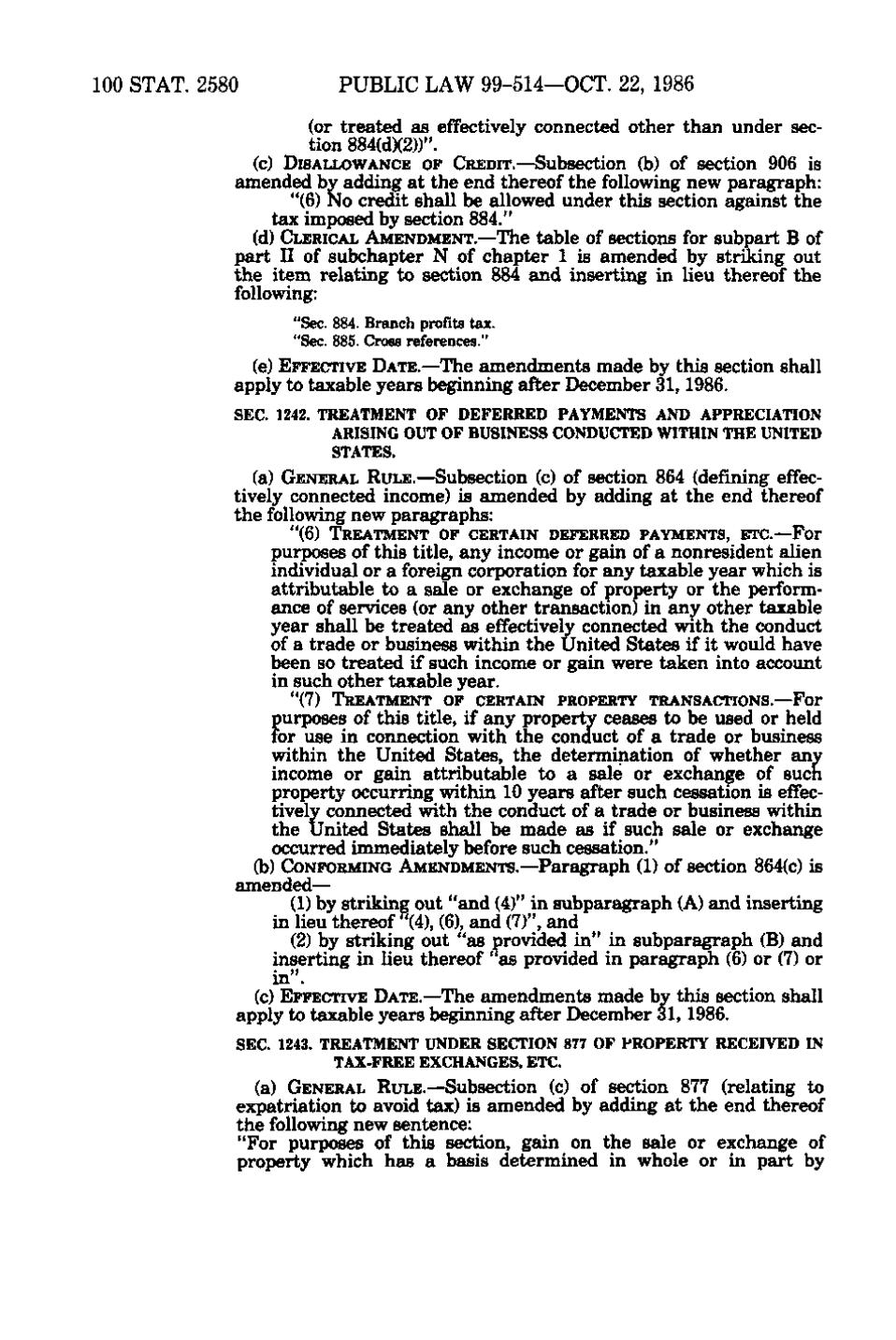

100 STAT. 2580

PUBLIC LAW 99-514—OCT. 22, 1986

£

(or treated as effectively connected other than under section 884(d)(2))". (c) DISALLOWANCE OF CREDIT.—Subsection (b) of section 906 is

amended by adding at the end thereof the following new paragraph: "(6) No credit shall be allowed under this section against the tax imposed by section 884." (d) CLERICAL AMENDMENT.—The table of sections for subpart B of part II of subchapter N of chapter 1 is amended by striking out the item relating to section 884 and inserting in lieu thereof the following: ^,. ^»... "Sec. 884. Branch profits tax. ^ "Sec. 885. Cross references." (e) EFFECTIVE DATE.—The amendments made by this section shall

apply to taxable years beginning after December 31, 1986. SEC. 1242. TREATMENT OF DEFERRED PAYMENTS AND APPRECIATION ARISING OUT OF BUSINESS CONDUCTED WITHIN THE UNITED STATES. (a) GENERAL RULE.—Subsection (c) of section 864 (defining effec-

tively connected income) is amended by adding at the end thereof the following new paragraphs: "(6) TREATMENT OF CERTAIN DEFERRED PAYMENTS, ETC.—For

purposes of this title, any income or gain of a nonresident alien individual or a foreign corporation for any taxable year which is attributable to a sale or exchange of property or the perform* ance of services (or any other transaction) in any other taxable year shall be treated as effectively connected with the conduct of a trade or business within the United States if it would have been so treated if such income or gain were taken into account in such other taxable year. "(7) TREATMENT OF CERTAIN PROPERTY TRANSACTIONS.—For

purposes of this title, if any property ceases to be used or held for use in connection with the conduct of a trade or business within the United States, the determination of whether any income or gain attributable to a sale or exchange of such property occurring within 10 years after such cessation is effectively connected with the conduct of a trade or business within the United States shall be made as if such sale or exchange occurred immediately before such cessation." (b) CONFORMING AMENDMENTS.—Paragraph (1) of section 864(c) is

amended— (1) by striking out "and (4)" in subparagraph (A) and inserting in lieu thereof "(4), (6), and (7)", and (2) by striking out "as provided in" in subparagraph (B) and inserting in lieu thereof "as provided in paragraph (6) or (7) or in". (c) EFFECTIVE DATE.—The amendments made by this section shall apply to taxable years beginning after December 31, 1986. SEC. 1243. TREATMENT UNDER SECTION 877 OF PROPERTY RECEIVED IN TAX-FREE EXCHANGES, ETC. (a) GENERAL RULE.—Subsection (c) of section 877 (relating to

expatriation to avoid tax) is amended by adding at the end thereof the following new sentence: "For purposes of this section, gain on the sale or exchange of property which has a basis determined in whole or in part by

�