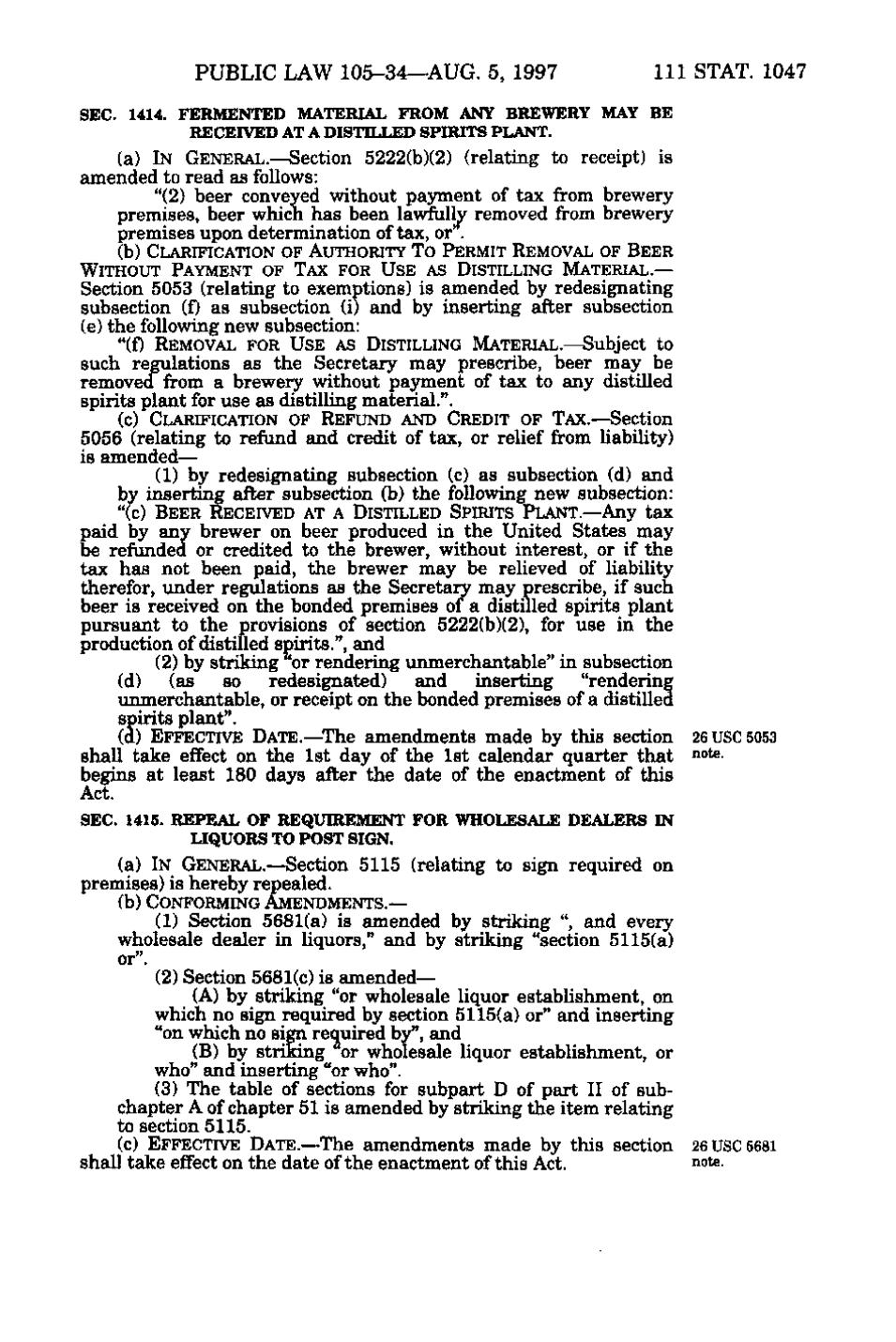

PUBLIC LAW 105-34—AUG. 5, 1997 111 STAT. 1047 SEC. 1414. FERMENTED MATERIAL FROM ANY BREWERY MAY BE RECEIVED AT A DISTILLED SPIRITS PLANT. (a) IN GENERAL.—Section 5222(b)(2) (relating to receipt) is amended to read as follows: "(2) beer conveyed without payment of tax from brewery premises, beer which has been lawfully removed from brewery premises upon determination of taix, or". (b) CLARIFICATION OF AUTHORITY TO PERMIT REMOVAL OF BEER WITHOUT PAYMENT OF TAX FOR USE AS DISTILLING MATERIAL.— Section 5053 (relating to exemptions) is amended by redesignating subsection (f) as subsection (i) and by inserting after subsection (e) the following new subsection: "(f) REMOVAL FOR USE AS DISTILLING MATERIAL.— Subject to such regulations as the Secretary may prescribe, beer may be removed from a brewery without payment of tax to any distilled spirits plant for use as distilling material.". (c) CLARIFICATION OF REFUND AND CREDIT OF TAX. — Section 5056 (relating to refund and credit of tax, or relief from liability) is amended— (1) by redesignating subsection (c) as subsection (d) and by inserting after subsection (b) the following new subsection: " (c) BEER RECEIVED AT A DISTILLED SPIRITS PLANT. —Any tax paid by any brewer on beer produced in the United States may be refunded or credited to the brewer, without interest, or if the teix has not been paid, the brewer may be relieved of liability therefor, under regulations as the Secretary may prescribe, if such beer is received on the bonded premises of a distilled spirits plant pursuant to the provisions of section 5222(b)(2), for use in the production of distilled spirits.", and (2) by striking "or rendering unmerchantable" in subsection (d) (as so redesignated) and inserting "rendering unmerchantable, or receipt on the bonded premises of a distilled spirits plant". (d) EFFECTIVE DATE.—The amendments made by this section 26 USC 5053 shall take effect on the 1st day of the 1st calendar quarter that note. begins at least 180 days after the date of the enactment of this Act. SEC 1415. REPEAL OF REQUIREMENT FOR WHOLESALE DEALERS IN LIQUORS TO POST SIGN. (a) IN GENERAL. —Section 5115 (relating to sign required on premises) is hereby repealed. (b) CONFORMING AMENDMENTS.— (1) Section 5681(a) is amended by striking ", and every wholesale dealer in liquors," and by striking "section 5115(a) or. (2) Section 5681(c) is amended— (A) by striking "or wholesale liquor establishment, on which no sign required by section 5115(a) or" and inserting "on which no sign required by", and (B) by striking "or wholesale liquor establishment, or who" and inserting "or who". (3) The table of sections for subpart D of part II of subchapter A of chapter 51 is amended by striking the item relating to section 5115. (c) EFFECTIVE DATE. —The amendments made by this section 26 USC 5681 shall take effect on the date of the enactment of this Act. note.

�