101 STAT. 1330-434

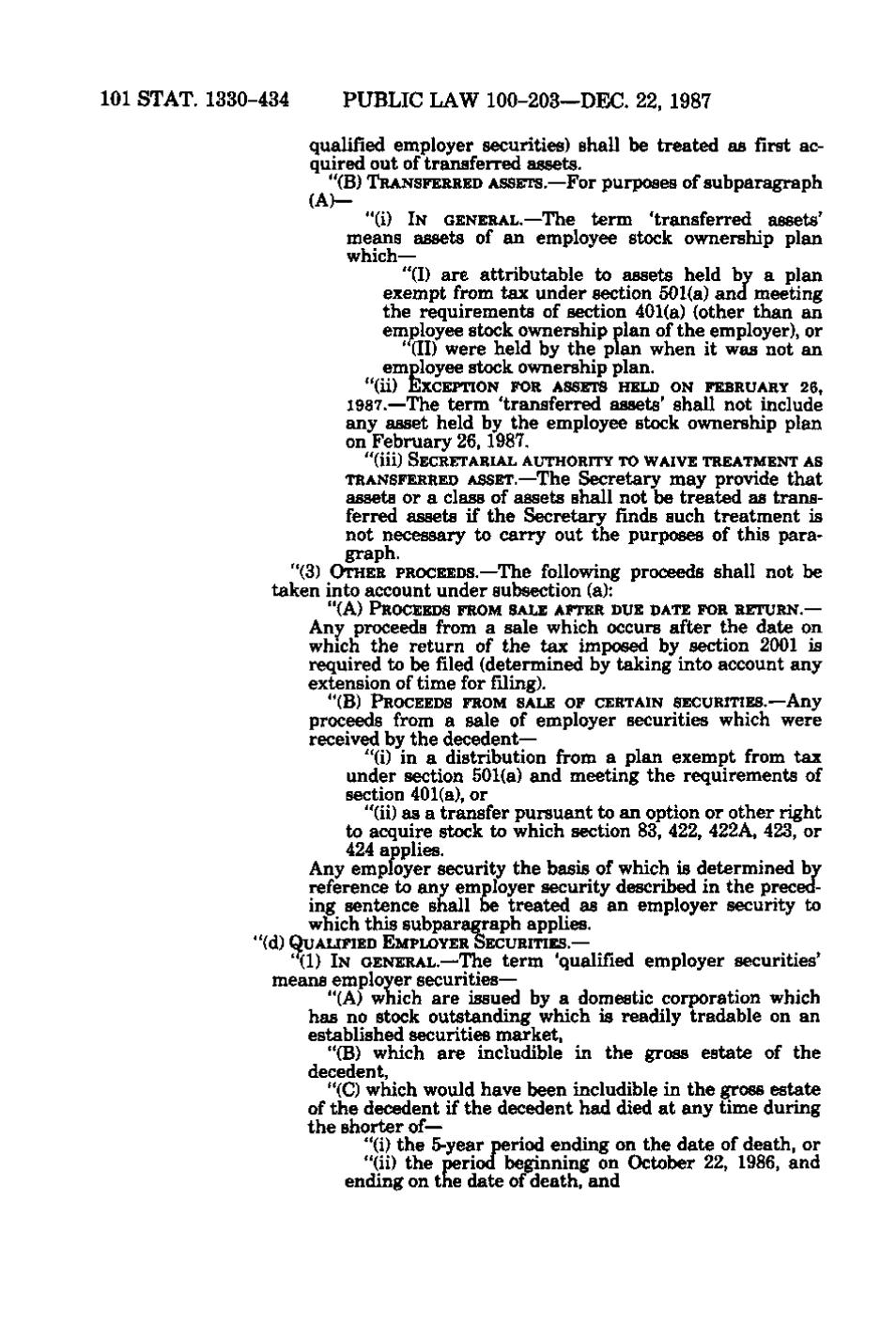

PUBLIC LAW 100-203—DEC. 22, 1987 qualified employer securities) shall be treated as first acquired out of transferred assets. "(B) TRANSFERRED ASSETS.—For purposes of subparagraph

(A)-

"(i) IN GENERAL.—The term 'transferred assets' ^ means assets of an employee stock ownership plan which— "(I) are attributable to assets held by a plan exempt from tax under section 501(a) and meeting ,. V the requirements of section 401(a) (other than an • 4 employee stock ownership plan of the employer), or ' (II) were held by the plan when it was not an

employee stock ownership plan. "(ii) EXCEPTION FOR ASSETS HELD ON FEBRUARY 26,

1987.—The term 'transferred assets' shall not include any asset held by the employee stock ownership plan on February 26, 1987. "(iii) SECRETARIAL AUTHORITY TO WAIVE TREATMENT AS TRANSFERRED ASSET.—The Secretary may provide that

- "•

assets or a class of assets shall not be treated as trans* ferred assets if the Secretary finds such treatment is not necessary to carry out the purposes of this paragraph. "(3) OTHER PROCEEDS.—The following proceeds shall not be taken into account under subsection (a): "(A) PROCEEDS FROM SALE AFTER DUE DATE FOR RETURN.—

-*^ «; ji,

': ' '^*

•'*

Any proceeds from a sale which occurs after the date on which the return of the tax imposed by section 2001 is required to be filed (determined by taking into account any extension of time for filing). u^gj PROCEEDS FROM SALE OF CERTAIN SECURITIES.—Any

proceeds from a sale of employer securities which were received by the decedent— "(i) in a distribution from a plan exempt from tax under section 501(a) and meeting the requirements of section 401(a), or "(ii) as a transfer pursuant to an option or other right to acquire stock to which section 83, 422, 422A, 423, or 424 applies. Any employer security the basis of which is determined by reference to any employer security described in the preceding sentence shall be treated as an employer security to which this subparagraph applies.

"(d) QUALIFIED EMPLOYER SECURITIES.—

"(1) IN GENERAL.—The term 'qualified employer securities' means employer securities— "(A) which are issued by a domestic corporation which has no stock outstanding which is readily tradable on an established securities market, "(B) which are includible in the gross estate of the decedent, "(C) which would have been includible in the gross estate of the decedent if the decedent had died at any time during the shorter of— "(i) the 5-year period ending on the date of death, or "(ii) the period beginning on October 22, 1986, and ending on the date of death, and ' * -

�