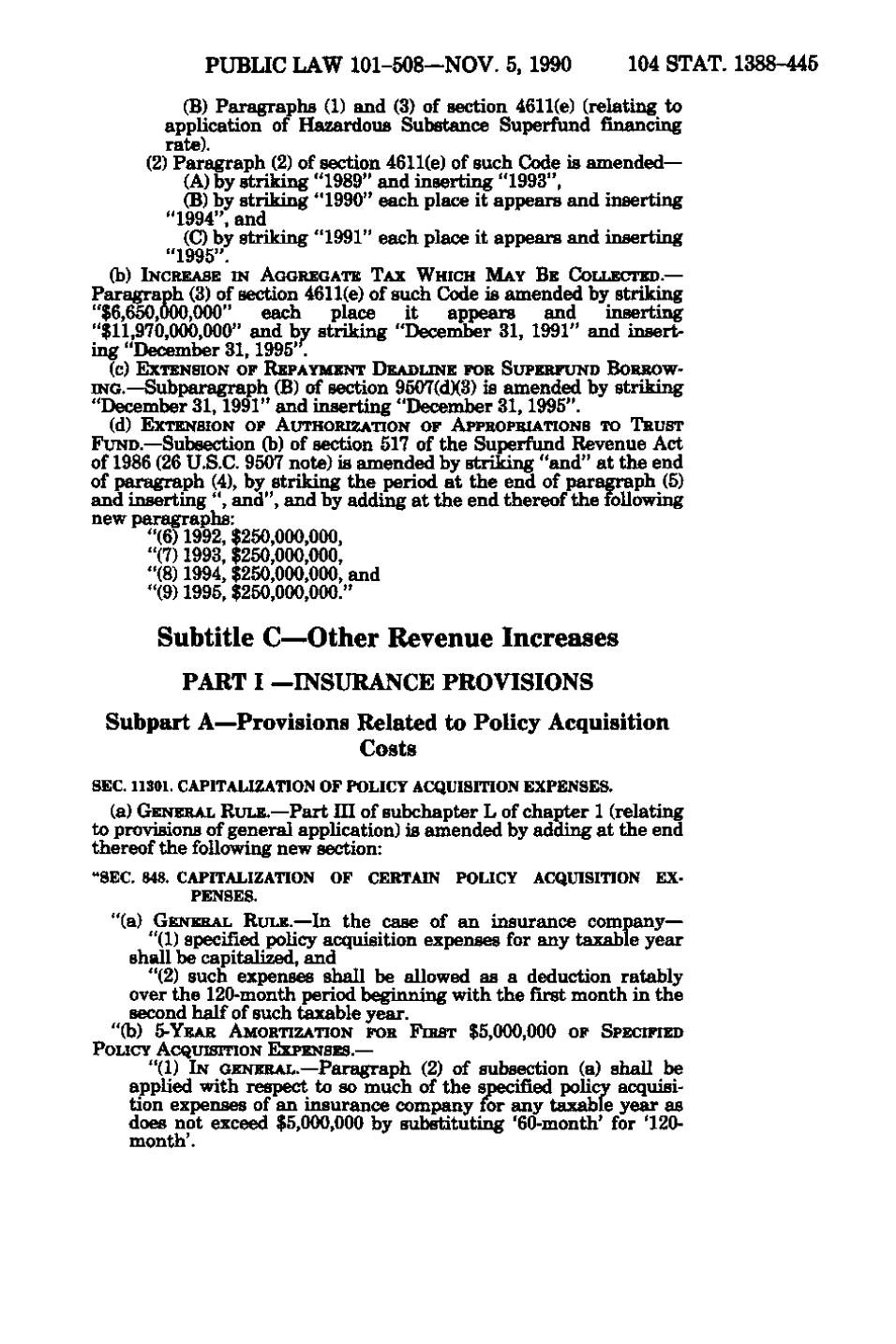

PUBLIC LAW 101-508 —NOV. 5, 1990 104 STAT. 1388-445 (B) Paragraphs (1) and (3) of section 4611(e) (relating to application of Hazardous Substance Superfund financing rate). (2) Paragraph (2) of section 4611(e) of such Code is amended— (A) by striking "1989" and inserting "1993", (B) by striking "1990" each place it appears and inserting " 1994", and (C) by striking "1991" each place it appears and inserting " 1995". (b) INCREASE IN AGGREGATE TAX WHICH MAY BE COLLECTED.— Paragraph (3) of section 4611(e) of such Code is amended by striking "$6,650,000,000" each place it appears and inserting "$11,970,000,000" and by striking "December 31, 1991" and inserting "December 31, 1995". (c) EXTENSION OF REPAYMENT DEADLINE FOR SUPERFUND BORROW- ING. — Subparagraph (B) of section 9507(d)(3) is amended by striking "December 31, 1991" and inserting "December 31, 1995". (d) EXTENSION OF AUTHORIZATION OF APPROPRIATIONS TO TRUST FUND. — Subsection (b) of section 517 of the Superfund Revenue Act of 1986 (26 U.S.C. 9507 note) is amended by striking "and" at the end of paragraph (4), by striking the period at the end of paragraph (5) and inserting ", and", and by adding at the end thereof the following new paragraphs: "(6) 1992, $250,000,000, "(7) 1993, $250,000,000, "(8) 1994, $250,000,000, and "(9) 1995, $250,000,000. " Subtitle C—Other Revenue Increases PART I —INSURANCE PROVISIONS Subpart A—Provisions Related to Policy Acquisition Costs SEC. 11301. CAPITALIZATION OF POLICY ACQUISITION EXPENSES. (a) GENERAL RULE.— Part III of subchapter L of chapter 1 (relating to provisions of general application) is amended by adding at the end thereof the following new section: "SEC. 848. CAPITALIZATION OF CERTAIN POLICY ACQUISITION EX- PENSES. "(a) GENERAL RULE. —In the case of an insurance company— "(1) specified policy acquisition expenses for any taxable year shall be capitalized, and "(2) such expenses shall be allowed as a deduction ratably over the 120-month period beginning with the first month in the second half of such taxable year. "(b) 5-YEAR AMORTIZATION FOR FIRST $5,000,000 OF SPECIFIED POLICY ACQUISITION EXPENSES. — "(1) IN GENERAL.— Paragraph (2) of subsection (a) shall be applied with respect to so much of the specified policy acquisition expenses of an insurance company for any taxable year as does not exceed $5,000,000 by substituting '60-month' for '120- month'.

�