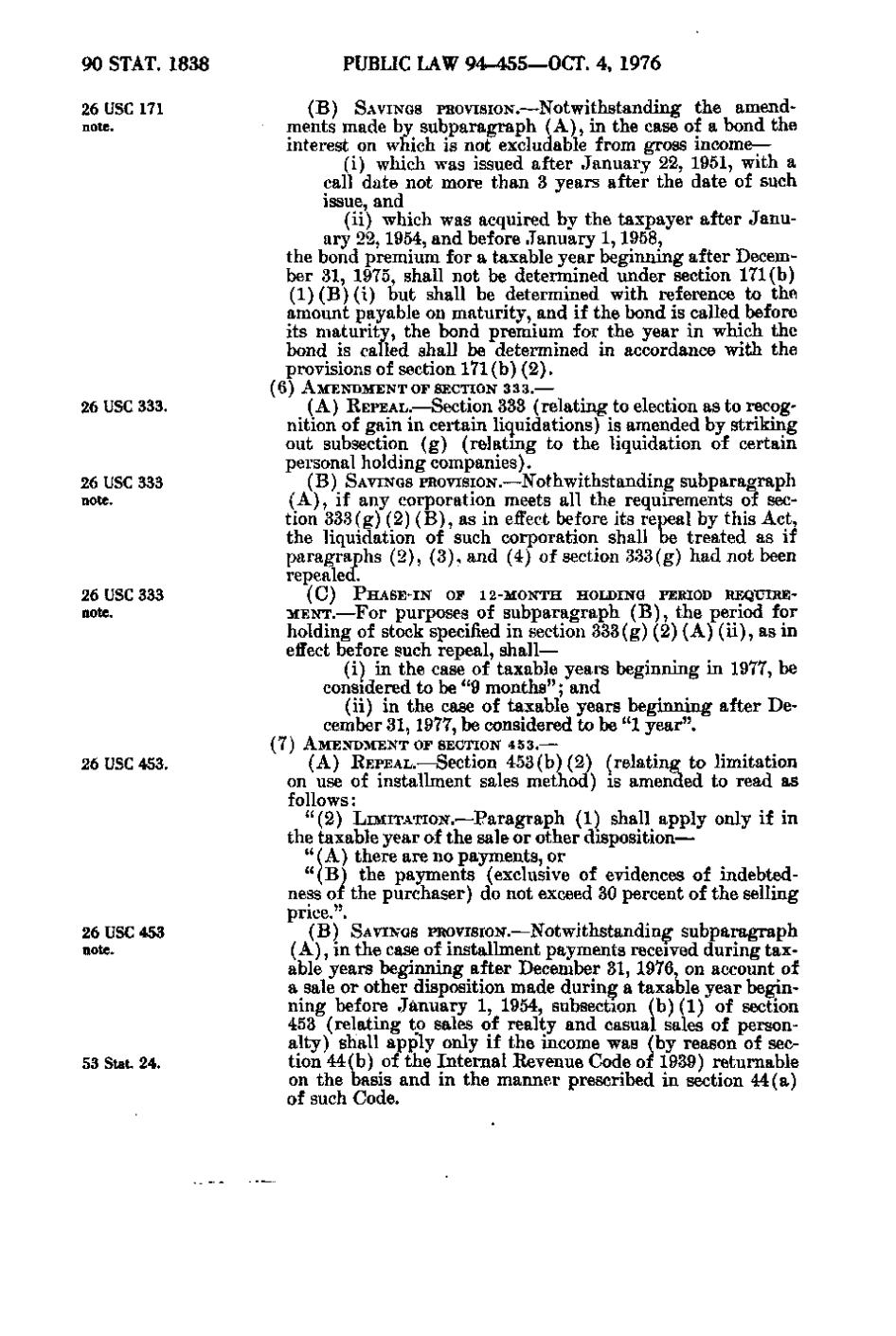

PUBLIC LAW 94-455—OCT. 4, 1976 (B) SAVINGS PROVISION.—Notwithstanding the amend^ ments made by subparagraph (A), in the case of a bond the interest on which is not excludable from gross income— (i) which was issued after January 22, 1951, with a call date not more than 3 years after the date of such issue, and (ii) which was acquired by the taxpayer after January 22, 1954, and before.January 1, 1958, the bond premium for a taxable year beginning after December 31, 1975, shall not be determined under section 171(b) (1)(B)(i) but shall be determined with reference to the amount payable on maturity, and if the bond is called before its maturity, the bond premium for the year in which the bond is called shall be determined in accordance with the provisions of section 171(b)(2). (6) AMENDMENT o r SECTION 333.—

26 USC 333.

26 USC 333 aote.

26 USC 333

note.

26 USC 453.

26 USC 453 note.

53 Stat. 24.

(A) REPEAL.—Section 333 (relating to election as to recognition of gain in certain liquidations) is amended by striking out subsection (g) (relating to the liquidation of certain personal holding companies). (B) SAVINGS PROVISION.—Notwithstanding subparagraph (A), if any corporation meets all the requirements of section 333(g)(2)(B), as in effect before its repeal by this Act, the liquidation of such corporation shall be treated as if paragraphs (2), (3), and (4) of section 333(g) had not been repealed. (C)

PHASE-IN

OF 12-MONTH HOLDING PERIOD REQUIRE-

MENT.—For purposes of subparagraph (B), the period for holding of stock specified in section 333(g)(2)(A) (ii), as in effect before such repeal, shall— (i) in the case of taxable years beginning in 1977, be considered to be "9 months"; and (ii) in the case of taxable years beginning after December 31, 1977, be considered to be "1 year". (7) AMENDMENT or SECTION 453.— (A) REPEAL.—Section 453(b)(2) (relating to limitation on use of installment sales method) is amended to read as follows: "(2) LIMITATION.—Paragraph (1) shall apply only if in the taxable year of the sale or other disposition— "(A) there are no payments, or "(B) the payments (exclusive of evidences of indebtedness of the purchaser) do not exceed 30 percent of the selling price.". (B) SAVINGS PROVISION.—Notwithstanding subparagraph (A), in the case of installment payments received during taxable years beginning after December 31, 1976, on account of a sale or other disposition made during a taxable year beginning before January 1, 1954, subsection (b)(1) of section 453 (relating to sales of realty and casual sales of personalty) shall apply only if the income was (by reason of section 44(b) of the Internal Revenue Code of 1939) returnable on the basis and in the manner prescribed in section 44(a) of such Code.

�