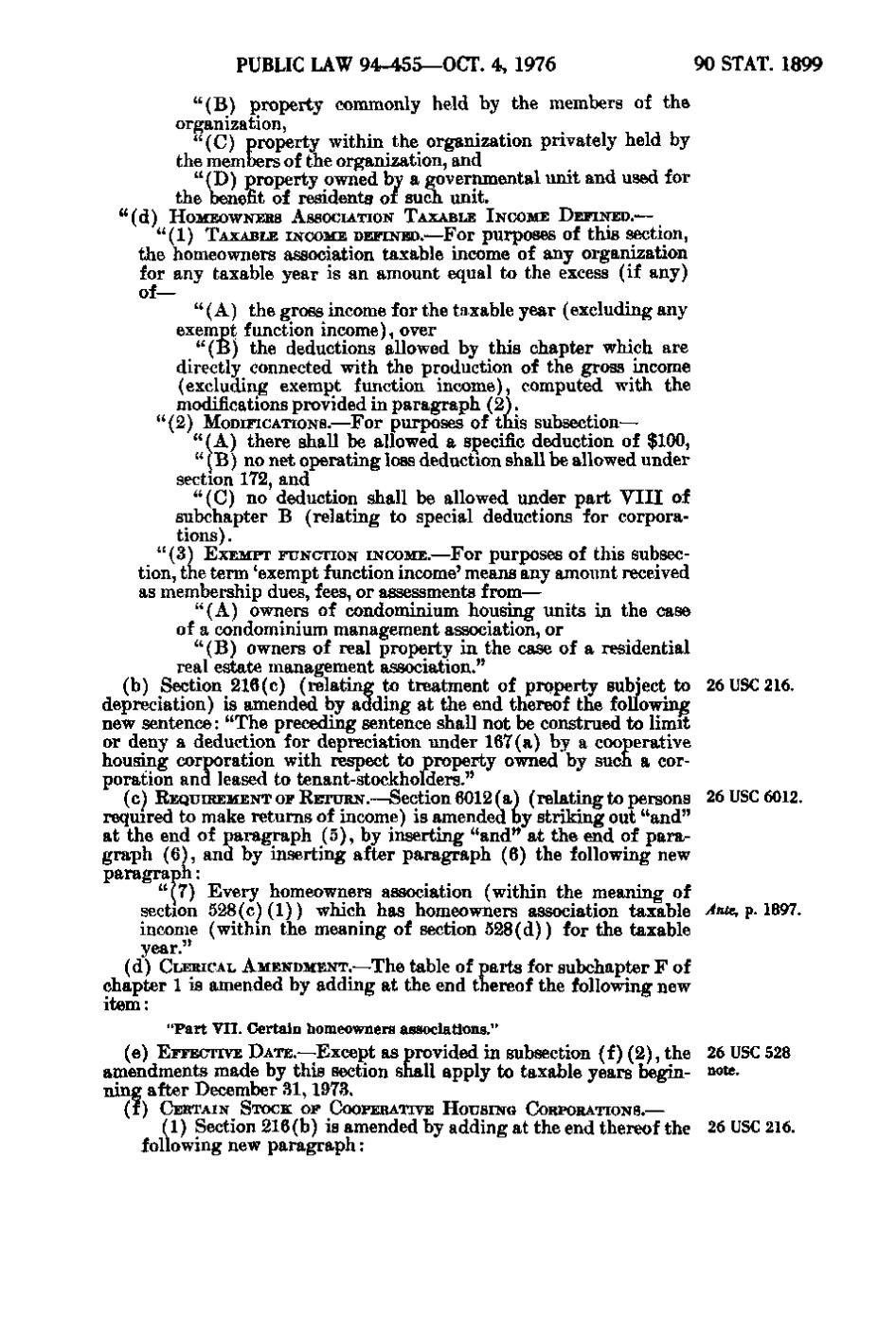

PUBLIC LAW 94-455—OCT. 4, 1976

9 0 STAT. 1899

" (B) property commonly held by the members of the organization, " (C) property within the organization privately held by the members of the organization, and " (D) property owned by a governmental u n i t and used for the benefit of residents of such unit. "(d)

HOMEOWNERS ASSOCIATION TAXABLE I N C O M E D E F I N E D. — " (1) TAXABLE INCOME D E F I N E D. — For purposes of t h i s section,

the homeowners association taxable income of any organization for any taxable year is an amount equal to the excess (if any) of-^ " (A) the gross income for the taxable year (excluding any exempt function income), over " (B) the deductions allowed by this chapter which are directly connected with the production of the gross income (excluding exempt function income), computed with the modifications provided in paragraph (2). " (2) MODIFICATIONS.—For purposes of tnis subsection— " (A) there shall be allowed a specific deduction of $100, " (B) no net operating loss deduction shall be allowed under section 172, and " (C) no deduction shall be allowed under part VIII of subchapter B (relating to special deductions for corporations). " (3) E X E M P T FUNCTION INCOME.—For purposes of this subsection, the term 'exempt function income' means any amount received as membership dues, fees, or assessments from— " (A) owners of condominium housing units in the case of a condominium management association, or " (B) owners of real property i n the case of a residential real estate management association." (b) Section 216(c) (relating to treatment of property subject to 26 USC 216. depreciation) is amended by a d d i n g a t the end thereof the following new sentence: " The preceding sentence shall not be construed to limit o r deny a deduction for depreciation under 167(a) by a cooperative housing corporation with respect to property owned by such a corporation and leased to tenant-stockholders." (c) REQUIREMENT OF R E T U R N. — S e c t i o n 6012 (a) ( r e l a t i n g to persons

26 USC 6012.

required to make returns of income) is amended by striking out " and " a t the end of paragraph (5), by inserting " and " a t the end of paragraph (6), and by inserting after paragraph (6) the following new paragraph: " (7) E v e r y homeowners association (within the meaning of section 5 2 8 (c)(1)) which has homeowners association taxable Ante, f. 1897. income (within the meaning of section 5 2 8 (d)) for the taxable year." (d) CLERICAL AMENDMENT. — The table of part s for subchapter F of

chapter 1 is amended by a d d i n g a t the end thereof the following new item: "Part VII. Certain homeowners associations." (e) EFFECTIVE D A T E. — E x c e p t as provided in subsection (f)(2), the

amendments made by this section shall a p p l y to taxable years beginn i n g after December 31, 1973. (i)

CERTAIN STOCK OF COOPERATIVE H O U S I N G

26 USC 528

note,

CORPORATIONS.—

(1) Section 216(b) is amended by a d d i n g at the end thereof the following new paragraph:

26 USC 216.

^

�