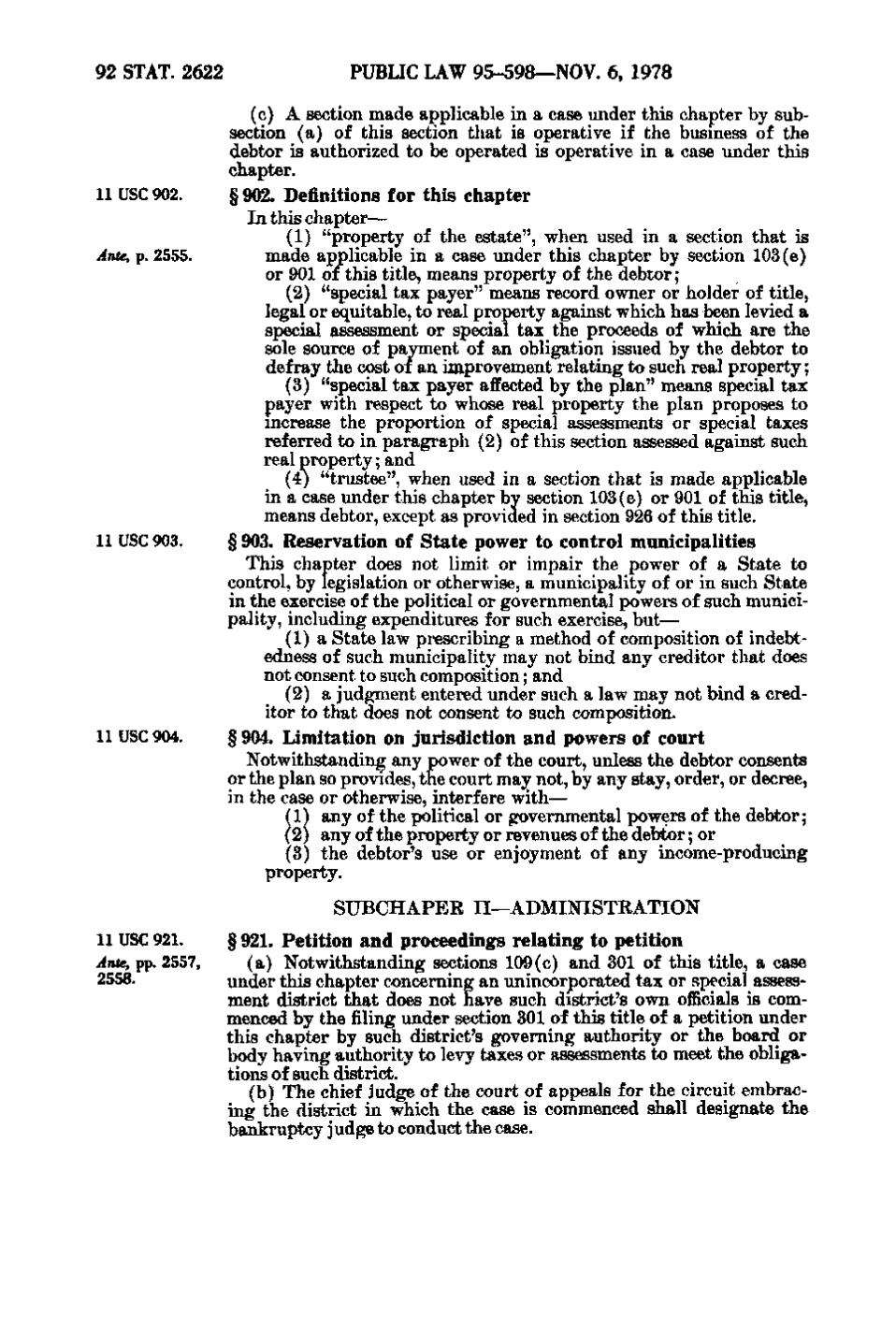

92 STAT. 2622

11 USC 902. Ante, p. 2555.

11 USC 903.

11 USC 904.

PUBLIC LAW 95-598—NOV. 6, 1978 (c) A section made applicable in a case under this chapter by subsection (a) of this section that is operative if the business of the debtor is authorized to be operated is operative in a case under this chapter. § 902. Definitions for this chapter In this chapter— (1) "property of the estate", when used in a section that is made applicable in a case under this chapter by section 103(e) or 901 of this title, means property of the debtor; (2) "special tax payer" means record owner or holder of title, legal or equitable, to real property against which has been levied a special assessment or special tax the proceeds of which are the sole source of payment of an obligation issued by the debtor to defray the cost oi an improvement relating to such real property; (3) "special tax payer affected by the plan" means special tax payer with respect to whose real property the plan proposes to increase the proportion of special assessments or special taxes referred to in paragraph (2) of this section assessed against such real property; and (4) "trustee", when used in a section that is made applicable in a case under this chapter by section 103(e) or 901 of this title, means debtor, except as provided in section 926 of this title. § 903. Reservation of State power to control municipalities This chapter does not limit or impair the power of a State to control, by legislation or otherwise, a municipality of or in such State in the exercise of the political or governmental powers of such municipality, including expenditures for such exercise, but— (1) a State law prescribing a method of composition of indebtedness of such municipality may not bind any creditor that does not consent to such composition; and (2) a judgment entered under such a law may not bind a creditor to that does not consent to such composition. § 904. Limitation on jurisdiction and powers of court Notwithstanding any power of the court, unless the debtor consents or the plan so provides, the court may not, by any stay, order, or decree, in the case or otherwise, interfere with— (1) any of the political or governmental powers of the debtor; (2) any of the property or revenues of the debtor; or (3) the debtor's use or enjoyment of any income-producing property. SUBCHAPER II—ADMINISTRATION

11 USC 921. § 921. Petition and proceedings relating to petition Ante, pp. 2557, (a) Notwithstanding sections 109(c) and 301 of this title, a case 2558. under this chapter concerning an unincorporated tax or special assessment district that does not have such district's own officials is commenced by the filing under section 301 of this title of a petition under this chapter by such district's governing authority or the board or body having authority to levy taxes or assessments to meet the obligations of such district. (b) The chief judge of the court of appeals for the circuit embracing the district in which the case is commenced shall designate the bankruptcy judge to conduct the case.

�