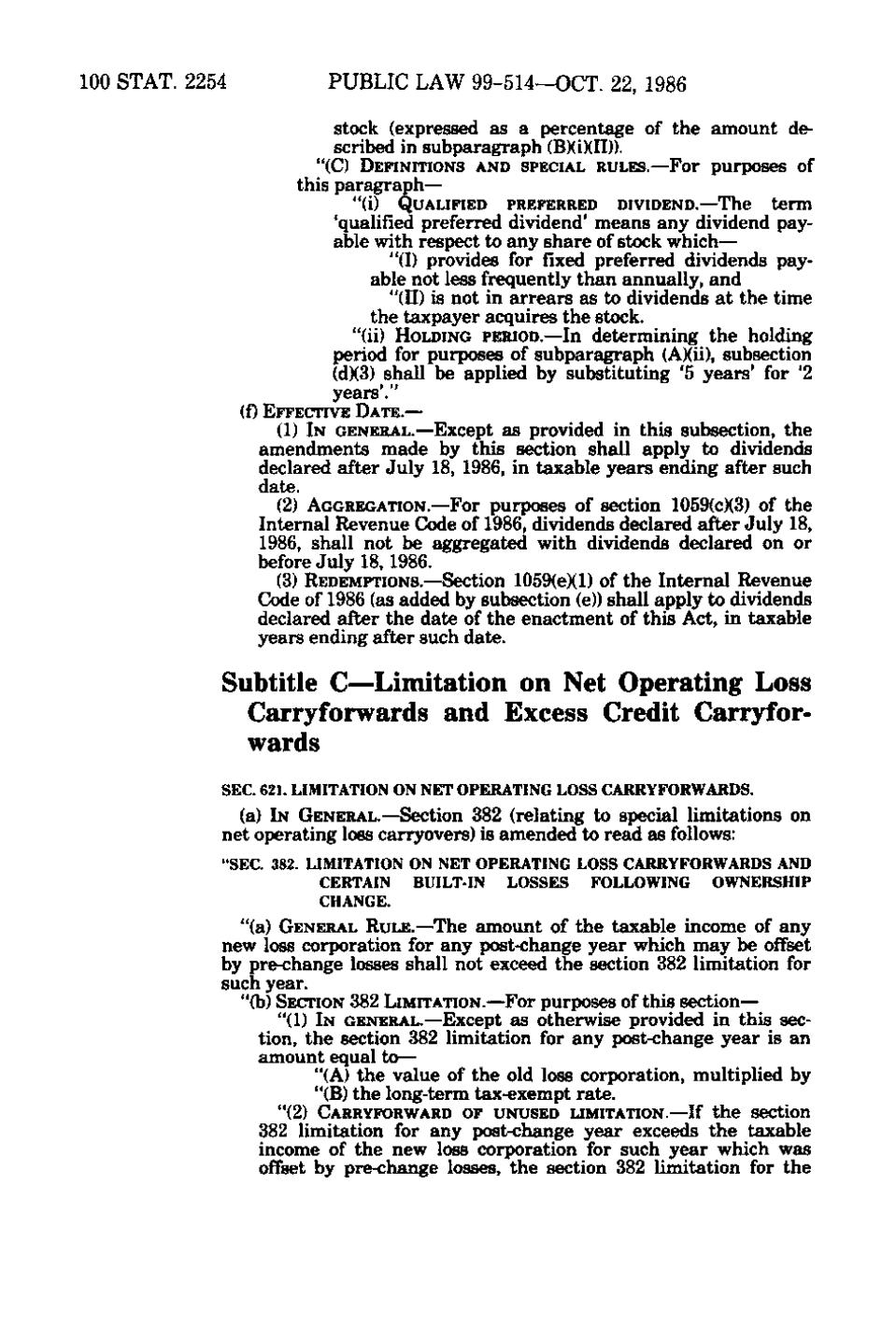

100 STAT. 2254

PUBLIC LAW 99-514—OCT. 22, 1986

arr fi^ixx H stock (expressed as a percentage of the amount de' J scribed in subparagraph (B)(i)(ID). "(C) DEFINITIONS AND SPECIAL RULES.—For purposes of

this paragraph— 'K-i "(i) QUALIFIED PREFERRED DIVIDEND.—The term • i ^' 'qualified preferred dividend' means any dividend payable with respect to any share of stock which— "(I) provides for fixed preferred dividends pay/\ able not less frequently than annually, and ": - • "(ID is not in arrears as to dividends at the time the taxpayer acquires the stock. J ^\ < ' t "(ii) HOLDING PERIOD.—In determining the holding period for purposes of subparagraph (A)(ii), subsection c.., (d)(3) shall be applied by substituting '5 years' for '2 years'." (f) EFFECTIVE DATE.—

(1) IN GENERAL.—Except as provided in this subsection, the amendments made by this section shall apply to dividends declared after July 18, 1986, in taxable years ending after such date. (2) AGGREGATION.—For purposes of section 1059(c)(3) of the Internal Revenue Code of 1986, dividends declared after July 18, 1986, shall not be aggregated with dividends declared on or

- ,, ^ before July 18, 1986.

(3) REDEMPTIONS.—Section 1059(e)(l) of the Internal Revenue Code of 1986 (as added by subsection (e)) shall apply to dividends ^ declared after the date of the enactment of this Act, in taxable years ending after such date.

Subtitle C—Limitation on Net Operating Loss Carryforwards and Excess Credit Carryforwards SEC. 621. LIMITATION ON NET OPERATING LOSS CARRYFORWARDS.

(a) IN GENERAL.—Section 382 (relating to special limitations on net operating loss carryovers) is amended to read as follows: "SEC. 382. LIMITATION ON NET OPERATING LOSS CARRYFORWARDS AND CERTAIN BUILT-IN LOSSES FOLLOWING OWNERSHIP CHANGE.

"(a) GENERAL RULE.—The amount of the taxable income of any new loss corporation for any post-change year which may be offset by pre-change losses shall not exceed the section 382 limitation for such year. "(b) SECTION 382 LIMITATION.—For purposes of this section— "(1) IN GENERAL.—Except as otherwise provided in this sec^fi • tion, the section 382 limitation for any post-change year is an amount equal to— "(A) the value of the old loss corporation, multiplied by "(B) the long-term tax-exempt rate. "(2) CARRYFORWARD OF UNUSED LIMITATION.—If the section

" ,,

382 limitation for any post-change year exceeds the taxable income of the new loss corporation for such year which wsis offset by pre-change losses, the section 382 limitation for the

�