PUBLIC LAW 99-498—OCT. 17, 1986

100 STAT. 1315

"(f) ASSESSMENT OF EFFECTIVE FAMILY INCOME.—(1) If the effective

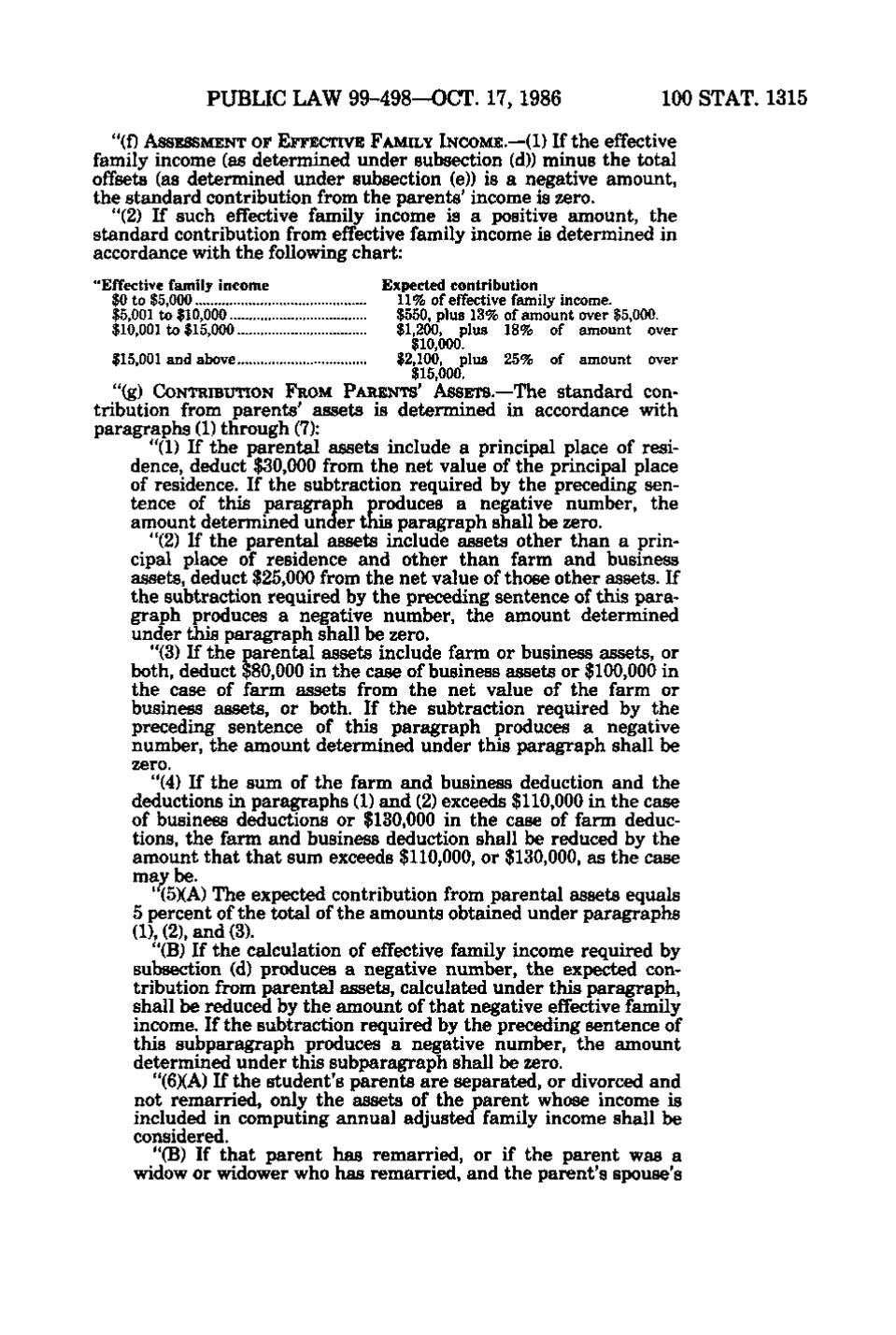

family income (as determined under subsection (d)) minus the total offsets (as determined under subsection (e)) is a negative amount, the standard contribution from the parents' income is zero. "(2) If such effective family income is a positive amount, the standard contribution from effective family income is determined in accordance with the following chart: "Effective family income $0 to $5,000 $5,001 to $10,000 $10,001 to $15,000

Expected contribution 11% of effective family income. $550, plus 13% of amount over $5,000. $1,200, plus 18% of amount over $10,000. $15,001 and above $2,100, plus 25% of amount over $15,000. "(g) CONTRIBUTION FROM PARENTS' ASSETS.—The standard con-

tribution from parents' assets is determined in accordance with paragraphs (1) through (7): "(1) If the parental assets include a principal place of residence, deduct $30,000 from the net value of the principal place of residence. If the subtraction required by the preceding sentence of this paragraph produces a negative number, the amount determined under this paragraph shall be zero. "(2) If the parental assets include assets other than a principal place of residence and other than farm and business assets, deduct $25,000 from the net value of those other assets. If the subtraction required by the preceding sentence of this paragraph produces a negative number, the amount determined under this paragraph shall be zero. "(3) If the parental assets include farm or business assets, or both, deduct $80,000 in the case of business assets or $100,000 in the case of farm assets from the net value of the farm or business assets, or both. If the subtraction required by the preceding sentence of this paragraph produces a negative number, the amount determined under this paragraph shall be zero. "(4) If the sum of the farm and business deduction and the deductions in paragraphs (1) and (2) exceeds $110,000 in the case of business deductions or $130,000 in the case of farm deductions, the farm and business deduction shall be reduced by the amount that that sum exceeds $110,000, or $130,000, as the case may be. "(5)(A) The expected contribution from parental assets equals 5 percent of the total of the amounts obtained under paragraphs (1), (2), and (3). "(B) If the calculation of effective family income required by subsection (d) produces a negative number, the expected contribution from parental assets, calculated under this paragraph, shall be reduced by the amount of that negative effective family income. If the subtraction required by the preceding sentence of this subparagraph produces a negative number, the amount determined under this subparagraph shall be zero. "(6)(A) If the student's parents are separated, or divorced and not remarried, only the assets of the parent whose income is included in computing annual adjusted family income shall be considered. "(B) If that parent has remarried, or if the parent was a widow or widower who has remarried, and the parent's spouse's

�