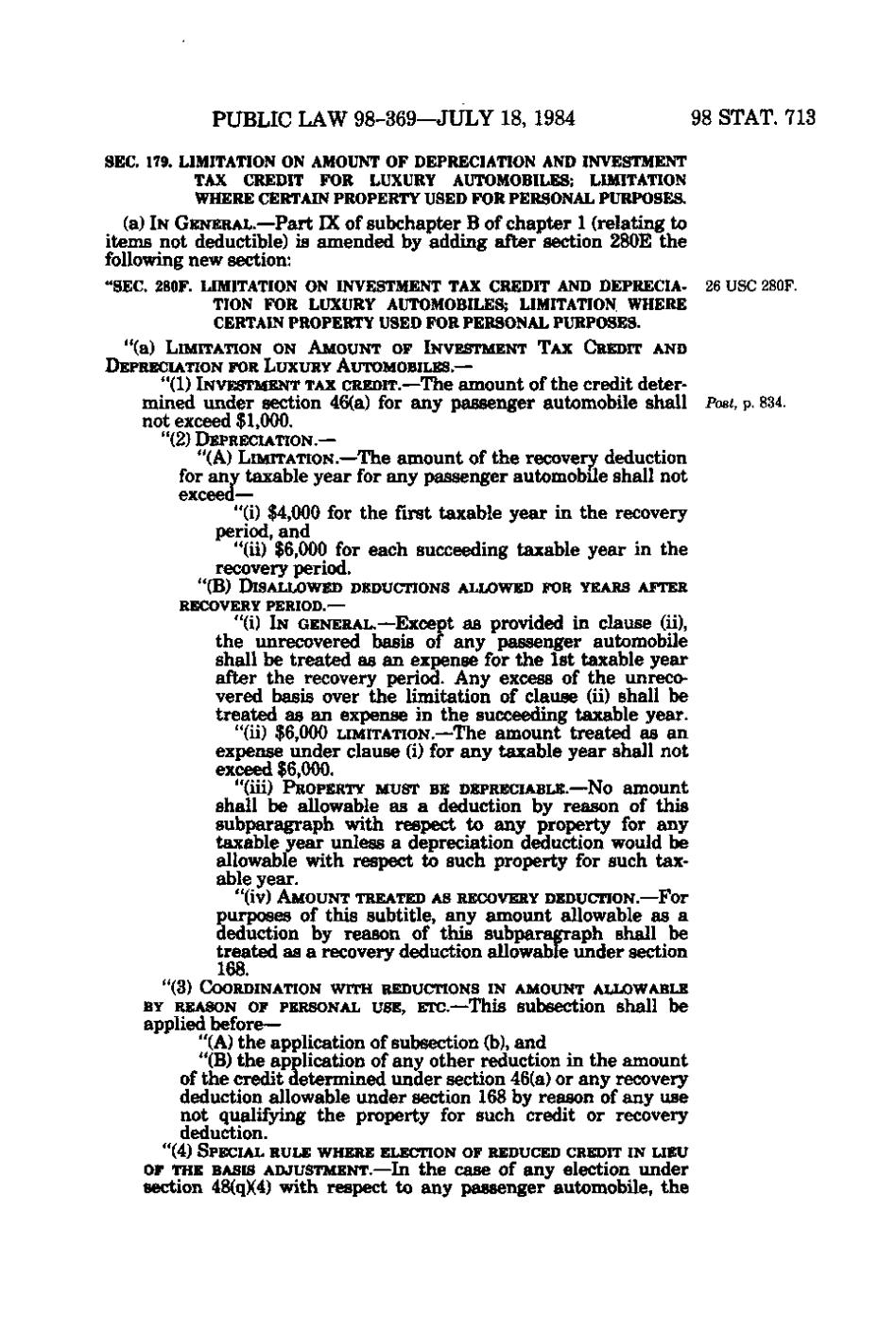

PUBLIC LAW 98-369—JULY 18, 1984

98 STAT. 713

SEC. 179. LIMITATION ON AMOUNT OF DEPRECIATION AND INVESTMENT TAX CREDIT FOR LUXURY AUTOMOBILES; LIMITATION WHERE CERTAIN PROPERTY USED FOR PERSONAL PURPOSES. (a) IN GENERAL.—Part IX of subchapter B of chapter 1 (relating to items not deductible) is amended by adding after section 280E the following new section: "SEC. 280F. LIMITATION ON INVESTMENT TAX CREDIT AND DEPRECIA- 26 USC 280F. TION FOR LUXURY AUTOMOBILES; LIMITATION WHERE CERTAIN PROPERTY USED FOR PERSONAL PURPOSES. "(a) LIMITATION ON AMOUNT OF INVESTMENT TAX CREDIT AND DEPRECIATION FOR LUXURY AUTOMOBILES.—

"(1) INVESTMENT TAX CREDIT.—The amount of the credit determined under section 46(a) for any passenger automobile shall Post, p. 834. not exceed $1,000. "(2) DEPRECIATION.—

mm:- r

"(A) LIMITATION.—The amount of the recovery deduction for any taxable year for any passenger automobile shall not exceed— "(i) $4,000 for the first taxable year in the recovery period, and "(ii) $6,000 for each succeeding taxable year in the recovery period.

r

"(B) DISALLOWED DEDUCTIONS ALLOWED FOR YEARS AFTER RECOVERY PERIOD.—

f

"(i) IN GENERAL.—Except as provided in clause (ii), the unrecovered basis of any passenger automobile shall be treated as an expense for the 1st taxable year after the recovery period. Any excess of the unrecovered basis over the limitation of clause (ii) shall be treated as an expense in the succeeding taxable year. "(ii) $6,000 LIMITATION.—The amount treated as an expense under clause (i) for any taxable year shall not exceed $6,000. "(iii) PROPERTY MUST BE DEPRECIABLE.—No amount shall be allowable as a deduction by reason of this subparagraph with respect to any property for any taxable year unless a depreciation deduction would be allowable with respect to such property for such taxable year.

V •

"(iv) AMOUNT TREATED AS RECOVERY DEDUCTION.—For

(

purposes of this subtitle, any amount allowable as a deduction by reason of this subparagraph shall be treated as a recovery deduction allowable under section 168. "(3) COORDINATION WITH REDUCTIONS IN AMOUNT ALLOWABLE

BY REASON OF PERSONAL USE, ETC.—This subsection shall be applied before— "(A) the application of subsection (b), and "(B) the application of any other reduction in the amount of the credit determined under section 46(a) or any recovery deduction allowable under section 168 by reason of any use not qualifying the property for such credit or recovery deduction. "(4) SPECIAL RULE WHERE ELECTION OF REDUCED CREDIT IN UEU

OF THE BASIS ADJUSTMENT.—In the case of any election under section 48(q)(4) with respect to any passenger automobile, the

�