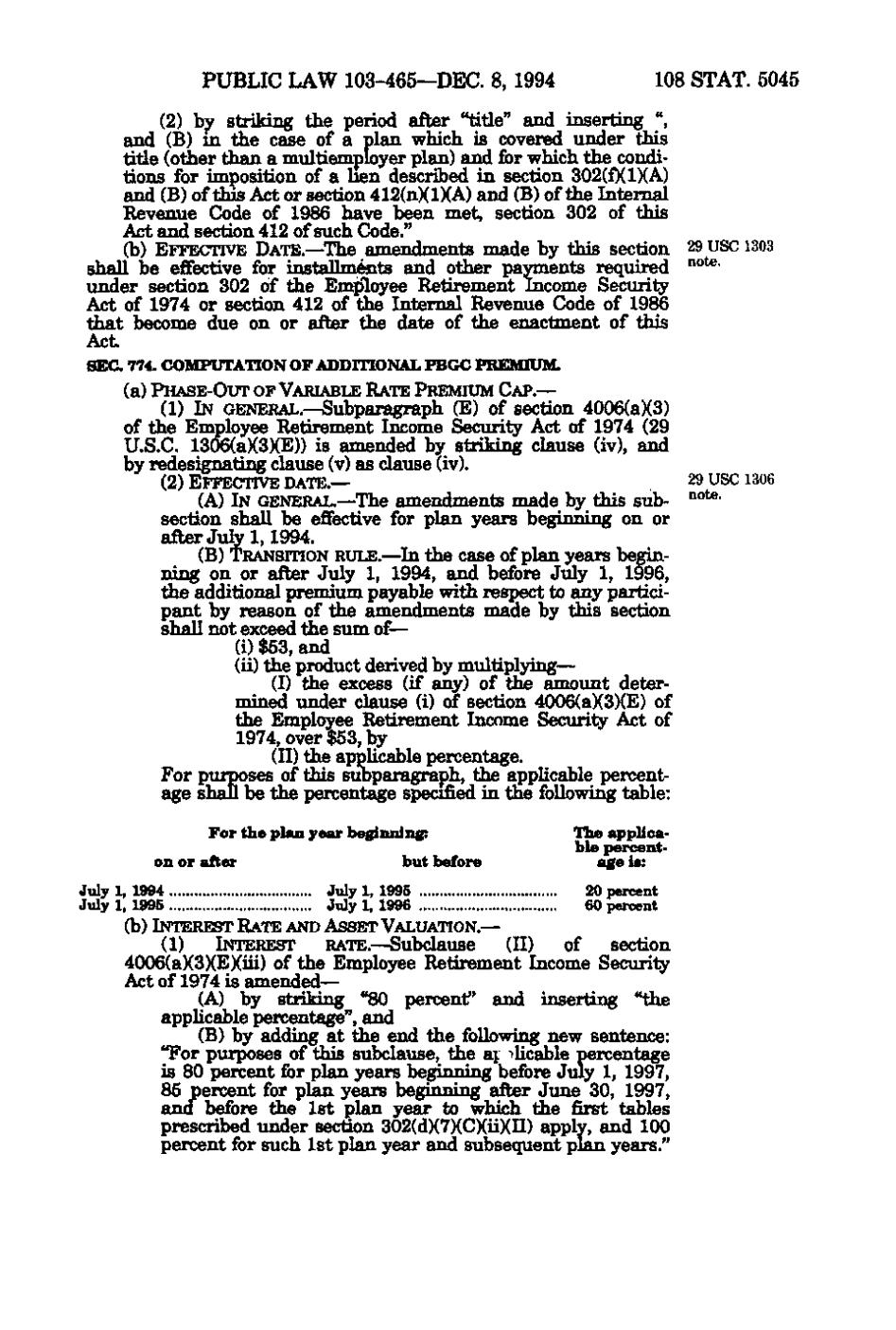

PUBLIC LAW 103-465—DEC. 8, 1994 108 STAT. 5045 (2) by striking the period after "title" and inserting ", and (B) in the case of a plan which is covered under this title (other than a multiemployer plan) and for which the conditions for imposition of a hen described in section 302(f)(1)(A) and (B) of this Act or section 412(n)(l)(A) and (B) of the Internal Revenue Code of 1986 have been met, section 302 of this Act and section 412 of such Code." (b) EFFECTIVE DATE.— The amendments made by this section 29 USC 1303 shall be effective for installments and other payments required ^°^- under section 302 of the Employee Retirement Income Security Act of 1974 or section 412 of the Internal Revenue Code of 1986 that become due on or after the date of the enactment of this Act SEC. 774. COMPUTATION OF ADDITIONAL PBGC PREMIUM. (a) PHASE-OUT OF VARIABLE RATE PREMIUM CAP. — (1) IN GENERAL.—Subparagraph (E) of section 4006(a)(3) of the Employee Retirement Income Security Act of 1974 (29 U.S.C. 1306(a)(3)(E)) is amended by striking clause (iv), and by redesignating clause (v) as clause (iv). (2) EFFECTIVE DATE.— 29 USC i306 (A) IN GENERAL.— The amendments made by this sub- "°**- section shall be effective for plan years beginning on or after July 1, 1994. (B) TRANSITION RULE.— In the case of plan years beginning on or after July 1, 1994, and before July 1, 1996, the additional premium payable with respect to any participant by reason of the amendments made by this section shall not exceed the sum of— (i) $53, and (ii) the product derived by multiplying— (I) the excess (if any) of the amount determined under clause (i) of section 4006(a)(3)(E) of the Employee Retirement Income Security Act of 1974, over $53, by (II) the appHcable percentage. For purposes of this subparagraph, the applicable percent- Eige shall be the percentage specified in the following table: For the plan year beginning: The applicable percenton or after but before age is: July 1, 1994 July 1, 1995 20 percent July 1, 1995 July 1, 1996 60 percent (b) INTEREST RATE AND ASSET VALUATION.— (1) INTEREST RATE.— Subclause (II) of section 4006(a)(3)(E)(iii) of the Employee Retirement Income Seciuity Act of 1974 is amended— (A) by striking **80 percent^' and inserting "the apphcable percentage", and (B) by adding at the end the following new sentence: "For purposes of this subclaiise, the aj licable percentage is 80 percent for plan years beginning before July 1, 1997, 85 percent for plan years beginning after June 30, 1997, and before the 1st plan year to which the first tables prescribed under section 302(d)(7)(C)(ii)(II) apply, and 100 percent for such 1st plan year and subsequent plan years."

�