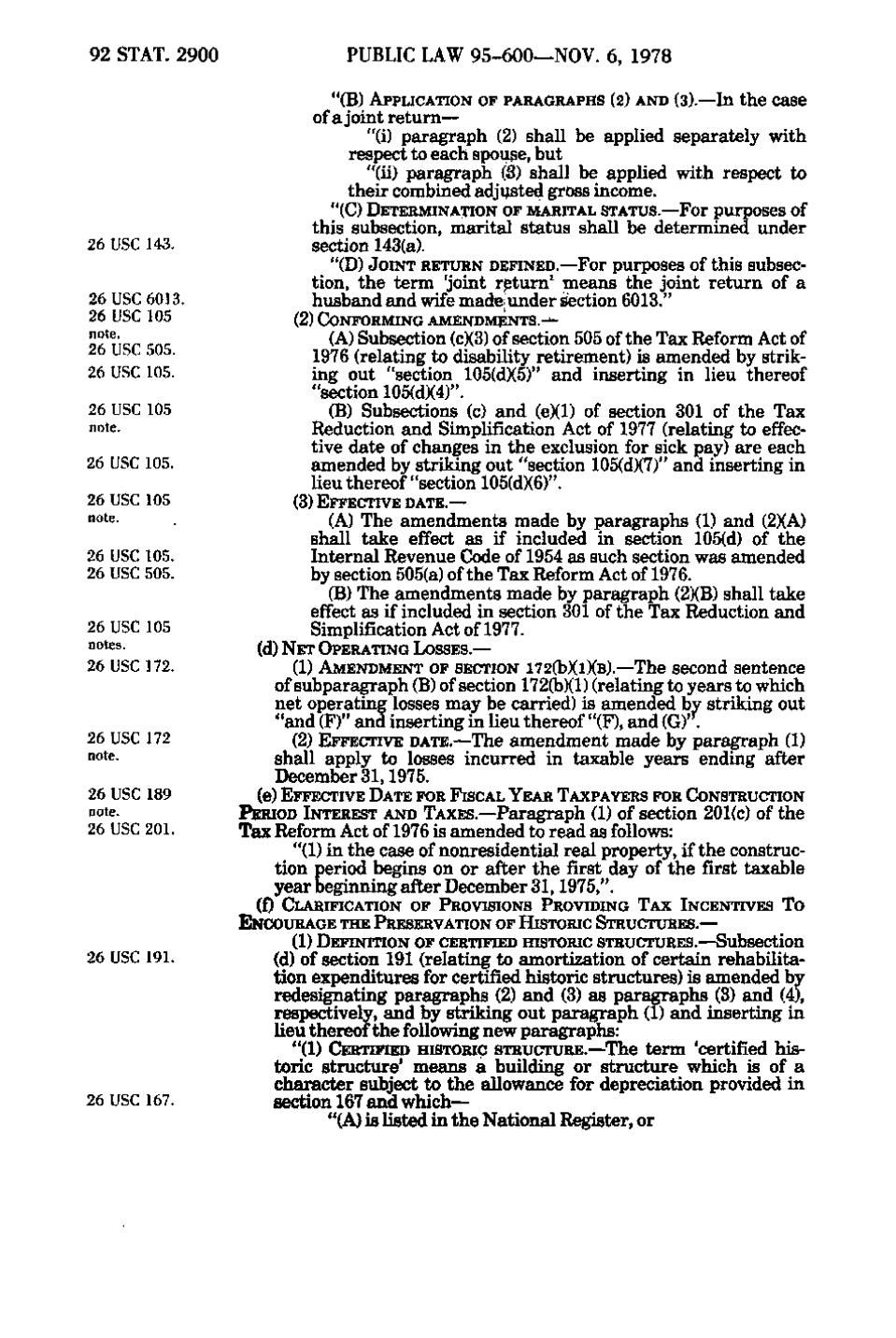

92 STAT. 2900

PUBLIC LAW 95-600—NOV. 6, 1978 "(B) APPLICATION OF PARAGRAPHS (2) AND (3).—In the case of a joint return— "(i) paragraph (2) shall be applied separately with respect to each spouse, but "(ii) paragraph (S) shall be applied with respect to their combined adjusted gross income. "(C) DETERMINATION OF MARITAL STATUS.—For purposes of

26 USC 143. 26 USC 6013. 26 USC 105 note. 26 USC 505. 26 USC 105. 26 USC 105 note. 26 USC 105. 26 USC 105 note. 26 USC 105. 26 USC 505. 26 USC 105 notes. 26 USC 172.

26 USC 172 note. 26 USC 189 note. 26 USC 201.

this subsection, marital status shall be determined under section 143(a). "(D) JOINT RETURN DEFINED.—For purposes of this subsection, the term 'joint return' means the joint return of a husband and wife made;under section 6013." (2) CONFORMING AMENDMENTS.-^

(A) Subsection (c)(3) of section 505 of the Tax Reform Act of 1976 (relating to disability retirement) is amended by striking out "section 105(d)(5)" and inserting in lieu thereof "section 105(d)(4)". (B) Subsections (c) and (e)(1) of section 301 of the Tax Reduction and Simplification Act of 1977 (relating to effective date of changes in the exclusion for sick pay) are each amended by striking out "section 105(d)(7)" and inserting in lieu thereof "section 105(d)(6)". (3) EFFECTIVE DATE.—

(A) The amendments made by paragraphs (1) and (2)(A) shall take effect as if included in section 105(d) of the Internal Revenue Code of 1954 as such section was amended by section 505(a) of the Tax Reform Act of 1976. (B) The amendments made by paragraph (2)(B) shall take effect as if included in section 301 of the Tax Reduction and Simplification Act of 1977. (d) NET OPERATING LOSSES.— (1) AMENDMENT OF SECTION 172(b)(1)(B).—The second sentence

of subparagraph (B) of section 1720b)(l) (relating to years to which net operating losses may be carried) is amended by striking out "and (F)" and inserting in lieu thereof "(F), and (G)'\ (2) EFFECTIVE DATE.—The amendment made by paragraph (1) shall apply to losses incurred in taxable years ending after December 31, 1975. (e) EFFECTIVE DATE FOR FISCAL YEAR TAXPAYERS FOR CONSTRUCTION PERIOD INTEREST AND TAXES.—Paragraph (1) of section 201(c) of the

Tax Reform Act of 1976 is amended to read as follows: "(1) in the case of nonresidential real property, if the construction period begins on or after the first day of the first taxable year beginning after December 31, 1975,". (f) CLARIFICATION OF PROVISIONS PROVIDING TAX INCENTIVES TO ENCOURAGE THE PRESERVATION OF HISTORIC STRUCTURES.— (1) DEFINITION OF CERTIFIED HISTORIC STRUCTURES.—Subsection

26 USC 191.

26 USC 167.

(d) of section 191 (relating to amortization of certain rehabilitation expenditures for certified historic structures) is amended by redesignating paragraphs (2) and (3) as paragraphs (3) and (4), respectively, and by striking out paragraph (1) and inserting in lieu thereof the following new paragraphs: "(1) CERTIFIED HISTORIC STRUCTURE.—The term 'certified historic structure' means a building or structure which is of a character subject to the allowance for depreciation provided in section 167 and which— "(A) is listed in the National Register, or

�