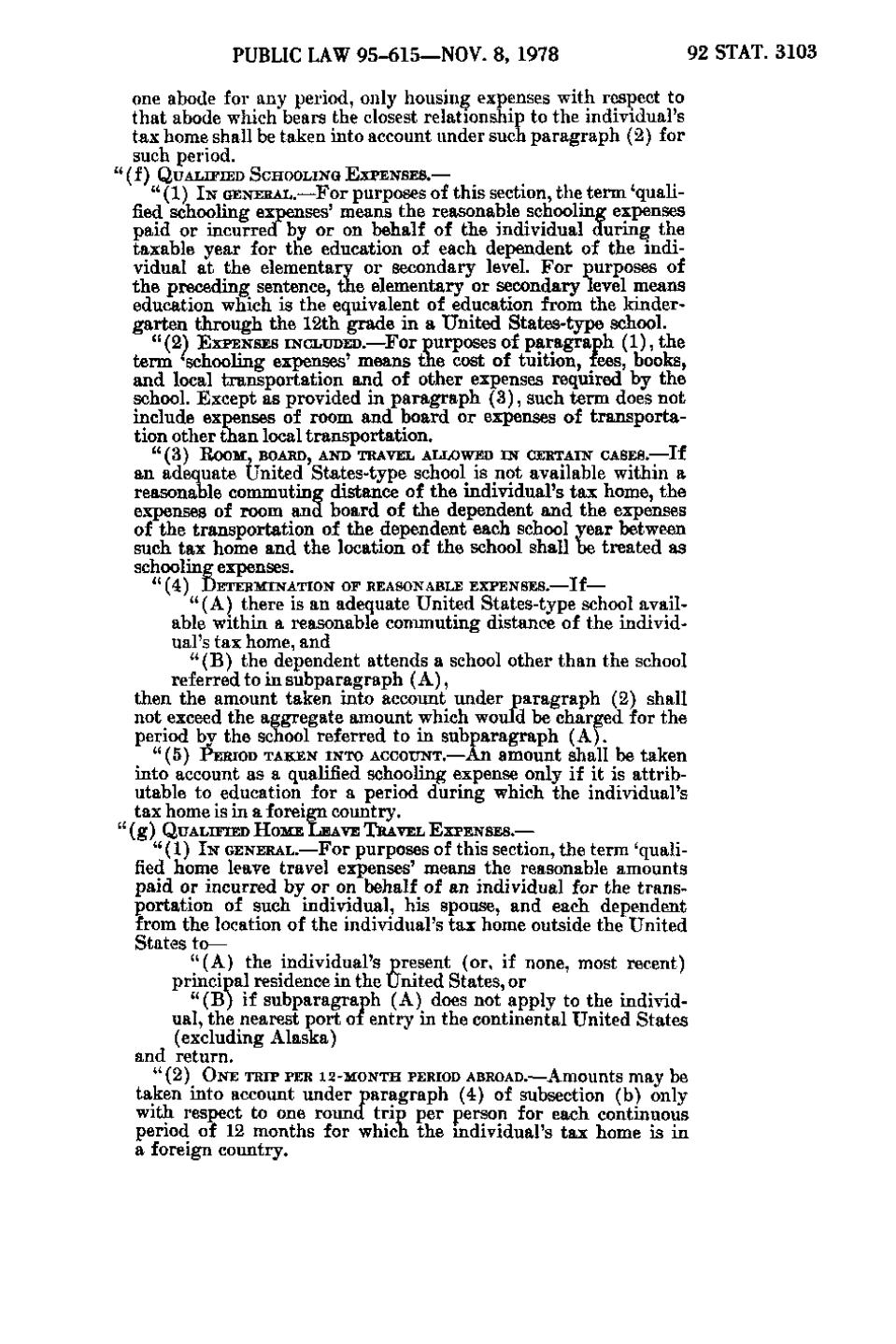

PUBLIC LAW 95-615—NOV. 8, 1978

92 STAT. 3103

one abode for any period, only housing expenses with respect to that abode which bears the closest relationship to the individual's tax home shall be taken into account under such paragraph (2) for such period. "(f)

QUALIFIED SCHOOLING E X P E N S E S. —

" (1) IN GENERAL.—For purposes of this section, the term 'qualified schooling expenses' means the reasonable schooling expenses paid or incurred by or on behalf of the individual during the taxable year for the education of each dependent of the individual at the elementary or secondary level. For purposes of the preceding sentence, the elementary or secondary level means education which is the equivalent of education from the kindergarten through the 12th grade in a United States-type school. "(2') EXPENSES INCLUDED.—For purposes of paragraph (1), the

term 'schooling expenses' means the cost of tuition, fees, books, and local transportation and of other expenses required by the school. Except as provided in paragraph (3), such term does not include expenses of room and board or expenses of transportation other than local transportation. "(3)

ROOM, BOARD, AND TRAVEL ALLOWED I N CERTAIN CASES.—If

an adequate United States-type school is not available within a reasonable commuting distance of the individual's tax home, the expenses of room and board of the dependent and the expenses of the transportation of the dependent each school year between such tax home and the location of the school shall be treated as schooling expenses. "(4)

DETERMINATION o r REASONABLE EXPENSES.—If—

" (A) there is an adequate United States-type school available within a reasonable commuting distance of the individual's tax home, and " (B) the dependent attends a school other than the school referred to in subparagraph (A), then the amount taken into account under paragraph (2) shall not exceed the aggregate amount which would be charged for the period by the school referred to in subparagraph (A).

•^ = '

" (5) PERIOD TAKEN INTO ACCOUNT.—An amount shall be taken

into account as a qualified schooling expense only if it is attributable to education for a period during which the individual's tax home is in a foreign country. " (g) QUALIFIED H O M E LEAVE TRAVEL E X P E N S E S. —

" (1) IN GENERAL.—For purposes of this section, the term 'qualified home leave travel expenses' means the reasonable amounts p a i d or incurred by or on behalf of an individual for the transportation of such individual, his spouse, and each dependent from the location of the individual's tax home outside the United States to— " (A) the individual's present (or, if none, most recent) principal residence in the United States, or " (B) if subparagraph (A) does not apply to the individual, the nearest port of entry in the continental United States (excluding Alaska) and return. "(2)

O N E TRIP PER i 2 - M O N T H PERIOD ABROAD.—Amounts may

be

taken into account under paragraph (4) of subsection (b) only with respect to one round t r i p per person for each continuous period of 12 months for which the individual's tax home is in a foreign country.

^

�