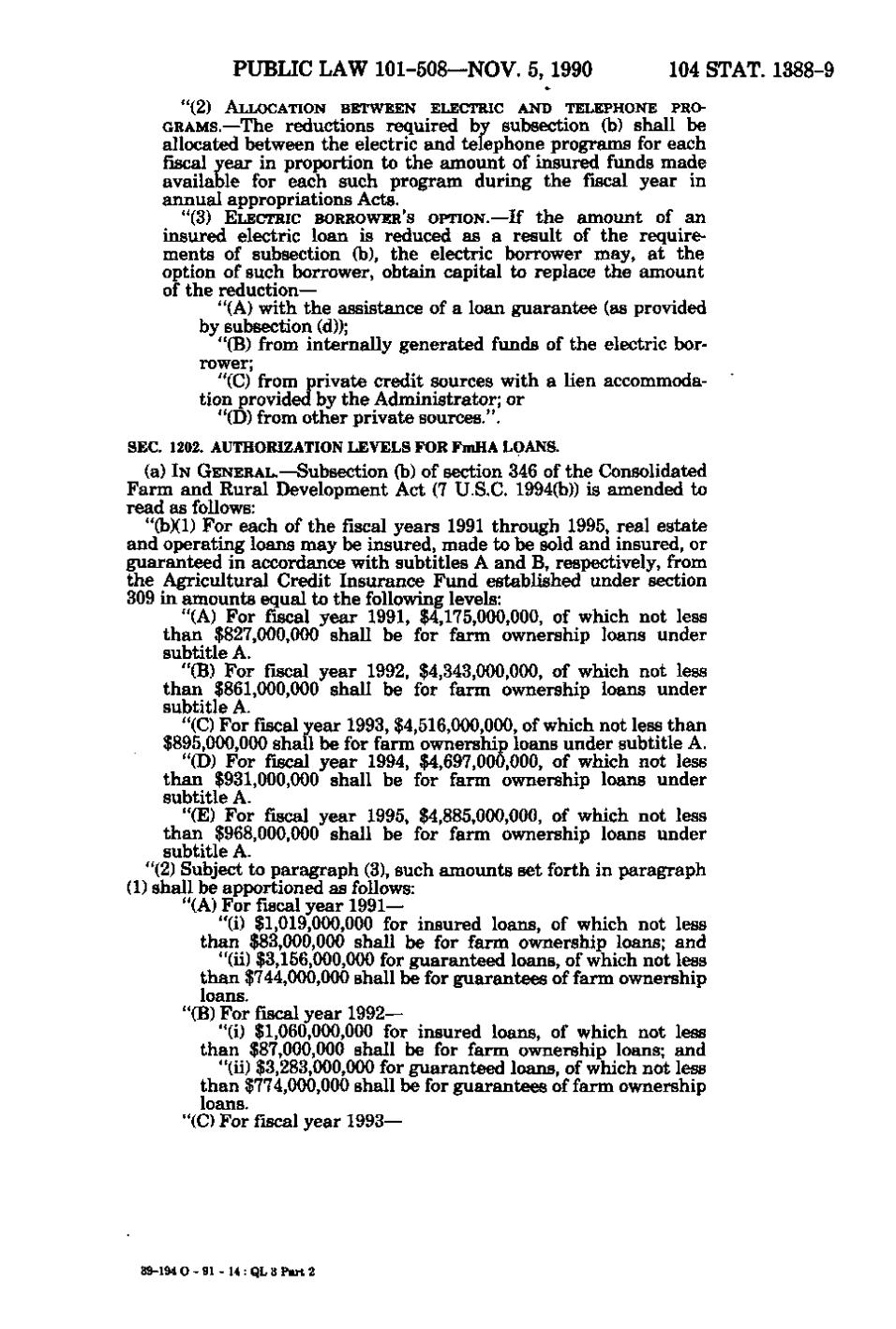

PUBLIC LAW 101-508—NOV. 5, 1990 104 STAT. 1388-9 " (2) ALLOCATION BETWEEN ELECTRIC AND TELEPHONE PRO- GRAMS.— The reductions required by subsection (b) shall be allocated between the electric and telephone programs for each fiscal year in proportion to the amount of insured funds made available for each such program during the fiscal year in annual appropriations Acts. "(3) ELECTRIC BORROWER'S OPTION. —I f the amount of an insured electric loan is reduced as a result of the requirements of subsection (b), the electric borrower may, at the option of such borrower, obtain capital to replace the amount of the reduction— "(A) with the assistance of a loan guarantee (as provided by subsection (d)); "(B) from internally generated funds of the electric borrower; "(C) from private credit sources with a lien accommodation provided by the Administrator; or "(D) from other private sources.". SEC. 1202. AUTHORIZATION LEVELS FOR FmHA LOANS. (a) IN GENERAL.— Subsection (b) of section 346 of the Consolidated Farm and Rural Development Act (7 U.S.C. 1994(b)) is amended to read as follows: "(b)(1) For each of the fiscal years 1991 through 1995, real estate and operating loans may be insured, made to be sold and insured, or guaranteed in accordance with subtitles A and B, respectively, from the Agricultural Credit Insurance Fund established under section 309 in amounts equal to the following levels: "(A) For fiscal year 1991, $4,175,000,000, of which not less than $827,000,000 shall be for farm ownership loans under subtitle A. "(B) For fiscal year 1992, $4,343,000,000, of which not less than $861,000,000 shall be for farm ownership loans under subtitle A. " (C) For fiscal year 1993, $4,516,000,000, of which not less than $895,000,000 shall be for farm ownership loans under subtitle A. "(D) For fiscal year 1994, $4,697,000,000, of which not less than $931,000,000 shall be for farm ownership loans under subtitle A. " (E) For fiscal year 1995, $4,885,000,000, of which not less ' than $968,000,000 shall be for farm ownership loans under subtitle A. "(2) Subject to paragraph (3), such amounts set forth in paragraph (1) shall be apportioned as follows: " (A) For fiscal year 1991— " (i) $1,019,000,000 for insured loans, of which not less than $83,000,000 shall be for farm ownership loans; and "(ii) $3,156,000,000 for guaranteed loans, of which not less than $744,000,000 shall be for guarantees of farm ownership loans. "(B) For fiscal year 1992— "(i) $1,060,000,000 for insured loans, of which not less than $87,000,000 shall be for farm ownership loans; and "(ii) $3,283,000,000 for guaranteed loans, of which not less than $774,000,000 shall be for guarantees of farm ownership loans. "(C) For fiscal year 1993— 39-194O- 91- 14:QL3Part2

�