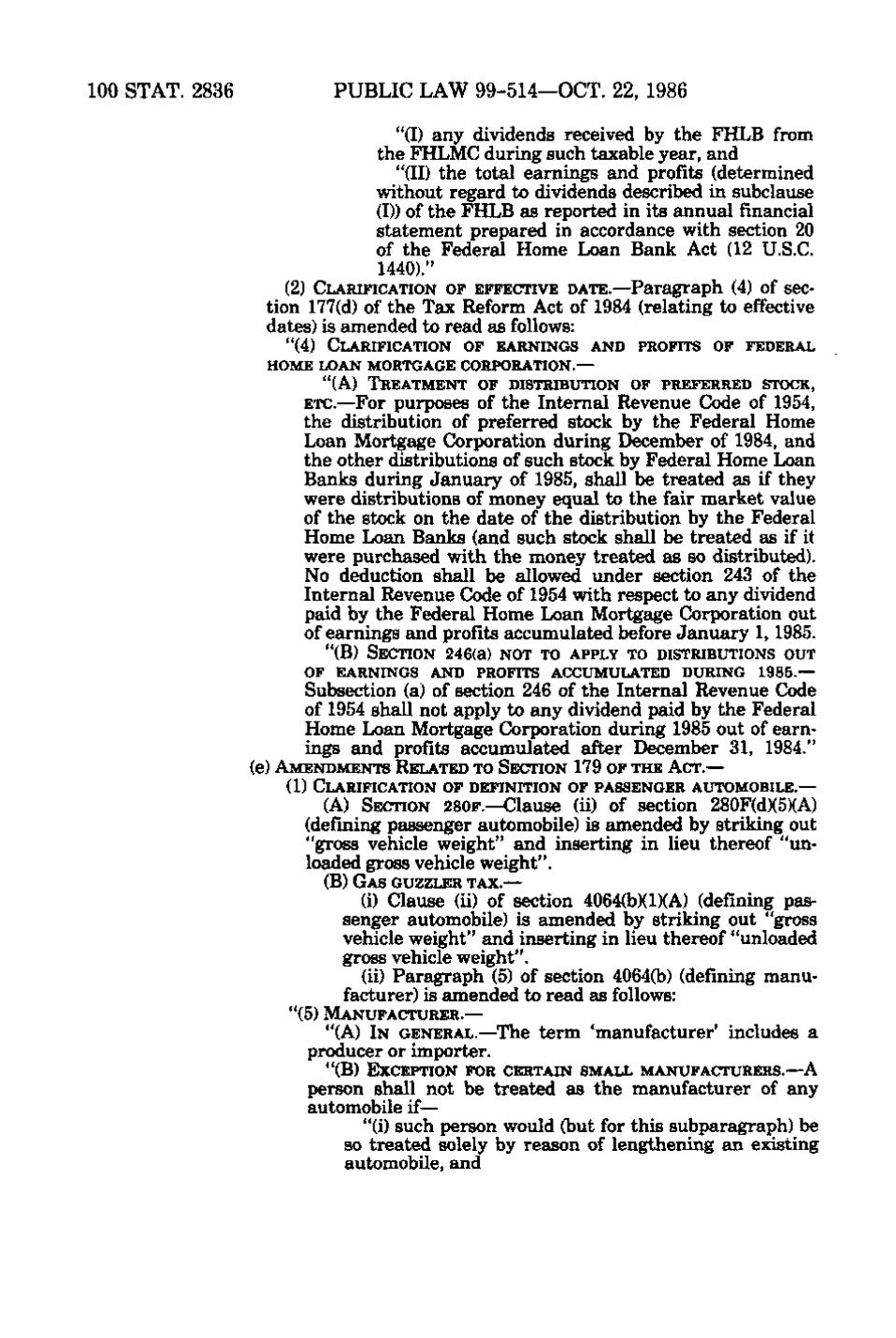

100 STAT. 2836

PUBLIC LAW 99-514—OCT. 22, 1986 £":«-->' ry,.: '. ' --. '

"(I) any dividends received by the FHLB from the FHLMC during such taxable year, and "(11) the total earnings and profits (determined ^c,.;' without regard to dividends described in subclause (I)) of the FHLB as reported in its annual financial statement prepared in accordance with section 20 of the Federal Home Loan Bank Act (12 U.S.C. 1440)." (2) CLARIFICATION OF EFFECTIVE DATE.—Paragraph (4) of section 177(d) of the Tax Reform Act of 1984 (relating to effective dates) is amended to read as follows: "(4) CLARIFICATION OF EARNINGS AND PROFITS OF FEDERAL HOME LOAN MORTGAGE CORPORATION.— "(A) TREATMENT OF DISTRIBUTION OF PREFERRED STOCK,

r- ir

ETC.—For purposes of the Internal Revenue Code of 1954, the distribution of preferred stock by the Federal Home Loan Mortgage Corporation during December of 1984, and the other distributions of such stock by Federal Home Loan Banks during January of 1985, shall be treated as if they were distributions of money equal to the fair market value of the stock on the date of the distribution by the Federal Home Loan Banks (and such stock shall be treated as if it were purchased with the money treated as so distributed). No deduction shall be allowed under section 243 of the Internal Revenue Code of 1954 with respect to any dividend paid by the Federal Home Loan Mortgage Corporation out of earnings and profits accumulated before January 1, 1985. "(B) SECTION 246(a) NOT TO APPLY TO DISTRIBUTIONS OUT

u ^.

'

OF EARNINGS AND PROFITS ACCUMULATED DURING 1985.—

Subsection (a) of section 246 of the Internal Revenue Code of 1954 shall not apply to any dividend paid by the Federal Home Loan Mortgage Corporation during 1985 out of earnings and profits accumulated after December 31, 1984." (e) AMENDMENTS RELATED TO SECTION 179 OF THE ACT.— (1) CLARIFICATION OF DEFINITION OF PASSENGER AUTOMOBILE.— (A) SECTION 280F.—Clause (ii) of section 280F(d)(5)(A)

- ,i« i

(defining passenger automobile) is amended by striking out "gross vehicle weight" and inserting in lieu thereof "unloaded gross vehicle weight". (B) GAS GUZZLER TAX.— (i) Clause (ii) of section 406403)(1)(A) (defining passenger automobile) is amended by striking out "gross vehicle weight" and inserting in lieu thereof "unloaded ' gross vehicle weight". (ii) Paragraph (5) of section 4064(b) (defining manufacturer) is amended to read as follows: "(5) MANUFACTURER.—

"(A) IN GENERAL.—The term 'manufacturer' includes a producer or importer. •

"(B) EXCEPTION FOR CERTAIN SMALL MANUFACTURERS.—A

r

person shall not be treated as the manufacturer of any automobile if— "(i) such person would (but for this subparagraph) be so treated solely by reason of lengthening an existing automobile, and

�