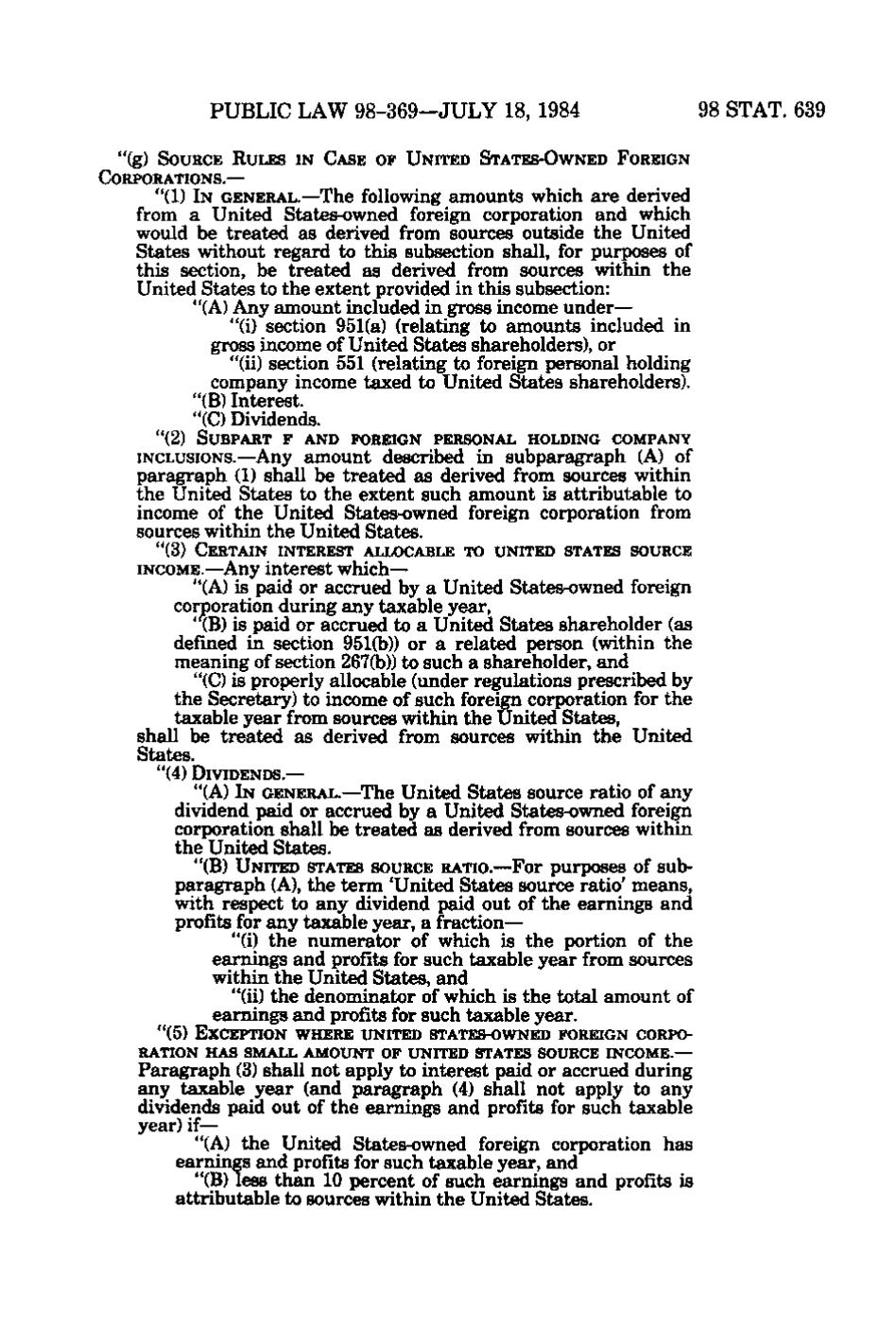

PUBLIC LAW 98-369—JULY 18, 1984

98 STAT. 639

"(g) SOURCE RULES IN CASE OF UNITED STATES-OWNED FOREIGN CORPORATIONS.—

"(1) IN GENERAL.—The following amounts which are derived from a United States-owned foreign corporation and which would be treated as derived from sources outside the United States without regard to this subsection shall, for purposes of this section, be treated as derived from sources within the United States to the extent provided in this subsection: "(A) Any amount included in gross income under— "(i) section 951(a) (relating to amounts included in gross income of United States shareholders), or "(ii) section 551 (relating to foreign personal holding company income taxed to United States shareholders). "(B) Interest. "(C) Dividends. "(2) SUBPART F AND FOREIGN PERSONAL HOLDING COMPANY

INCLUSIONS.—Any amount described in subparagraph (A) of paragraph (1) shall be treated as derived from sources within the United States to the extent such amount is attributable to income of the United States-owned foreign corporation from sources within the United States. "(3) CERTAIN INTEREST ALLOCABLE TO UNITED STATES SOURCE

INCOME.—Any interest which— "(A) is paid or accrued by a United States-owned foreign corporation during any taxable year, "(B) is paid or accrued to a United States shareholder (as E defined in section 951(b)) or a related person (within the meaning of section 267(b)) to such a shareholder, and "(C) is properly allocable (under regulations prescribed by the Secretary) to income of such foreign corporation for the taxable year from sources within the United States, shall be treated as derived from sources within the United States.

ti m i u) sj a &

"(4) DIVIDENDS.—

"(A) IN GENERAL.—The United States source ratio of any dividend paid or accrued by a United States-owned foreign corporation shall be treated as derived from sources within the United States. "(B) UNITED STATES SOURCE RATIO.—For purposes of subparagraph (A), the term 'United States source ratio' means, with respect to any dividend paid out of the earnings and if, profits for any taxable year, a fraction— "(i) the numerator of which is the portion of the earnings and profits for such taxable year from sources bjvi ij^ within the United States, and "(ii) the denominator of which is the total amount of earnings and profits for such taxable year. "(5) EXCEPTION WHERE UNITED STATES-OWNED FOREIGN CORPORATION HAS SMALL AMOUNT OF UNITED STATES SOURCE INCOME.—

Paragraph (3) shall not apply to interest paid or accrued during any taxable year (and paragraph (4) shall not apply to any dividends paid out of the earnings and profits for such taxable year) if— "(A) the United States-owned foreign corporation has earnings and profits for such taxable year, and "(B) less than 10 percent of such earnings and profits is attributable to sources within the United States.

.bm q d\ni

�