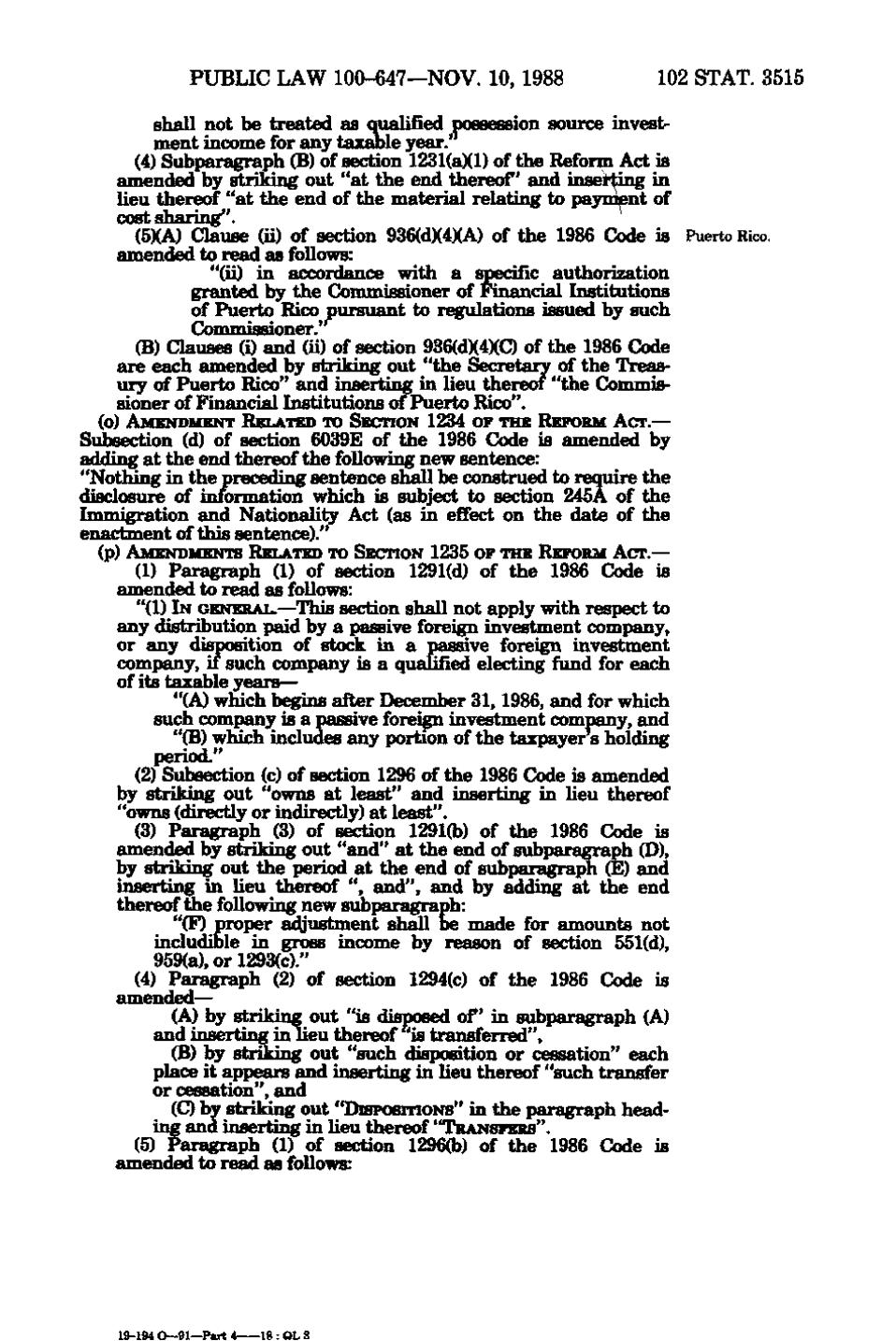

PUBLIC LAW 100-647—NOV. 10, 1988

102 STAT. 3515

shall not be treated as qualified possession source investment income for any taxable year.' (4) Subparagraph (B) of section 1231(a)(l) of the Reform Act is amended by striking out "at the end thereof and inserting in lieu thereof "at the end of the material relating to payment of cost sharing". (5)(A) Qause (ii) of section 936(d)(4)(A) of the 1986 Ckxie is Puerto Rico. amended to read as follows: "(ii) in accordance with a specific authorization granted by the Commissioner of Financial Institutions of Puerto Rico pursuant to r^ulations issued by such Commissioner." (B) Qauses (i) and (ii) of section 936(d)(4)(C) of the 1986 Code are each amended by striking out "the Secretary of the Treasury of Puerto Rico" and inserting in lieu thereof "the (Dommissioner of Financial Institutions of Puerto Rico", (o) AMENDMENT RELATED TO SECTION 1234 OF THE REFORM ACT.—

Subsection (d) of section 6039E of the 1986 Code is amended by adding at the end thereof the following new sentence: "Nothing in the preceding sentence shall be construed to require the disclosure of information which is subject to section 245A of the Immigration and Nationality Act (as in effect on the date of the enactment of this sentence)." (p) AMENDMENTS RELATED TO SECTION 1235 OF THE REFORM ACT.—

(1) Paragraph (1) of section 1291(d) of the 1986 Code is amended to read as follows: "(1) IN GENERAL.—This section shall not apply with respect to any distribution paid by a passive foreig^i investment company, or any disposition of stock in a passive foreign investment company, if such company is a qualified electing fund for each of its taxable years— "(A) which begins after December 31, 1986, and for which such company is a passive for e ^ investment company, and "(B) which includes any portion of the taxpayer s holding period." (2) Subsection (c) of section 1296 of the 1986 Code is amended by striking out "owns at least" and inserting in lieu thereof "owns (directly or indirectly) at least". (3) Paragraph (3) of section 1291(b) of the 1986 Code is amended by striking out "and" at the end of subparagraph (D), by striking out the period at the end of subparagraph (E) and inserting in lieu thereof ", and", and by adding at the end thereof the following new subparagraph: "(F) proper adjustment shall be made for amounts not includible in gross income by reason of section 551(d), 959(a), or 1293(c)." (4) Paragraph (2) of section 1294(c) of the 1986 Code is amended— (A) by striking out "is disposed o f in subparagraph (A) and inserting in lieu thereof is transferred", CB) by striking out "such disposition or cessation" each place it appears and inserting in lieu thereof "such transfer or cessation", and (O by striking out "DLSPOSITIONS" in the p£u*agraph heading and insertii^ in lieu thereof "TRANSFERS". (5) Paragraph (1) of section 1296(b) of the 1986 Code is amended to read as follows:

19-194 O—91—Part 4

18: OL 3

�