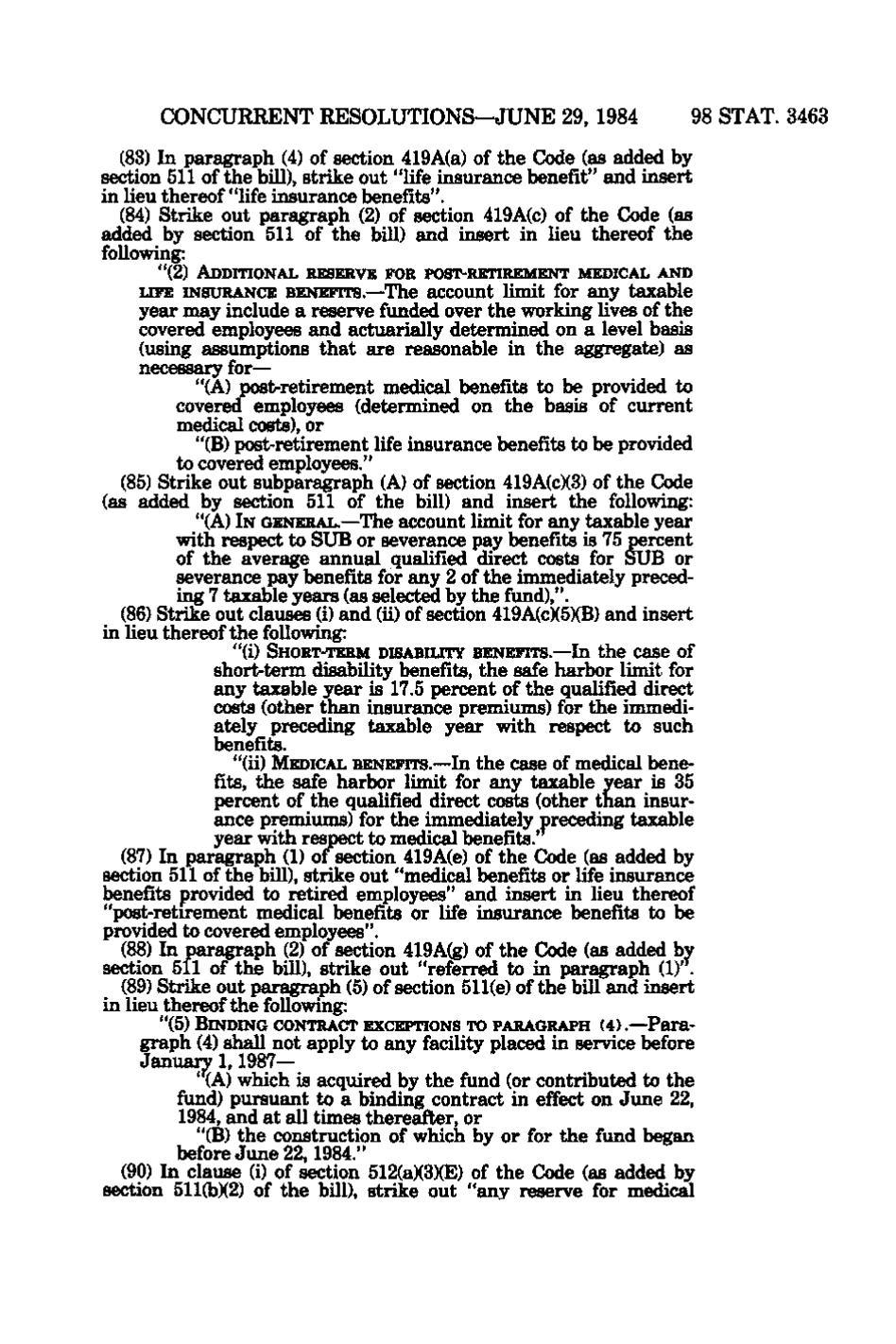

CONCURRENT RESOLUTION S — J U N E 29, 1984

98 STAT. 3463

(83) In paragraph (4) of section 419A(a) of the Code (as addedl by section 511 of the bill), strike out "life insurance benefit" and insert in lieu thereof "life insurance benefits". (84) Strike out paragraph (2) of section 419A(c) of the Code (as added by section 511 of the bill) and insert in lieu thereof the following: "(2) ADDITIONAL RESERVE FOR POST-RETIREMENT MEDICAL AND

LIFE INSURANCE BENEFITS.—The account limit for any taxable year may include a reserve funded over the working lives of the covered employees and actuarially determined on a level basis (using assumptions that are reasonable in the aggregate) as necessary for— "(A) post-retirement medical benefits to be provided to covered employees (determined on the basis of current medical costs), or "(B) post-retirement life insurance benefits to be provided to covered employees," (85) Strike out subparagraph (A) of section 419A(c)(3) of the Code (as added by section 511 of the bill) and insert the following: "(A) IN GENERAL.—The account limit for any taxable j^ear with respect to SUB or severance pay benefits is 75 percent of the average annual qualified direct costs for SUB or severance pay benefits for any 2 of the immediately preceding 7 taxable years (as selected by the fund),". (86) Strike out clauses (i) and (ii) of section 419A(c)(5)(B) and insert in lieu thereof the following: "(i) SHORT-TERM DISABILITY BENEFITS.—In the case of short-term disability benefits, the safe harbor limit for any taxable year is 17.5 percent of the qualified direct costs (other than insurance premiums) for the immediately preceding taxable year with respect to such benefite. "(ii) MEDICAL BENEFITS.—In the case of medical benefits, the safe harbor limit for any taxable year is 35 percent of the qualified direct costs (other than insurance premiums) for the immediately preceding taxable year with respect to medical benefits. (87) In paragraph (1) of section 419A(e) of the Code (as added by section 511 of the bill), strike out "medical benefits or life insurance benefits provided to retired employees" and insert in lieu thereof "post-retirement medical benefits or life insurance benefits to be provided to covered employees". (88) In paragraph (2) of section 419A(g) of the Code (as added by section 511 of the bill), strike out "referred to in paragraph (1). (89) Strike out paragraph (5) of section 511(e) of the bill and insert in lieu thereof the following: "(5) BINDING CONTRACT EXCEPTIONS TO PARAGRAPH (4).—Paragraph (4) shall not apply to any facility placed in service before January 1, 1987— ' (A) which is acquired by the fund (or contributed to the fund) pursuant to a binding contract in effect on June 22, 1984, and at all times thereafter, or "(B) the construction of which by or for the fund began before June 22, 1984." (90) In clause (i) of section 512(a)(3)(E) of the Code (as added by section 511(b)(2) of the bill), strike out "any reserve for me^lical

�