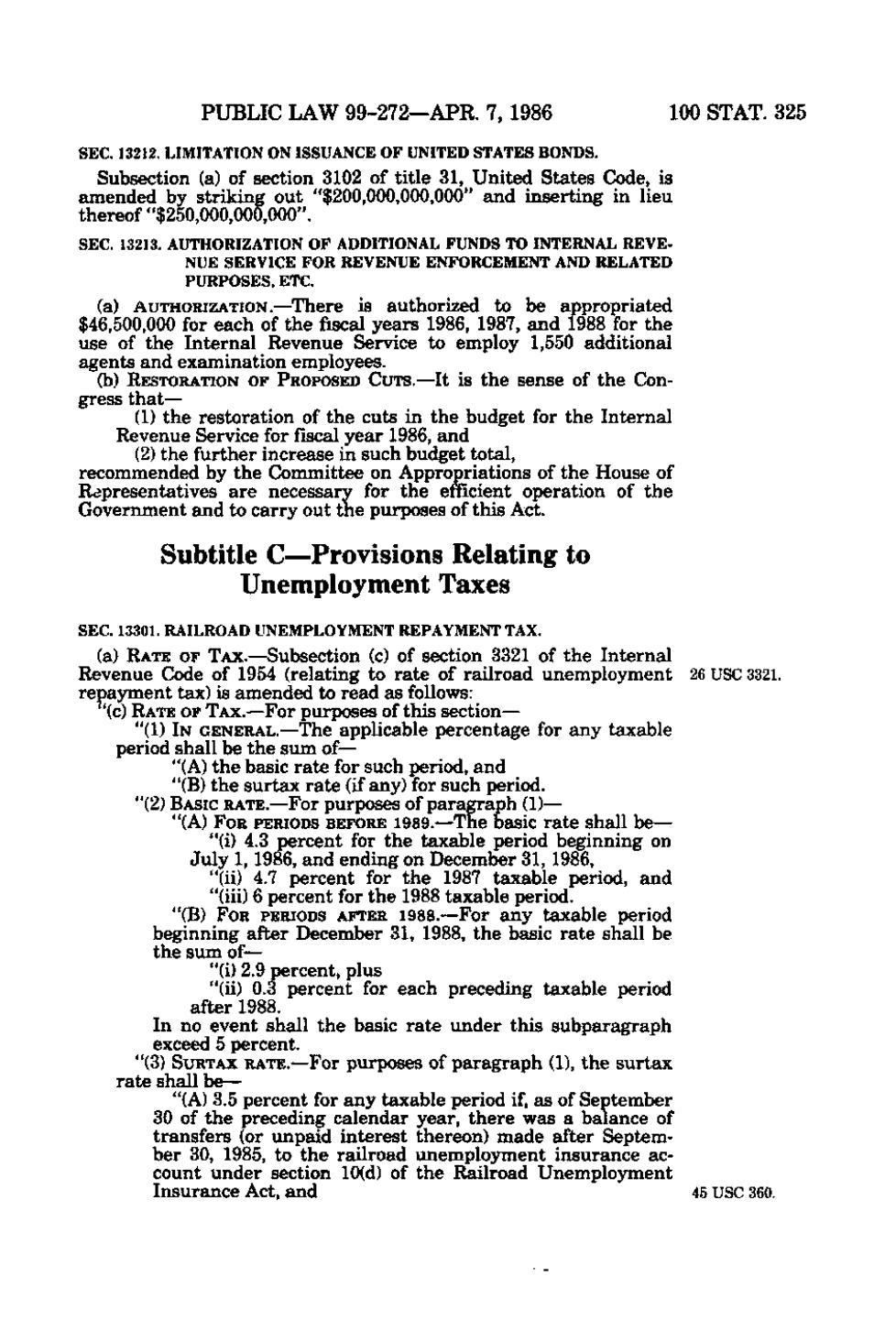

PUBLIC LAW 99-272—APR. 7, 1986

100 STAT. 325

SEC. 13212. LIMITATION ON ISSUANCE OF UNITED STATES BONDS. Subsection (a) of section 3102 of title 31, United States Code, is amended by striking o u t "$200,000,000,000" and inserting in lieu thereof "$250,000,000,000". SEC. 13213. AUTHORIZATION OF ADDITIONAL FUNDS TO INTERNAL REVENUE SERVICE FOR REVENUE ENFORCEMENT AND RELATED PURPOSES, ETC. (a) AUTHORIZATION.—There is authorized to be a p p r o p r i a t e d $46,500,000 for each of the fiscal year s 1986, 1987, and 1988 for the use of the I n t e r n a l Revenue Service to employ 1,550 additional a g e n t s and examination employees. (b) RESTORATION O F PROPOSED C U T S. — I t is the sense of the Con-

gress that — (1) the r e s to r a t i o n of the cuts in the budget for the I n t e r n a l Revenue Service for fiscal year 1986, and (2) the f u r the r increase in such budget total, recommended by the Committee on Appropriations of the House of Representatives a r e necessary for the efficient operation of the Government and to c a r r y o u t the purposes of t h i s Act.

Subtitle C—Provisions Relating to Unemployment Taxes SEC. 13301. RAILROAD UNEMPLOYMENT REPAYMENT TAX. (a) R A T E O F TAX.—Subsection (c) of section 3321 of the I n t e r n a l Revenue Code of 1954 (relating to r a t e of railroad unemployment r e payment tax) is amended to read a s follows: "(c) R A T E OF T A X. — For purposes of this section— "(1) IN GENERAL.—The applicable p e r c e n t a g e for any tax a b l e period shall be the s u m of— "(A) the basic r a t e for such period, and "(B) the s u r tax r a t e (if any) for such period. "(2) BASIC RATE.—For purposes of paragraph (1)— "(A) FOR PERIODS BEFORE 1989.—The basic r a t e shall be— "(i) 4.3 percent for the tax a b l e period beginning on July 1, 1986, and ending on December 31, 1986, "(ii) 4.7 percent for the 1987 tax a b l e period, and "(iii) 6 p e r c e n t for the 1988 tax a b l e period.

26 USC 3321.

"(B) FOR PERIODS AFTER 1988. — For any tax a b l e period

beginning after December 31, 1988, the basic r a t e shall be the s u m of— "(i) 2.9 percent, plus "(ii) 0.3 percent for each preceding taxable period after 1988. In no event shall the basic r a t e under this subparagraph exceed 5 percent. "(3) SURTAX RATE.—For purposes of paragraph (1), the s u r tax r a t e shall be— "(A) 3.5 percent for any tax a b l e period if, a s of September 30 of the preceding c a l e n d a r year, the r e w a s a b a l a n c e of transfers (or u n p a i d i n t e r e s t thereon) m a d e after September 30, 1985, to the railroad unemployment insurance account under section 10(d) of the Railroad Unemployment Insurance Act, and

45 USC 360.

�