$@9 ~ TITLE; £8;·-I N 1*1

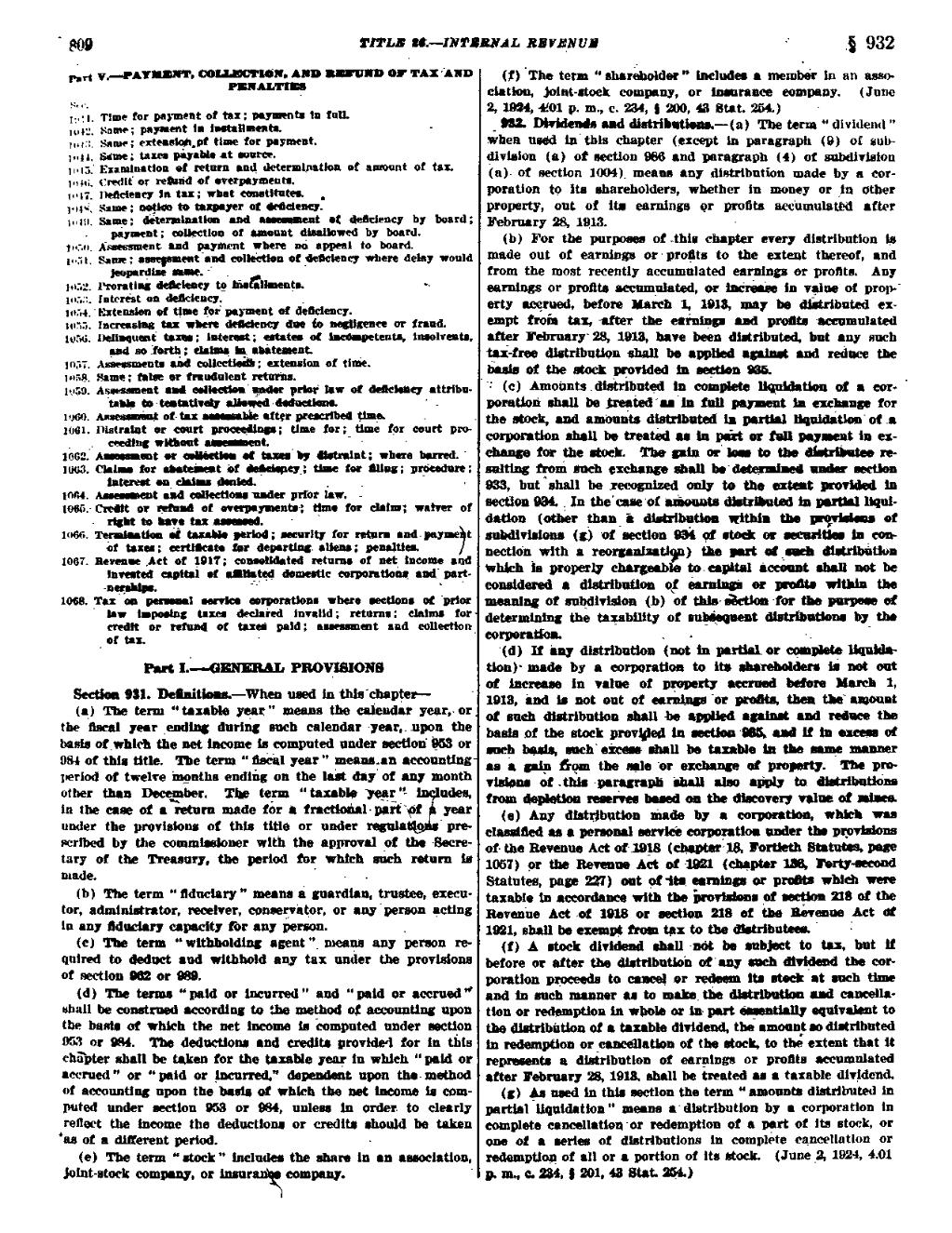

- ·#¤·¢ V.-—PAY§hNT• G01.L¤Ci'1§H. AND Lktlillli or *i*AX·lAiD

‘ P¤!•2.ALTI@ _ $4·c_‘. —` _ R _ §;·:1, Time for paymeat of tax; paymventas in mu. mai. same; payment in imaumeun. - · gmx?. Smué; exiesslqigpf time for payment. wigs. sims; tanxcs §&,Y8¤.8 at `murcé. ~- gu mf Examination at return nm! gletermipatiou of anmunt of tax. wm Credit' or rékmd at averpnymamm, » gm?. lwiicieacy in tax; what constitutes. _ yusi. Sam; t¤ umayer at é;£cie¤¢y._ . gum. samp: ééiermingticn and a. e¤t _¤£ déciency by board; , payment; wliwecticn of smbunt qisalimyed by board. ‘ ‘ gum. `A` me¤L and gymmt Fhffém so appeal to bbard, W3!. Sam: aucyeiat and cclleizticn dt §c§cie¤cy where delay would m.Yi2. 1"x+ora;in; dehéieacy tg liisitllmeays." ·~ 3:;;:2, Inicrési oa de£<‘:ie¤cy.‘ _ ·` _ msi. Bxteasiam of time {Q1" payment of demzicucy. ._ _ _ _ wsa. Increasing tax when dedciemzy dug iqnegligggxéc or fraud. , mas;. mliuqumi tamu; interest; gtnt¤» ot mcwpetemta, jusolvenys, gud sb Liang; claim; qixgmtemcm. · ‘ ‘ ms?. Amemaeats md col1cctie&§ extension of tide. was. Same: tulsa 9: !‘1jn udulg¤t-returns; _ w:;9. Asggesmeét `ami prbi law ot dmckhcy attribu- _ ’ teal; t¤·tu¤ti¤r&r •1lcyed~ded · ‘ - wsél attnx amaqsnbiegttgr prescribw um;. » ` . 1*361. Distmlnt or cmirt time tor; (aime `fpr court pro—_ BGG?. Auuammt at oallétthm elf umu by &stra1at:·whgre·b•ned.‘ 1<2»03. Claimi $0: •tat t is! d¢§¢imcy_: use ‘f¤r·§1i¤s; pr§codm·é_; 1atere•to¤_alad¤ndm$¤d.A _ ,__` `· IGG4. A$ t and under prfor luv. -~ , - .1@65·.-itrcmt ar ricfuml ot 0vu·pny·ments~% tfmo ?tm· chim: waive; of

. rum tqhngn · . · _

1066. Tqmhation ad taxabk period; aécurity for return gud. paymc t . ct taxes: certiacata lar dep•rtl¤¢> aliens; pcnaltiu. 1667. nwenne Act of QBIY; connoiidntgd 1’€$_¥1!'!lBN0f ¤ct_ fincome nm! invested capital at miiggqd écmcstic ccrpomtigénq ug:d,` pagb 1068. Tu an parses:} service corporations there nectioin ox 'prlor

law imposing taxes declaied . iniralid; r=et¤m•;_c1aims forcmdii or refnmé, pt taxa quid; asniessmmt and collection,

lot tax. ‘ ‘ ‘ - ‘ ‘

I.;-eGENERAL PROVISIONS 931. De£niti¢ns,—-—When xfsed 1¤i·uu¤‘c1mp;er-— . "

(3) The term "taxablo y<;sut" mgans calendar year,-91·_ the Hscal year ending during such, calendar -ymr,.11p0u tthe. mais otwhich the net {meme IS computed unqier, section @53 or @$4 c! this title. The term “Sschl year-"·mca1;sTa¤ agcountiugr period at twelve mgnths cndiing on the lam ddy of any mcufgh biker than Tm tcg·m " taxabkf ’! udcs, in the case ct a retum magic for 1 tractiohgl~pa1·£`@t _ year mader the provisions pi this title or under ruula 0 `prescribed by the commiwicuer with the approval of tm ·Secre~ tary of me Treasury, the period for which such mmm is made. _' F W (b} The term “Bdaciary ” mains ii guardian, trustee, executor, adminimrator, receiver, conservator, or any upcrson acting is any aduclary capacity. for Yany person. __ _ (c) term " wmyholdiug agent "_ meaqs amy person required to deduct sud withhold any tax under the provisions of section 962 or · ‘ . (G) The terms "mid or incurred *’ and "paid or accrued "' shall be construed according to the meghocl ot accomitiqg upon the basis at which the ue; income is computed under sect{0n 953 or The deductions and credits pmviéd for in this chZ1`pter shall M taken for the tangle yea; in which " paid or accrued ” or “ paid or ;ncurred," dapemmt umu the method of accounting upon the basis qt which the act inmms is com- Pvfm .m1der· section 953 pr QQ4, unless in order to clearly ( reflect the income the deductions or credits should bc taken "as oi u dimarant perigd, Y (e) The term “¤0ck" mcludu the share in an association, jcinbstock company, or msuranx commu:. '

taxa. xvmmm _§ 932 _ '(1’).The term " ¤har§ho1der" includa an Jmembér in an asso-° wciatkm, joint-stock company, for mmrmzce commuy. (June 2, 1%, 4401 p. m., ez. 234, § @0, 43 Stat. 254.) · 1 _ $524 Dividends and distrib¤tic¤s.·-—-(al The term " divideml ." when uséd intbis chapter (except in mragraph 4(9) of sub- Qiivision (a) of section @6 and parapaph (4) of subdivision (:1)- ot section 1004) means any distribution made by a coxporation to its shagehclders, wmther ini; money or rin other property, out of its mmit1gs q:·r pméts accixmulatiié after February 28, 1313. J ~ 5 °(b). For the purposes of tthis chapter every distribution ip, made out of earnings orf moms t0_ the extent tbzreof, and from the most recently accumulated earnings or grams; Any earnings or »pm§ts`accum_ulated, or in vglue of prop? icrty anegrucd, before Qiarch ?1,‘ 1918, may be éihtzributed éx- gmpt {mh tax, 111:12: the and pxipms accumulated _ after l‘¢brt1¤ry‘ 28, 1913,. h;vej been distributed, ibm {ny such igi-trée{ distribution ·s1gall`bo appkwd and reduce the bssigotthestogkpatcvided m.ség®¤935. _

°¤ (c)·Amouuts».distriti¤t¢;d» in complete tliqnkxuon of a wr- °

poration bs ,tregtc<1‘ns`i¤ mit paywt in exchapge mr 1 the stcckynnd gmbunts distributed in partial of ta ¢¤1’l>01*¤tict1 shell tbetreatéd as in pirtcrtfvll Nimeut in cxy éhnnse mt- me ¤t;¤¢1¤. crm m¤m—`m¤¤ w ze- Sulting such éxéhéiagc shall ¤&· sectimx 933; bitt shall bexecoguized only to the u@t provlézd in section 834. ,121 the'case‘0£_ tmt lpnrtml lghldwtion (other thanui "dim·ib¤tic¤Yvzithi¤ tm of subdivi¤i0ns·(g)*cf sectiaa 91 st0& an- securik in- can tncctidu with a reotgénizatign) ~prt M m¤h `1M tié¤ which is properly chirgmbla tot capital iccwnf shall mt be considered a `distribinticn og! er www within tm meaning df sutzgtlivmod (L) of this for @ www at determining the tagability of `su§é§q¤ept distribuéom hy tm corpomdom. - _ . _ -.

‘(d) It hay distribution (not iupnrtialcr liquiéw

.ti<m)* made by ’a corporation to its mswhcldcrs `ié not mt bi inérensa -in . value of accrued bdsm `Mamh 1, 1913{hnd iinot outta! br than the` ·+ · · =c! such Qdributioé shall be applied and reduce the ·msis¤f the swék.pmviped in ttm new of meh basis, mclfctizéas shallabc taxabhin thsjmm manner as d nip figm the eagle or excbnnge dt pmperty. Re pmvisions at -p•ragrap1i mall aim •»p1y’ ta frm d m rmgrireé b•sQ ca thetdisccvery mlm of mipéa. (e), Any -dist1§}putio¤ made _ by a ccrpcrzésm, which was clamwd m n pers¤§s1_¤ervieé umm: the mjovmans of this R€V€H\18.A¢t ofz1918 Faiwth S¤tirt@._D&88 1057) gr the Revmue Act M1921 (chapter 186. I‘¤r¤r¤¤€°·¤d Statutw, pass @7) out qt its amingsv cr pméw which wm taxable in ncmrdance with the Bmvisiqna pt 218 at the _Rcva¤`ue Act ot 19181 er section 218 at the Bcvume Act at 1921, sha1.lbeetemp$trmt.gxtothsdktrib»utw.`. V 1 —. (I) A stock dividw s1mlI·mt be subject to tax, but H before or utter the distrihtttioh cfany such @.vi the carporaticm proceeds in mma; QI°·l'¢d& its stacktat such time and in such manner as to mam; cancellation or magmpuoa in whole or inypnrt equivalent to the distribiztion ot a taxable dividend, the among; as dinributed in red~m1ptio¤.or car.ice1latkm at the stock, to the extant that it mpmsmts a distribution A of eargzings me pmms accumulated after February 28, 1913. shall be treated as a taxable dividend. .”(g) és used in this sectionthe term {amounts distrilmted in partial liquidation ” means a‘ distribution by a corporation in complete cancellation ‘m· redemption of a- pgrt. of its stock, or om ut a series ot distributions in complete cancellation or redemptiog of__ all or a. portion of its stock. (June _2, 1924, 4.01 t D·m·.¢=·234. 5 201.43 Stat.§4·)