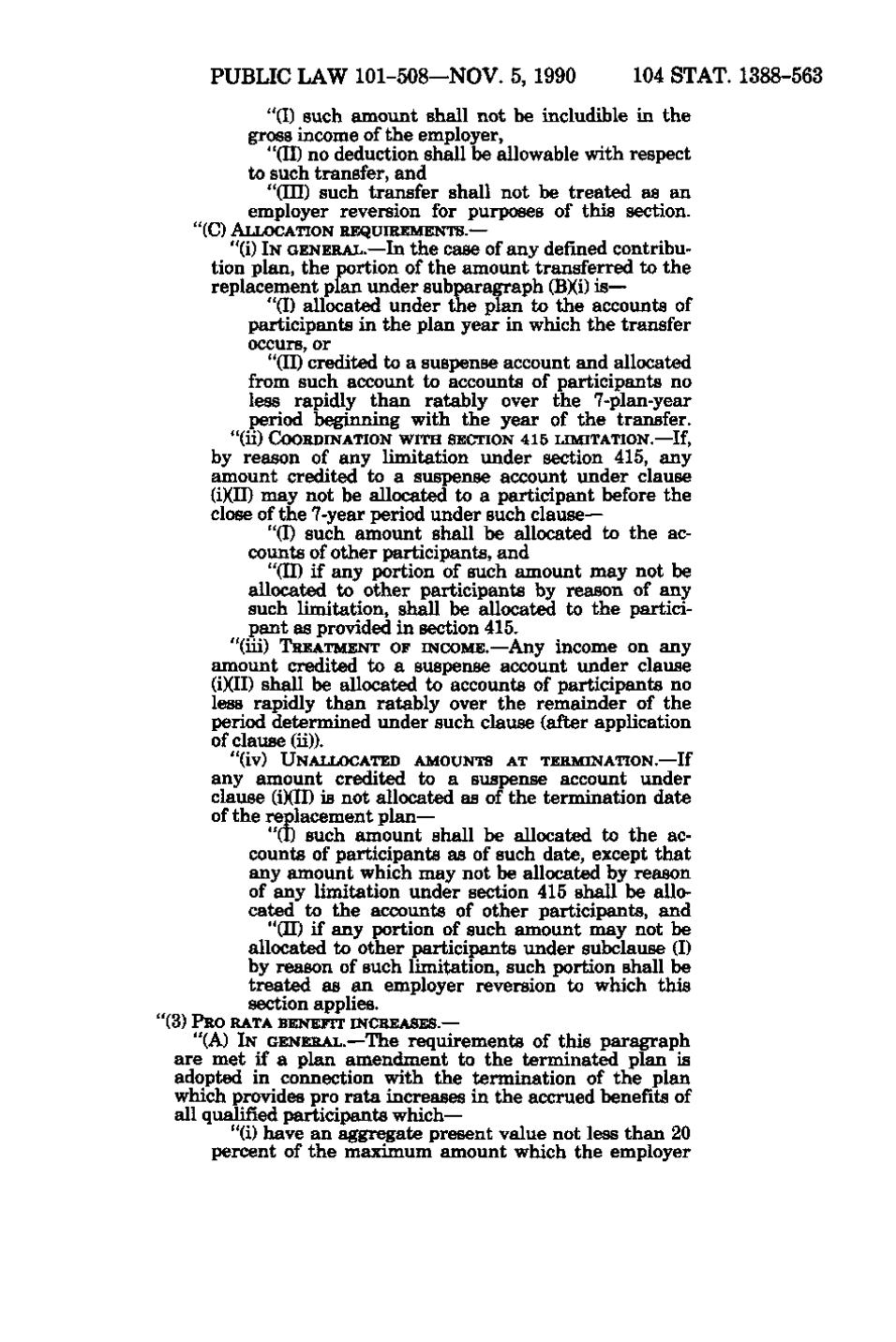

PUBLIC LAW 101-508 —NOV. 5, 1990 104 STAT. 1388-563 "(I) such amount shall not be includible in the gross income of the employer, "(11) no deduction shall be allowable with respect to such transfer, and "(III) such transfer shall not be treated as an employer reversion for purposes of this section. " (C) ALLOCATION REQUIREMENTS. — "(i) IN GENERAL. — In the case of any defined contribution plan, the portion of the amount transferred to the replacement plan under subparagraph (B)(i) is— "(I) allocated under the plan to the accounts of participants in the plan year in which the transfer occurs, or "(II) credited to a suspense account and allocated from such account to accounts of participants no less rapidly than ratably over the 7-plan-year period beginning with the year of the transfer. "(ii) COORDINATION WITH SECTION 415 LIMITATION.— If, by reason of any limitation under section 415, any amount credited to a suspense account under clause (i)(II) may not be allocated to a participant before the close of the 7-year period under such clause— "(I) such amount shall be allocated to the accounts of other participants, and "(II) if any portion of such amount may not be allocated to other participants by reason of any such limitation, shall be allocated to the participant as provided in section 415. "(iii) TREATMENT OF INCOME.—Any income on any amount credited to a suspense account under clause (i)(II) shall be allocated to accounts of participants no less rapidly than ratably over the remainder of the period determined under such clause (after application of clause (ii)). "(iv) UNALLOCATED AMOUNTS AT TERMINATION. — If any amount credited to a suspense account under clause (i)(II) is not allocated as of the termination date of the replacement plan— "(I) such amount shall be allocated to the accounts of participants as of such date, except that any amount which may not be allocated by reason of any limitation under section 415 shall be allocated to the accounts of other participants, and "(II) if any portion of such amount may not be allocated to other participants under subclause (I) by reason of such limitation, such portion shall be treated as an employer reversion to which this section applies. " (3) PRO RATA BENEFIT INCREASES.— "(A) IN GENERAL.—The requirements of this paragraph are met if a plan amendment to the terminated plan is adopted in connection with the termination of the plan which provides pro rata increases in the accrued benefits of all qualified participants which— "(i) have an aggregate present value not less than 20 percent of the msiximum amount which the employer

�