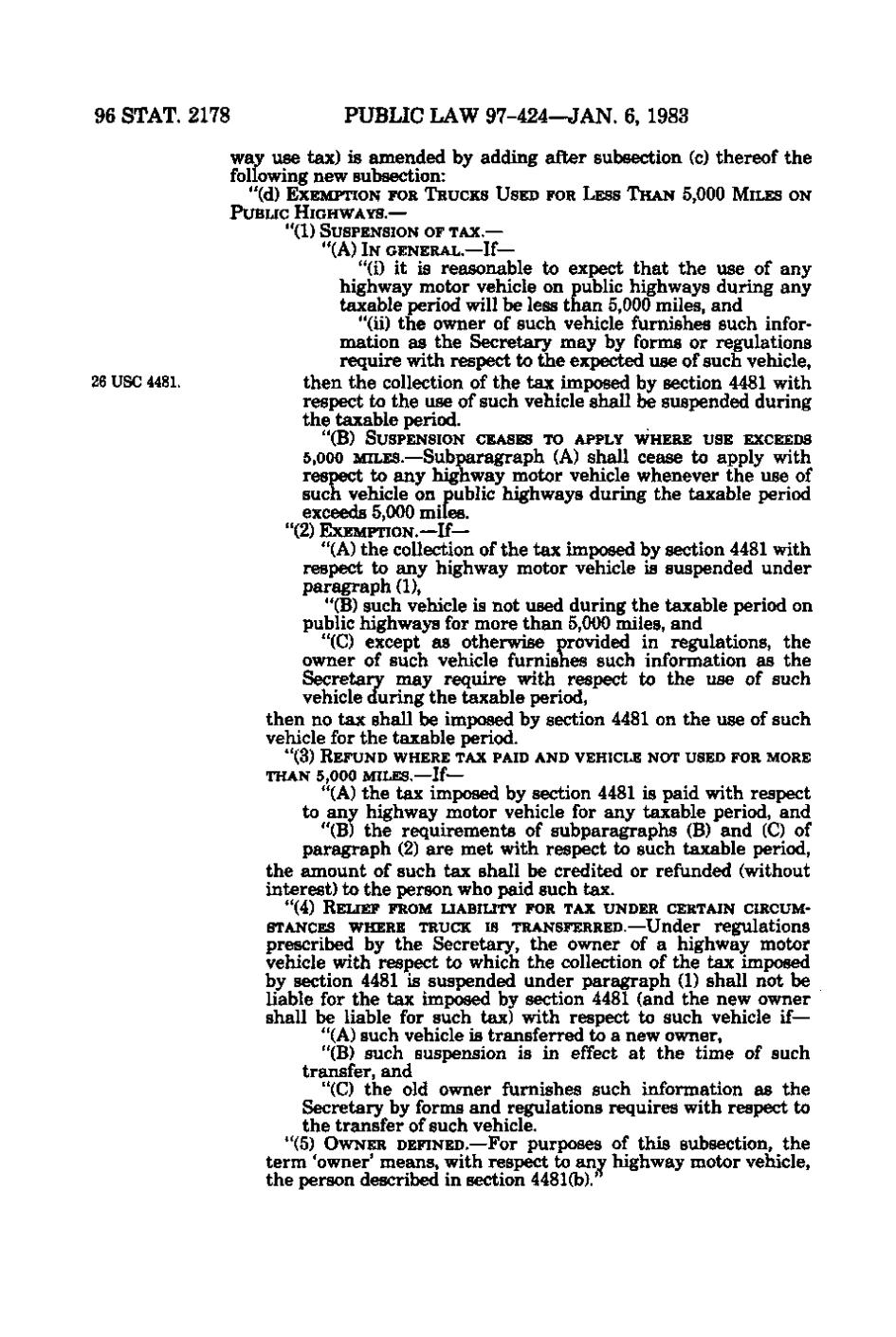

96 STAT. 2178

PUBLIC LAW 97-424—JAN. 6, 1983 way use tax) is amended by adding after subsection (c) thereof the following new subsection: "(d) EXEMPTION FOR TRUCKS USED FOR LESS THAN 5,000 MILES ON PuBuc HIGHWAYS.— "(1) SUSPENSION OF TAX.— "(A) IN GENERAL.—If—

26 USC 4481.

"(i) it is reasonable to expect that the use of any highway motor vehicle on public highways during any taxable period will be less than 5,000 miles, and "(ii) the owner of such vehicle furnishes such information as the Secretary may by forms or regulations require with respect to the expected use of such vehicle, then the collection of the tax imposed by section 4481 with respect to the use of such vehicle shall be suspended during the taxable period. "(B) SUSPENSION CEASES TO APPLY WHERE USE EXCEEDS

5,000 MILES.—Subparagraph (A) shall cease to apply with respect to any highway motor vehicle whenever the use of such vehicle on public highways during the taxable period exceeds 5,000 miles. "(2) EXEMPTION.—If—

"(A) the collection of the tax imposed by section 4481 with respect to any highway motor vehicle is suspended under paragraph (1), "(B) such vehicle is not used during the taxable period on public highways for more than 5,000 miles, and "(C) except as otherwise provided in regulations, the owner of such vehicle furnishes such information as the Secretary may require with respect to the use of such vehicle during the taxable period, then no tax shall be imposed by section 4481 on the use of such vehicle for the taxable period. "(3) REFUND WHERE TAX PAID AND VEHICLE NOT USED FOR MORE

THAN 5,000 MILES.—If— "(A) the tax imposed by section 4481 is paid with respect to any highway motor vehicle for any taxable period, and "(B) the requirements of subparagraphs (B) and (C) of paragraph (2) are met with respect to such taxable period, the amount of such tax shall be credited or refunded (without interest) to the person who paid such tax. "(4) R E U E F FROM LIABILITY FOR TAX UNDER CERTAIN CIRCUM-

STANCES WHERE TRUCK IS TRANSFERRED.—Under regulations prescribed by the Secretary, the owner of a highway motor vehicle with respect to which the collection of the tax imposed by section 4481 is suspended under paragraph (1) shall not be liable for the tax imposed by section 4481 (and the new owner shall be liable for such tax) with respect to such vehicle if— "(A) such vehicle is transferred to a new owner, "(B) such suspension is in effect at the time of such transfer, and "(C) the old owner furnishes such information as the Secretary by forms and regulations requires with respect to the transfer of such vehicle. "(5) OWNER DEFINED.—For purposes of this subsection, the term 'owner' means, with respect to any highway motor vehicle, the person described in section 4481(b)."

�