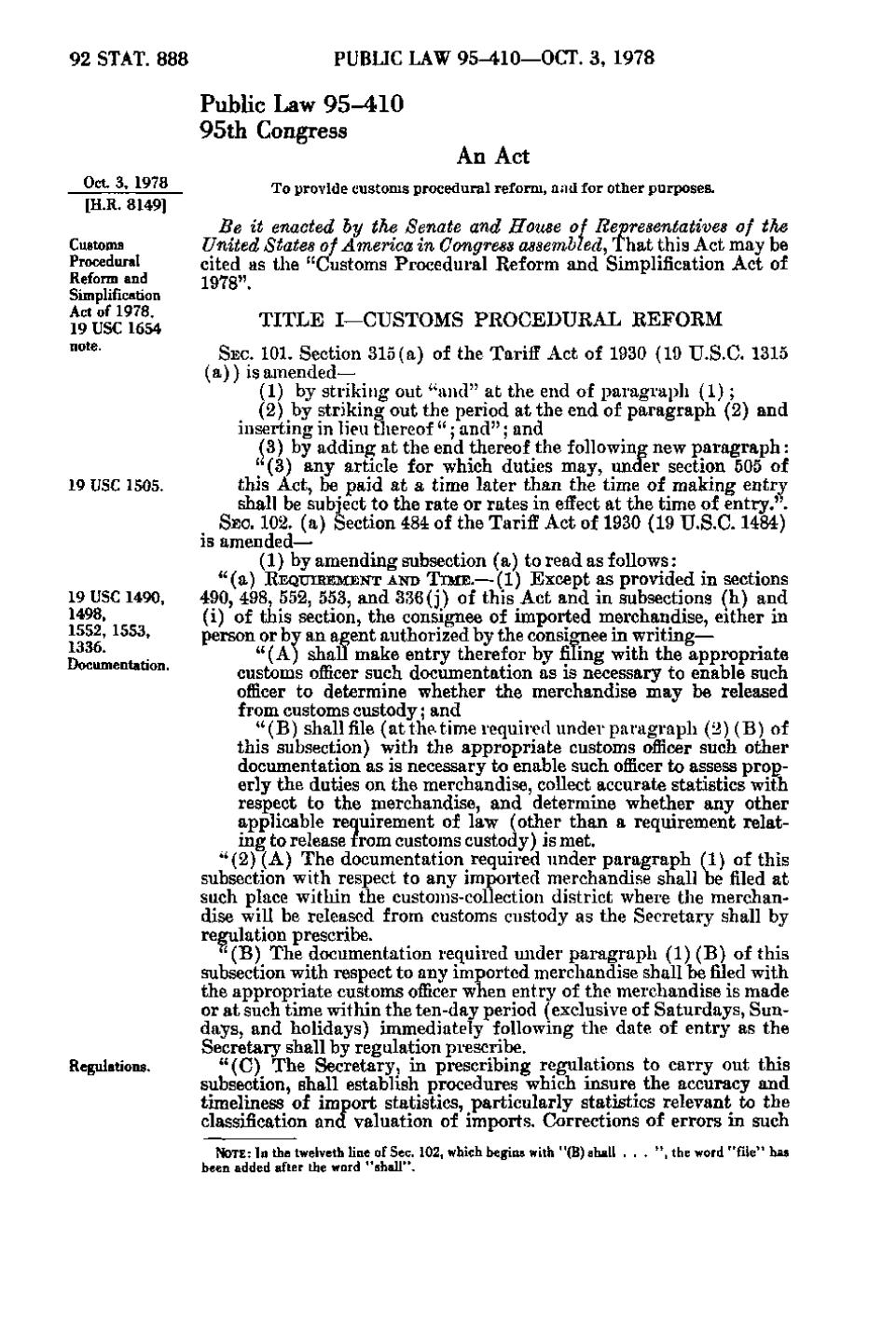

92 STAT. 888

PUBLIC LAW 95-410—OCT. 3, 1978

Public Law 95-410 95th Congress An Act Oct. 3, 1978 [H.R. 8149] Customs Procedural Reform and Simplification Act of 1978. 19 USC 1654 note.

19 USC 1505.

19 USC 1490, 1498, 1552, 1553, 1336. Documentation.

Regulations.

To provide customs procedural reform, and for other purposes.

Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, That this Act may be cited as the "Customs Procedural Reform and Simplification Act of 1978".

TITLE I—CUSTOMS PROCEDURAL REFORM SEC. 101. Section 315(a) of the Tariff Act of 1930 (19 U.S.C. 1315 (a)) is amended— (1) by striking out "and" at the end of paragraph (1); (2) by striking out the period at the end of paragraph (2) and inserting in lieu thereof "; and"; and (3) by adding at the end thereof the following new paragraph: "(3) any article for which duties may, under section 505 of this Act, be paid at a time later than the time of making entry shall be subject to the rate or rates in effect at the time of entry.". SEC. 102. (a) Section 484 of the Tariff Act of 1930 (19 U.S.C. 1484) is amended—• (1) by amending subsection (a) to read as follows: "(a) REQUIREMENT AND TIME.— (1) Except as provided in sections 490, 498, 552, 553, and 336 (j) of this Act and in subsections (h) and (i) of this section, the consignee of imported merchandise, either in person or by an agent authorized by the consignee in writing— "(A) shall make entry therefor by filing with the appropriate customs officer such documentation as is necessary to enable such officer to determine whether the merchandise may be released from customs custody; and "(B) shall file (at the time required under paragraph (2)(B) of this subsection) with the appropriate customs officer such other documentation as is necessary to enable such officer to assess properly the duties on the merchandise, collect accurate statistics with respect to the merchandise, and determine whether any other applicable requirement of law (other than a requirement relating to release from customs custody) is met. "(2)(A) The documentation required under paragraph (1) of this subsection with respect to any imported merchandise shall be filed at such place within the customs-collection district where the merchandise will be released from customs custody as the Secretary shall by regulation prescribe. "(B) The documentation required under paragraph (1)(B) of this subsection with respect to any imported merchandise shall be filed with the appropriate customs officer when entry of the merchandise is made or at such time within the ten-day period (exclusive of Saturdays, Sundays, and holidays) immediately following the date of entry as the Secretary shall by regulation prescribe. "(C) The Secretary, in prescribing regulations to carry out this subsection, shall establish procedures which insure the accuracy and timeliness of import statistics, particularly statistics relevant to the classification and valuation of imports. Corrections of errors in such NOTE: In the twelveth line of Sec. 102, which begins with "(B) shall. been added after the word "shall".

", the word "file" has

�