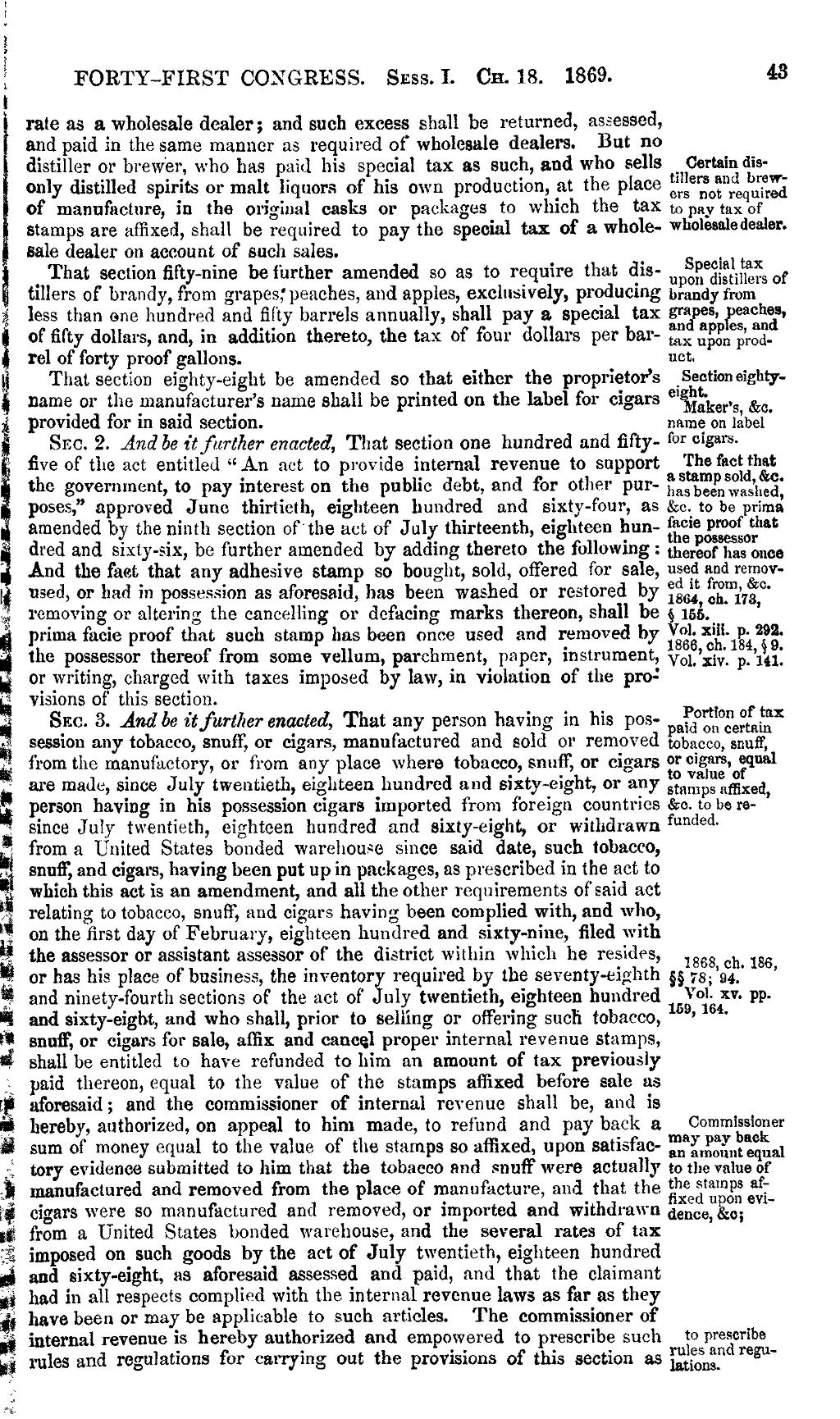

FORTY—FIRST CONGRESS. Sess. I. Ch. 18. 1869. 43

rate as a wholesale dealer; and such excess shall be returned, assessed,

and paid in the same manner as required of wholesale dealers. But no distiller or brewer, who has paid his special tax as such, and who sells H:Jcrtni15dQ;w_

0nly distilled spirits or malt liquors of his own production, at the place e;S°':0*;'°r0quired

of manufhcture, in the original casks or packages to which the tax mpaymx or

Stamps are affixed, shall be required to pay the specral tax of a. whole- Wh°l¤¤°·l¤d°¤l°¥‘·

sale dealer on account of such sales. _ S _ Max

That section fifty-nine beiurther amended so as to require that dis- upOK°§{;‘m1m,SOf tlllers of brandy, from grapes;peaches, and apples, exclusively, producing 1,.-andy {mm

less than one hundred and fifty barrels annually, shall pay a. special ta? §;**dP:?;p{;;?;l;?»

of fifty dollars, and, in addmon thereto, the tax of four dollars per bm- me upon pred. rel of forty proof gallons.

That Section eighty-eight be amended so that either the proprietor’s cigfpeticneighty- name or the manufacturers name shall be printed on the label for cigars akeps M - . • • n 7 ' é pFOV1d6d for m said Section. name on label

Sec. 2. And be itfhrther enacted, That section one hundred and fifty- {Or °*S**”~ " five of the act entitled "An act to provide internal revenue to support E6 faclighgt the government, to pay interest on the public debt, and for other pur- :;Sbr;lelLs;aS’heg; poses," approved June thirtieth, eighteen hundred and sixty-four, as &c._ to be prima amended by the ninth section of the act of July thirteenth, eighteen hun- "“‘”° P'°°‘T *h°“ i . . . . the possessor ' dred and sixty-six, be further amended by adding thereto the following: thereof has ence ” And the fact that any adhesive stamp so bought, sold, offered for sale, ugee end regovyi used, or had in possession as aforesaid, has been washed or restored by $86;, c'H‘°{73,°’ g,; removing or altering the cancelling or defacing marks thereon, shall be §155.___ é prima facie proof that such stamp has been once used and removed by xgé 1g4g3g- —‘ the possessor thereof from some vellum, parchment, paper, instrument, Ve1_’xi,J_ p_’1e1Q or writing, charged with taxes imposed by law, in violation of the provisions of this section.

Portion of tax

Sec. 3. And be it further enacted, That any person having in his pos- M "mai gg session any tobacco, snuHQ or cigars, manufactured and sold or removed i)0LiM(:;,cs¤ulff;1

from the manufactory, or from any place where tobacco, snuff, or cigars °*` °lg¤*°S» **1

» . . . . . 1

are made, since July twentieth, eighteenlhundred and siatyienght, or any gggfpgigliede person having in his possession mgars imported from foreign countries &c.w be re-

§ since July twentieth, eighteen hundred and sixty-eight, or withdrawn f““d9d·

from a United States bonded warehouse since said date, such tobacco, snuff, and cigars, having been put up in packages, as prescribed in the act to which this act is an amendment, and all the other requirements ofsaid act relating to tobacco, snuff; and cigars having been complied with, and who, on the first day of February, eighteen hundred and sixtymine, filed with the assessor or assistant assessor of the district within which he resides, 1868 ch. 186 or has his place of business, the inventory required by the seventy-eighth gg ·;g;’g4_ ’ and ninety-fourth sections of the act of July twentieth, eighteen hundred 1J0gés1V- Pp-

E and sixty-eight and who shall, prior to sellinrr or ofl"ering such tobacco, ’ ' ti snuff, or cigars, for sale, ailix and cancel propgr internal revenue stamps,

shall be entitled to have refunded to him an amount of tax previously paid thereon, equal to the value of the stamps aihxed before sale as

if aforesaid; and the commissioner of internal revenue shall be, and is

hereby, authorized, on appeal to him made, to refhnd and pay back a C<>¤¤m¤¤S¤¤¤¤r

Q f ·l t tl l f tl t- ·tl‘i d u satisfac- maylmy b°°k sum o money equa o ie va ue o ie s amps so a xc , upo an emmmeeqm,1 iii tory evidence submitted to him that the tobacco and snuff were actually to the value of

manufactured and removed from the place of manufacture, and that the ggglzlgx :3; cirrars were so mariufactured and removed, or 1mported and withdrawn denee gee;

¢€ frdm a United States bonded warehouse, and the several rates of tax l

imposed on such goods by the act of July twentieth, eighteen hundred

Q and sixty-eight, as aforesaid assessed and paid, and that the claimant

had in all respects complied with the internal revenue laws as far as they have been or may be applicable to such articles. The commissioner of internal revenue is hereby authorized and empowered to prescribe such to prescribe

I! · { · h · · { hi · rules and reguig rules and regulations or carrying out the provisions o t s sectwn as mmm_